Why are you saying that you can’t DCA on IB? I have IB and I invest small amounts monthly.

If you are below 25 the threshold is even lower (3$/mo maintenance fee), I did not do the math but I am pretty sure it is below the minimum balance of TW.

I also started with TW and then started investing directly with Saxo (genius move I know, but I rejected IB at first cause I though I could not invest with an US broker). I later moved both over to IB.

@Kilbim

I think TW is a good choice for someone who just wants to turn a risk dial and put some money in, if you already went through the trouble of picking your own assets you might as well do it yourself.

Don’t you pay a lot in fees?

It depends on what is your “small amount” obviously, but if have a portfolio with 5-6 different ETFs and you want to invest in all these each month you end up paying a lot with most brokers. BUt I don’t know what IB charges, so it might be low, even for small amounts (lower than 1000 CHF a month)

https://www.interactivebrokers.com/en/index.php?f=1590&p=stocks1

You’ll pay either 1 dollar or 35cts for amounts lower than 1000chf.

I just bought my first stock  58 of VT for the time being and I plan to buy some amount at fixed intervals.

58 of VT for the time being and I plan to buy some amount at fixed intervals.

Do you suggest buying every month or maybe like once every 3-6 months?

I’m still trying to understand some things in the interface:

- can I buy fractions of shares? I found myself with a few CHF and a few USD after converting USD.CHF and buying the shares

- can I see the fees that were paid for my purchase of the ETFs?

Don’t you pay a lot in fees?

It’s exactly other way round. IB is much cheaper. Normally I pay few bucks (max $2-3) for my monthly transactions (including forex costs which are ridiculously high in all other brokers and banks).

As far as I know “Tiered” price scheme is a bit cheaper:

https://www.interactivebrokers.com/en/index.php?f=1590&p=stocks2

Don’t you pay a lot in fees?

It depends on what is your “small amount” obviously, but if have a portfolio with 5-6 different ETFs and you want to invest in all these each month you end up paying a lot with most brokers. BUt I don’t know what IB charges, so it might be low, even for small amounts (lower than 1000 CHF a month)

As others have said - fees can run down to 0.35/transaction (with tiered pricing).

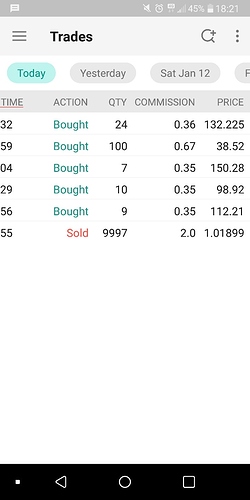

I just yesterday bought 10k worth of shares of 2 ETFs (VTI, VEA) and 3 individual stocks - and below are the fees.

(bottom one is from CHF-USD conversion)

- can I buy fractions of shares? I found myself with a few CHF and a few USD after converting USD.CHF and buying the shares

- can I see the fees that were paid for my purchase of the ETFs?

- Not as far as I know. Just leave them until your next buy in.

- Yes, in your “Trades” section of the app, as below.

At the moment my equity portfolio is made of VTI + VXUS. However these ETFs are not available anymore on DEGIRO and I’m trying to replicate the same exposure with european funds.

(The reason I’m not simply switching to IB is that I’m far away from the >100k necessary to avoid fees on IB, and 120CHF per year are too much for me, and more than the difference in TER. Also, I’m not 100% sure that IB won’t prevent US ETFs as well in 1 year).

For the US I thought that Vanguard S&P 500 (VUSA), although with much fewer stocks, should give me similar exposure to VTI with low TER.

Is there anything similar to VXUS that is available in Europe and that mustachians recommend? EIMI looks good for EM, but anything for non-US developed markets?

120CHF per year are too much for me

These include your trading commissions.

So your monthly cost is MAX(sum_of_commissions, 10).

and I’m trying to replicate the same exposure with european funds.

