Synthetic etfs get around withholding tax. But: you have a swap fee, that’s like an indirect ter. You do save a bit in total, but not the full wht. So you would need to include that swap fee in a fair comparison.

Thanks. But synthetic ETFs their own risks. Anyways good to know

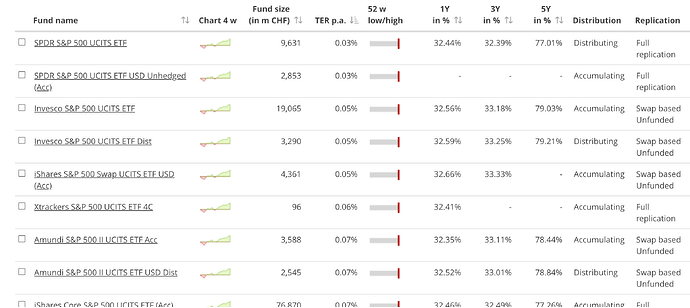

@Tony1337 Below is the comparison between some swaps ETFs and full replication.

The returns are always higher on the swap

Was not saying they would not be, just not the full withholding tax difference, all-else-equal.

Maybe we get a BOXX like etf for the S&P 500 soon. Sounds almost too good to be true.

Would be fully tax free for us.

Anyone have the prospectus?

I don’t think it’s available yet.

Question about swap-based ETFs to avoid US WHT: if those “dividends” are not real dividends but rather returns from swaps, why do the Invesco funds (for S&P500 and MSCI World) show taxable returns in ICTax?

As simple as looking at ICTax

https://www.ictax.admin.ch/extern/fr.html#/security/IE00B3YCGJ38/20231231

The part of the swap that covers the dividend is considered taxable.

Les éventuels paiements compensatoires constituent un rendement imposable au sens de l’article 20, alinéa 1, lettre a, LIFD; à cet égard, il est indifférent que les distributions des actions sous-jacentes constituent des dividendes normaux, des remboursements de valeur nominale ou des remboursements de réserves issues d’apports de capital.

Interesting, thank you. So no loophole then, sadly ![]()

But one coming soon probably: Chronicles of fat years [2024-2027 Edition] - #119

Don’t see how it’s different, the dividend part of the TR should be taxed.

Though it’s true the tax authorities might initially miss it since they’re not used to having US funds do that kind of things, unlike UCITS funds.

Because it‘s not a swap

The circular doesn’t mention swaps at all, seems written in fairly generic terms.

Do you have a german version on hand?

I still think it’s very different in this case, as the etf will use SPY options directly.

2.6.5

Bei kollektiven Kapitalanlagen, welche ihr Exposure synthetisch replizieren, ist zwingend ein

gesondertes Steuerreporting für Schweizer Einkommenssteuerzwecke zu erstellen, aus welchem die Rendite des(r) Basiswerte(s) hervorgeht. Massgebend für die Ermittlung des steuerbaren Ertrages von Swap-based ETFs, welchen Aktienindizes zugrunde liegen, ist die Nettodividenden-Rendite (net dividend yield). Darunter ist die Bruttodividenden-Rendite der entsprechenden Indizes, abzüglich der anwendbaren Quellensteuern zu verstehen. Die Nettodividenden-Rendite für alle wichtigen Aktienindizes wird von den anerkannten Providern publiziert und kann für das Steuerreporting verwendet werden. Allfällige weitere Ertragspositionen

gemäss Jahresrechnung werden zur berechneten Nettorendite addiert.

I don’t think they care how it’s implemented, as long as the goal of the fund is to replicate an index.

(I’m fairly sure the fund factsheet will claim it aims at replicating the performance of the SP500TR, which makes it a synthetic SP500 ETF just like any of the other UCITS ones)

(the french version doesn’t mention swaps, just synthetic)

You may be right here actually. The wording is broad enough, that it could be categorized as such.

Might still be a chance, depending on how the fund is finally framed as and executed.

If you read the circular it’s pretty clear the goal is that taxation is based on the economic value, not how something is constructed.

That’s actually pretty nice since it avoids artificial complexity for pure tax avoidance.

That said, like BOXX until there’s scrutiny (eg because this becomes popular), they might treat the whole thing as capital gain.

(I’m fairly sure the tax office can apply the same reasoning they do for synthetic ETFs to BOXX, since it’s clear the purpose is to give the interest rate of US obligations just wrapped differently, it’s just nobody looked in detail to assess it beyond what the underlyings are)

I‘d say it would start to be worth it for an 0.3 TER (depends on their indirect trading costs).

You also have an assured way to circumvent withholding tax, for example for people having mortgages, that otherwise could not get them back with da-1. That alone can make sense for some. Probably similar than swap etfs, but potentially a slight edge.

Although there are talks to prevent swap etfs in the future circumventing the wht. With this it would always be possible.

I think it‘s another tool in the arsenal, to be deployed in specific circumstances.