Wasn’t there another discussion recently which proved that currency risks can be neglected because as soon as you’re invested in an asset you own parts of it which will automatically adjust for inflation too? (Iirc it was the discussion between a Vanguard ETF in EUR vs. CHF)

It shouldn’t make much of a difference if the fund is issued in CHF, EUR or USD. But that doesn’t change the fact that you are investing in companies who use a different currency then yours - somewhere along the investment chain, you are holding non-CHF values which you will need in CHF again later in your life.

Personally, I don’t know a solution for this - the strong Chf historically makes investing for CH people more difficult imo, because (historical) it worked against your stock returns.

Am curious how CH-people who hold a few 100k in VT or similar for example think about this?

Maybe make sure to take a step back and double check you’re not reacting purely based on recent events.

I did notice quite a few posts in various forums along the lines of “I want to hedge now because the US stock market has such nice number but in my base currency they aren’t as great”.

To me those sound like people who just have some fear of missing out, one of the major reasons the US stock market is having those gains is because the USD is losing value. So with that in mind, why not go all-in and start playing/betting in the FX market (since that’s where the gains are).

(I didn’t see people have the reverse argument when the USD was going in the other direction)

The behavioral part of https://personal.vanguard.com/pdf/ISGPCH.pdf might be interesting as well.

Yes, in addition to what nabalzbhf wrote, keep in mind that if the dollar gains value and the stocks go down, with an hedged fund you will lose twice (as the stocks and the CHF are both going down).

Keep in mind as well that the USD didn’t change much in the past 10 years (except for the last few months). It would be tough to stick to the strategy and losing 1% (or more) per year on the hedging for 10 years without visible benefits.

My point of view is that if the CHF raises I’m happy because I can buy at cheaper prices, if it goes down I’m happy because my net worth in CHF increases. Of course it depends much on how much you have accumulated.

It works both ways - one side, your stock returns might be valued less in CHF, but on the other side with the time you can buy more assets abroad more cheaply with your CHF savings. It’s not an inherently worse position for investing than in (more) inflationary countries.

Do you have to make your investment decision based on what country you’ll be retiring to tough?

Of course I’d want to retire to a country with low crime rates and relatively high development indicators, such as a good health care system. These usually go hand in hand with a country’s economic prosperity - which, in turn, is often correlated to a rising strength in its currency.

But that doesn’t necessarily mean it’s the best investment opportunity, does it?

Take Japan, for instance. Potential language barrier and restrictions on immigration aside, it does seem as a good destination to retire, doesn’t it? It’s one of the safest, least crime-ridden countries in the world, and with one of the highest life expectancies in the world, the health care system can only be reasonably good.

Yet over the last 20 years, the Yen has lost half roughly of its value against the Swiss Franc - and the stock market hasn’t really done that great either. For the aspiring Japanese retiree, investing in Switzerland (= abroad) would, with the benefit of hindsight, have been a much better choice.

That is true, as long as you are adding more to your portfolio.

In the end, it’s not uncommon to still have a lot of your net worth in CHF probably as well, e.g because of real estate or similar.

As stated previously, I’m not really learned on the topic so may very well be proven wrong but, to me, when investing in a country, it’s important to consider the broad picture of how its economy works in its local context, i.e. how it relates to its citizens and the quality of living there.

It’s a different thing to invest in Japan for purely abroad purposes than to invest in it considering its value from a home perspective. My belief is that a government is more affected by what goes on home than by international pressures, so is more likely to choose to preserve home value rather than international value if the choice comes to that (it goes too for those situations where preserving international value is the way to best protect home value - in which case home value stays the ultimate purpose and keep being in sight).

I try to capitalize on that by creating bonds with the economies I’m willing to invest on (actually going there semi-frequently to develop relationships with people and get them to develop more good will toward my own situation / understanding the local situation better and what’s going on with its economy).

I’m also investing abroad in the off chance that Switzerland manages to do real poorly and I need a contingency plan from living here. I don’t see it as very likely but, should it happen, it would have a big impact on my life so it’s a risk I’m willing to plan for once my well being in Switzerland is secured. That makes countries where I would be willing to live in better candidates for investing in my view but I admit it’s a peculiar one and not how most people consider international investing as part of their portfolio.

