A large part of the swiss bond funds is covered by institutional and pension funds where retail investors don’t have access to.

Do I understand correctly that this yield (YTM) number is what is called the nominal yield? And then one should subtract the inflation rate from that number to get the real yield?

Note that I have not much clue, just trying to make sense of all these terms I read ![]()

Yes. If all bonds are held until matured.

Yes, you can put it this way.

Why bother about real yields? Easier to compute everything in nominal yields.

It depends what you mean with nominal because it can be understood in two ways.

In its first meaning, nominal means “whatever is written on the coupon” so the ratio between coupon and principal.

The YTM is the “actual” yield taking account the bond price, which is different from the principal because of the current market rates. It could also be considered “nominal” in the sense that, although it is not the coupon, it does not take inflation into account.

Then there is the real YTM which is the “nominal YTM” minus inflation.

Totally agree with you. I just wanted to point out that although Swiss bond yields look much more interesting than what they used to be a few months ago, taking in account inflation (in Switzerland currently around 3-4% if I am not mistaken), the real yield is still in negative territory.

Of course this is still much more interesting than your average Swiss bank account which is now starting to offer interest rates of (only) 0.3-0.5%.

Well, it’s not so easy. Let’s take the fund with the shortest maturity. YTM is 0.8% in 1.5 years. Minus TER of 0.15% leaves 0.65% p.a. Then taxes on distributions, i.e. coupon of 2.4% ![]() . Let’s say 20% marginal income tax. So 0.48% p.a. goes to taxes

. Let’s say 20% marginal income tax. So 0.48% p.a. goes to taxes ![]() . We are left with 0.2%. While with savings account giving 0.5%, we are only taxed on these 0.5% and are left with 0.4%.

. We are left with 0.2%. While with savings account giving 0.5%, we are only taxed on these 0.5% and are left with 0.4%.

Not a result that I expected, but this exactly why it is important to do actual calculations. Why so? Because institutions can buy short term Swiss government bonds, but they can’t deposit cash at 0.5% p.a. (or can they?).

So, again, as a private investor, you are better off with investment products that privilege private investors.

Very interesting, thank you for the detailed calculations. This means that at this point of time one should either wait for yields to go higher which is probably the case until end of the year, or go for longer duration bonds. Then the downside with longer term duration bonds you introduce more price volatility and sensitivity to rising interest rates…

Well, I guess if SNB rises rates, YUH will follow in their publicity stunt.

Or Kassenobligationen, which have higher yield than bonds of the same duration and don’t have this problem of coupon being higher as yield.

When I am thinking about it now, bonds, individual or in a fund, might become really interesting when/if their market price drops below the nominal value. Then a part of the yield will be coming from a tax-free “discount” vs. the nominal value.

They can and they do.

As a side note, for pension funds, the bond rates are more attractive as they pay lower or no tax on the coupons.

Not sure I understand that… how do you find out if the market price dropped below the nominal value? You have an example maybe?

Bonds are always issued with a nominal value, e.g. CHF 100’000, which you get back at the maturity date. The market price is the value that this bond has at the moment based on demand (what people are willing to pay), if lots of people want to buy this bond, its price will increase to e.g. CHF 110’000, then the market price is above the nominal value.

This is a quote for one bond:

Price is quoted in % of the nominal value, and if it is below 100, then the price is below the nominal value.

For funds you can compare yield to maturity and coupon. If coupon is higher than yield, it means that the market price is above the nominal value.

I see, so taking a previous example of the CSBGC0.SW ETF the Weighted Avg Coupon is at 1.59% and Weighted Av YTM is at 1.36% might really become soon interesting like you mentioned as soon as the coupon is lower than the yield.

And again meanwhile, or 4 months later, weighted avg YTM of CSBGC3 has increased to 1.36% (weighted avg coupon at 2.41%), so I still have this one on my radar…

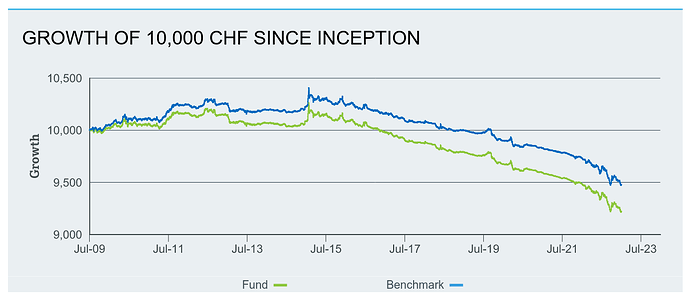

But there is something else I would like to understand: why is the price of this particular ETF falling sind around mid of 2014? Can it simply be resumed to the fact that since then Switzerland has entered 0 or negative interest rates?

That chart is taken from their official and latest fact sheet dated December 2022.

I thought that when interest rates fall bond price should rise and the other way round… So I don’t really understand what is happening to this particular ETF. Maybe a Swiss thing or there is something else “wrong” with this ETF I am missing?

I see, then let’s hope one day this ETF will have a higher yield than its coupon…

Eeeh, no, you don’t want this ![]()

Yeah, if the yield moves as “fast” as our Berne fédérale we can all wait a very long time ![]()

Anyway my radar now is pointing me more and more into the direction of VGSH as I think I can definitely forget Swiss treasury bonds.

Well, on a global scale you should be glad that the yields on short term Swiss bonds is only 1.36%. The whole complex of problems in 2022 have moved them from -0.75% to where they are now, and I don’t know what else should happen for these yields to go one more % up.