See this post:

I strongly believe you should form a core portfolio with a minimal number of ETFs which will cover the broad investible market as close as possible, at low cost. VWRL (IE based) and VT (US based) are one stop shops for the beginner investor, but can be improved upon. My short list for IE-based ETFs: XDWL + IUSN (or WOSC) + EIMI covers 100% of the MSCI ACWI IMI universe with a market cap weighted average TER of 0.2% My short list for US-based ETFs: Vanguard: VTI + VEA + VWO for weighted a…

You can get exposure to full MSCI ACWI IMI (all cap all world) with effective TER of 0.2%. This is as good as you can get with IE based funds.

Which multiplied by 12 months anyway ends up being 120CHF per year. At DEGIRO most of these ETFs are commission-free. With the tiny size of my investments this ends up being more than the difference in TER between european and US funds.

At DEGIRO most of these ETFs are commission-free.

Once a month comission free, then more expensive than IB, also if used for European funds. And don’t forget 0.5% currency exchange fees on Degiro … and the commision free list is not that interesting IMO.

If you insist on Degiro, stick with Vanguard VWRL. You can get additional exposure to world small caps with VIAC, but you have to keep in mind that VWRL follows FTSE All-World Index, while VIAC has MSCI index tracking funds.

Once a month comission free, then more expensive than IB, also if used for European funds. And don’t forget 0.5% currency exchange fees on Degiro … and the commision free list is not that interesting IMO. If you insist on Degiro, stick with Vanguard VWRL. You can get additional exposure to world small caps with VIAC, but you have to keep in mind that VWRL follows FTSE All-World Index, while VIAC has MSCI index tracking funds.

The currency exchange is 0.1 not 0.5%. The Poor Swiss has made a nice article about the IB/Degiro comparison (https://thepoorswiss.com/comparison-brokers-interactive-brokers-tiered/) and also a spreadsheet to show how the fees change with different investments: Copy of IB / DEGIRO - Google Tabellen

Even when buying the non-free ETFs there is still a decent difference.

I would think that even if you pay the full 10chf per month it is worth it being able to buy what you want and not be treated like a child by your broker

I didn’t know this.

Probably because IB is an USA broker, so I didn’t checked it back then.

Also, I personally have no experience with an US broker, I don’t know what differencies it entails for me. Even knowing it cost so less I would have not gone the way of IB because it was already enough new stuff for me to figure out without adding having an US broker

edit: and I just saw now that OP already started with IB. By all means, stay with it. Once you pull the trigger there is no reason to change to something where you pay more fees

edit2: just read IB has a yearly fee of 120 CHF if you’re under 100k. From this: https://docs.google.com/spreadsheets/d/15wCKnAF17WJdO8Aap8qzdBJPc83PLCSqxGn1cz3QUgA/edit#gid=0 it seems still less expensive than TW, but I guess it truly depends from everyone’s invested amount and number of ETFs bought and with which frequency.

(The reason I’m not simply switching to IB is that I’m far away from the >100k

Maybe you should concentrate on fixing that problem. Or use a reseller like captrader or lynx or something, fee-free from 10k i think, all dealing and money should still go directly through IB

Which multiplied by 12 months anyway ends up being 120CHF per year. At DEGIRO most of these ETFs are commission-free

Don’t get so excited about it. First it doesn’t exactly cost a fortune to trade on US markets, 100k trade should cost a few dollars tops and second I’d be willing to bet IB’s order execution is superior to degiro (i.e. lower bid/ask spread, rebates from exchanges) so it might not be that free to you after all

Probably because IB is an USA broker

No, they also operate from UK, and as a european customer you will be serviced by UK subsidiary and have no say in this matter

You can then consider using Degiro up to 100k and then move to IB. Or just start with IB and focus on improving your income/savings rate.

Yes, I agree, indeed that was my point and I’m trying to “fix” that problem but since I don’t make money appear out of thin air, and since at the moment it is objectively cheaper to invest in european funds on degiro rather than paying 120CHF per year on IB (although I guess that means being treated like a child) I was just asking advice on european funds to invest in the meantime, in particular for a good global ex-US ETFs. It’s ok anyway, I’ll keep searching.

So as I said, captrader and lynx and some others resell IB’s services and don’t have maintenance fee from 10k balance or so. The catch is AFAIK transactions are a bit more expensive than through IB directly.