@1000000CHF

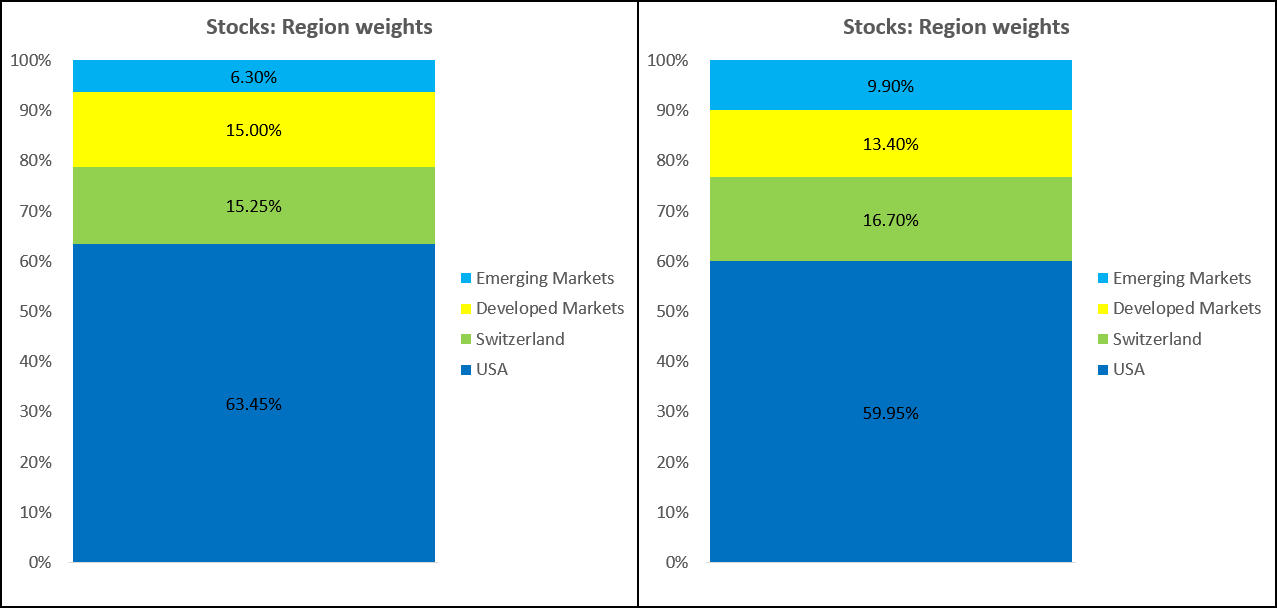

I’ll probably retire in Switzerland (75% sure), but I could imagine living in the US or being a digital nomad. How much currencies like the USD lose matters because of stock returns. The US makes up almost 60% of the global market, so the USD will be the biggest part of your investments if you aim for a market neutral portfolio. Seeing the SP500 at 14’500 the day you retire might look great on paper (assuming 7% nominal return for the next 21 years till I’m 50yo), but would still suck if the USD is only worth 0.50 CHF by then. It would reduce the performance down to 4%/year in CHF. I’m not worried about politics in Switzerland btw. SVP is losing ground.

@ProvidentRetriever

Could you please explain the effect of interest rates, inflation and FX rates? Is FX risk irrelevant longterm and thus currency hedging a zero sum game over 2 decades? It’s really the only thing I’m not understanding very well.

I know that we live in a very complex world with highly globalized companies which in itself have currency risk that impacts their revenues. But does it really have to be exact? I’m not hedging my whole portfolio, just 30% of it (20% USD, 10% mostly EUR, GBP, JPY), so I’m still exposed to foreign currencies by 50%.

@Wolverine

I strongly believe what John Bogle said and that nobody knows nothing. I have no idea how the future will look like, which countries and stocks will perform good. That’s why I try to invest as passively as possible with as few active choices as possible. I’m just questioning if this also applies 100% to a Swiss investor. The role of the SNB, tax implications and the ongoing USD/EUR devaluation might change what the most efficient portfolio for a Swiss investor should be? You are too diverging from the pure market neutral portfolio.

@nabalzbhf

I’m starting to question my changes for sure, because of my lack of understanding regarding central bank interest rates, FX rates and inflation.

Just checked Ben Felix on that matter. According to his research there is no longterm benefit for currency hedging and if you do so, to keep it below 50% of your portfolio. But starting hedging now might be market timing truly! I mean the USD already lost 10% YTD, so hedging after the fact might be stupid.

I still think there is room for optimism. Firstly, CHF is very hard currency, USD due to international demand (being reserve and global transactions currency) is moderately hard, most of other currencies are more inflationary than USD. Secondly, most of the new money created in US by FED lands one way or another in the stock market. If inflation will be higher, then most likely stock returns will be proportionally higher too (unless there’ll be some great bust of this bubble and we will see stagflation, but I really doubt in this, it hasn’t happen since 2008, it’s unlikely it will happen after this crisis).

