They can and they do.

As a side note, for pension funds, the bond rates are more attractive as they pay lower or no tax on the coupons.

Not sure I understand that… how do you find out if the market price dropped below the nominal value? You have an example maybe?

Bonds are always issued with a nominal value, e.g. CHF 100’000, which you get back at the maturity date. The market price is the value that this bond has at the moment based on demand (what people are willing to pay), if lots of people want to buy this bond, its price will increase to e.g. CHF 110’000, then the market price is above the nominal value.

This is a quote for one bond:

Price is quoted in % of the nominal value, and if it is below 100, then the price is below the nominal value.

For funds you can compare yield to maturity and coupon. If coupon is higher than yield, it means that the market price is above the nominal value.

I see, so taking a previous example of the CSBGC0.SW ETF the Weighted Avg Coupon is at 1.59% and Weighted Av YTM is at 1.36% might really become soon interesting like you mentioned as soon as the coupon is lower than the yield.

And again meanwhile, or 4 months later, weighted avg YTM of CSBGC3 has increased to 1.36% (weighted avg coupon at 2.41%), so I still have this one on my radar…

But there is something else I would like to understand: why is the price of this particular ETF falling sind around mid of 2014? Can it simply be resumed to the fact that since then Switzerland has entered 0 or negative interest rates?

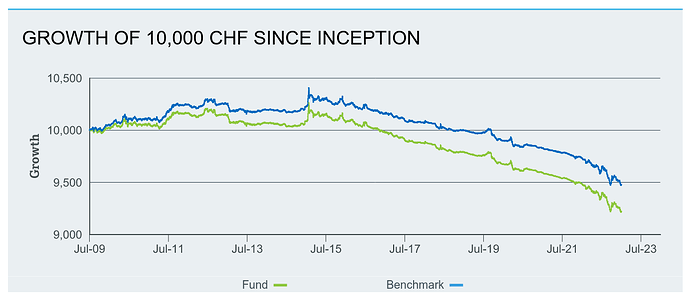

That chart is taken from their official and latest fact sheet dated December 2022.

I thought that when interest rates fall bond price should rise and the other way round… So I don’t really understand what is happening to this particular ETF. Maybe a Swiss thing or there is something else “wrong” with this ETF I am missing?

I see, then let’s hope one day this ETF will have a higher yield than its coupon…

Eeeh, no, you don’t want this ![]()

Yeah, if the yield moves as “fast” as our Berne fédérale we can all wait a very long time ![]()

Anyway my radar now is pointing me more and more into the direction of VGSH as I think I can definitely forget Swiss treasury bonds.

Well, on a global scale you should be glad that the yields on short term Swiss bonds is only 1.36%. The whole complex of problems in 2022 have moved them from -0.75% to where they are now, and I don’t know what else should happen for these yields to go one more % up.

I agree here and one can not simply compare 1-3y Swiss government bonds with 1-3y US treasury bonds. So yes indeed 1.36% is already very good compare to what we saw in the past years.

I dont think thats accurate. In this case the bond etf price changed only because of the interest changes of the SNB.

The weighted avg coupon (which is anyway totally irrelevant) is higher, as new bonds coming into the etf, have a higher coupon and weight more, due to the higher face value.

As now Switzerland 1 year bond has 1.5% yield, and I have piled some cash I would like to park part of my cash for a short period there.

How can I buy them? I have not experience buying any kind of bonds.

Thanks

I have +100K CHF.

I have Interactive Broker, but I am open to use another broker if fees are much lower.

I think it would be a good idea to buy 1 year CHF bonds like every month 10K. So parking that money in bonds and distributing it on time, I would get an average yield (maybe it will go up or down, who knows) and after a year when the money in bonds are getting free, monthly I will be able to reinvest in bonds again or in stocks if the market is crashing and good opportunities appear.

I got the idea of 1.54% yield for 1-year CH bond from Switzerland Government Bonds - Investing.com, but maybe I am mistaken.

Do you know any list of corp bonds with high yield/risk in CHF?

Which is a good broker to buy Swiss bonds or Swiss corp bonds?

As swiss interest rate is becoming > 1%, I am trying to buy swiss bond directly

I have try to benchmark swiss bank but they take in the better case ~60 bips of fees on a 1% rate

That’s huge

Does anyone know how to buy the swiss treasury directly or a product that is much more competitive than bank cash account ?

Thanks for your help

Does Swiss national Bank issue any debt instruments, actually? I think not.

Why should Swiss confederation issue debt instruments to satisfy investors’ needs? No thank you, I prefer current system where our state budget is not excessively in debt and the bonds are issued only occasionally and mostly for specific projects. And not that the new debt is used to repay old debts, forever.

Sure, I just don’t understand why banks get access to higher rates than retail customers.

There’s a huge spread between rates accessible to banks and rates accessible to retail investors in Switzerland that does not exist to this extent in the US.

I guess the way to limit debt is to issue less debt, but access to debt should be equal for retail customers, unless we want to subsidize our banking system.

I like the auction system of the US where everyone has access to.

But maybe I lack some understanding here.

I don’t think there’s many countries where people have access to the primary market (I assume it’s a bit of a pain for treasuries to deal with it, and it’s not their primary job vs. making sure their debt emissions are selling), and it shouldn’t be an issue since retail have access to secondary markets.

The main issue for me is the high fee of swiss brokers/banking/exchanges, which is probably due to the size of the market and lack of competition.

(If you could buy 10k worth of confederation bonds, or pfandbrief on SIX for 1-2 CHF, it would be worth it, but currently you’re more likely to have to pay 100x that in fees)