If I were you, I’d keep investing in USD and kept the “safe” part of my portfolio in hardish assets (CHF, Gold, maybe some sort of Swiss bonds, etc). This would protect me from the USD inflation and it would provide means to rebalance USD stocks with CHF. I think it makes more sense to increase your CHF reserves, rather than increase concentration risk by adapting more home bias in your Portfolio. In fact that’s what I’m doing myself - my portfolio consists mostly of VT and CHF cash (+ a little bit of Gold and a little bit of KBA).

PS. SVP might be loosing ground now, but once there will be another round of refugees weave, it might get back ground again quickly. Look how draconian measures where introduced in Denmark or Netherlands after few immigrant riots in past years - in two of the most open countries historically in the world. Opinion pools might change quickly.

@1000000CHF

@ProvidentRetriever

Ok got it now! Thank you very much. So there is really no point in hedging. I’m still going to adjust my region weights to get closer to VT.

Nice thread!

I wonder if someone can explain me how do you track FX on your investments.

If you buy 10k CHF of say VT every 2 months, what do you log?

I’d track the price of VT (say 80), how much I’ve bought, the total in chf and the total in usd for that transaction. What I would have is a list of values and the sum of usd and chf. I would then compare the value in chf of the sum spent vs the actual value and it will show me how much I’ve lost/gained with the exchange rate then sum how much VT I’ve bought, calculate its value in usd and chf. Comparing the two CHF values would show me how much i’ve really made. Should I track more ? Does it make sense to track how much the single buy has made until now?

That’s what I’m actually doing in a spreadsheet.

Regarding tracking more: I don’t think it makes sense to track down how much gain/loss every single transaction made until now. I assume you are doing buy&hold, so it would be enough to check your total portfolio value in USD vs CHF (maybe every 3 months).

Personally, I track my accounts + portfolio every month in a spreadsheet. My base currency is EUR though (because I started this spreadsheet before I moved to Switzerland). The portfolio value in USD I multiply/divide with the actual conversion rate of CHF/USD.

I think long-term you should be aware about currency conversion rate, but short-term it doesn’t really make sense.

I guess most of us are trusting/hoping/praying to the gods (take whatever applies to you) that the USD will still stay the world’s base currency. Otherwise, the whole “investing in broad passive ETFs” is going to be a problem anyway.

This is coming back to the question: where do you plan to retire? If you are going to retire in Switzerland (one of the most expensive countries, not ideal for the RE part of FIRE), you are right: the performance goes down.

If you are planning to live as a digital nomad (most probably sounds better than it really is in reality), you won’t care about the performance in CHF. If USD is still one of the harder currencies, you can still live a good life in other countries with weaker currencies.

So it comes down to: where do I see myself living in 20 years. Distributing your investments in different currencies might make sense then, but which currencies do you choose? CHF, USD, EUR, NOK?

It’s a question which is really difficult to answer.

I’ve edited my answer to make it clearer. Interesting/sad is that the amount I’ve earned is halved once I compare the CHF spent until now vs CHF value vs USD spent vs USD value.

I am doing the calc in quite a similar fashion - tracking:

- CHF sent in vs. Current (with “live” fx)

- Purchase price in USD vs. Current

For me the diff is currently 13.5% vs. 17.3% - so definitely not negligible.

Of course, this largely depends on when was what bought/sold.

28% usd, 14% chf. At least it’s positive anyway.

I wonder if there is a graph somewhere showing the price of VT with and without FX with chf.

I still wonder if it makes sense to see every single transaction FX difference. I might see that my latest transactions might show positive in USD and negative in CHF. I might temporarily stop buying…

Wouldn’t u get that comparison (at least approximately, but enough exact for most purposes) if you compare VT and VWRL (in CHF).

If you dont mind, can you share this tracking sheet (of course, after removing your records)

That’s not something which is worth to share. You can do it yourself in 2 minutes.

It’s basically:

- first column of the row: date of the month (e.g. 01.09.2020)

- then each column is one account (different bank accounts, IB, Revolut)

- last two columns are: net worth in CHF and net worth in EUR (approx. rate, which I set at the beginning of each year…)

If you are searching for a good spreadsheet, you can use the one from @MrRIP. He has links to the ETFs and current conversion rates. You can find it here