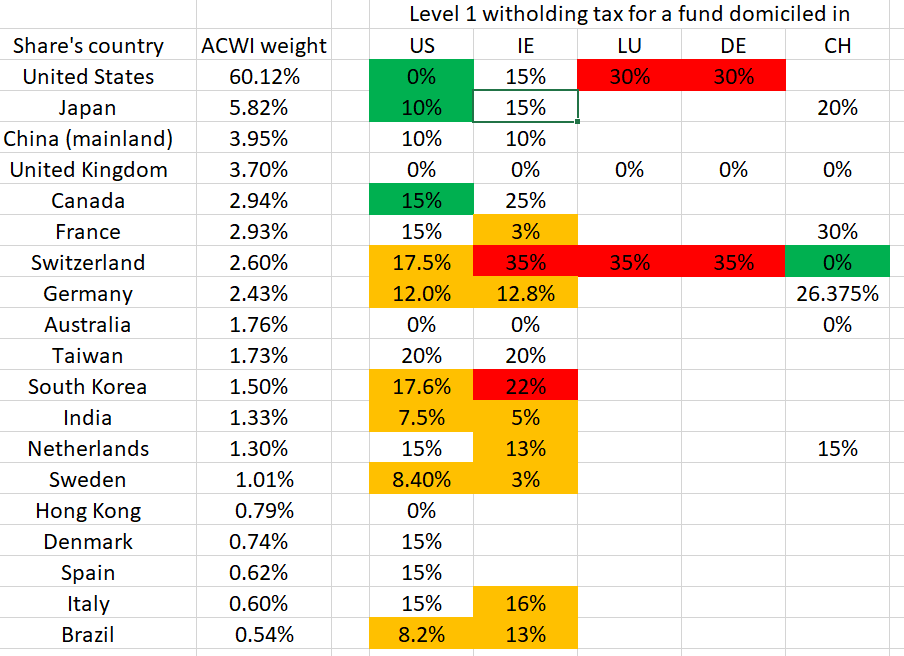

Dataset 1: withholding taxes on dividends received from stocks from different countries for funds with different domiciles.

Data are both “theoretical” and extracted from yearly reports of various ETFs. Unfortunately LU ETFs do not report gross dividends and withholding taxes separately.

Red: expensive taxes

Green: potential tax savings

Yellow: data as extracted from annual report which I don’t understand completely. Could be one-off effects in particular funds.

In case of a Swiss resident, tax optimization includes (at least) two things: (i) less non-reclaimable withholding tax on dividends and (ii) less dividends which are taxed as income. So it is for example possible to move a segment that pays more dividends into a tax-sheltered account (3a funds at finpension/VIAC).

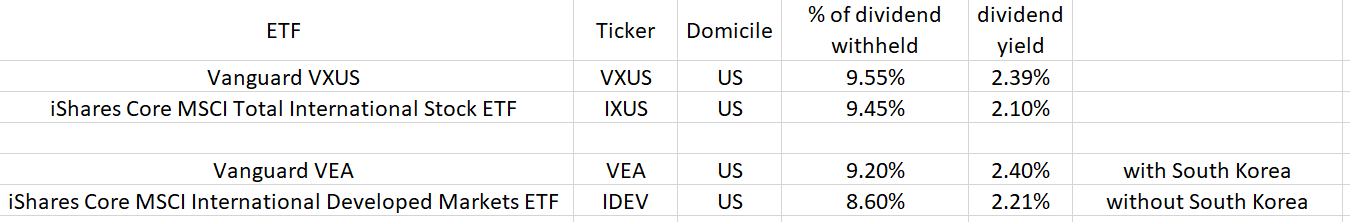

Dataset 2: % of non-reclaimable witholding taxes on dividends and dividend yields for some “whole world” (with and without emerging markets) funds.

Dataset 3: % of non-reclaimable witholding taxes on dividends and dividend yields for some “World ex US” funds. Only US domicile exists!

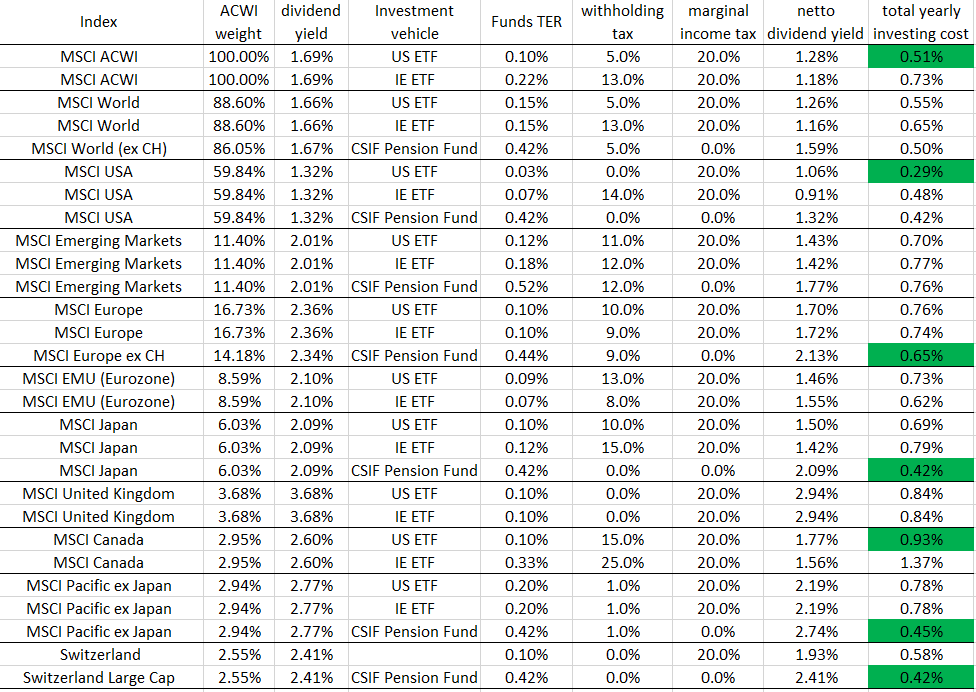

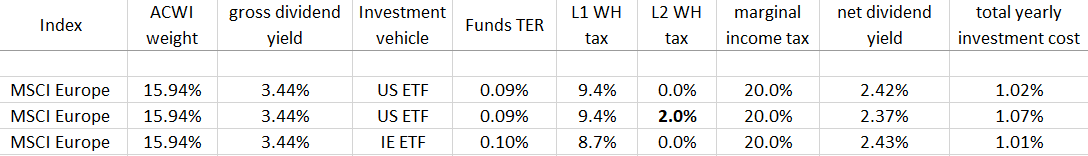

Dataset 4: MSCI indices (groups of countries) and withholding taxes reported by funds replicating those indices:

An interesting topic.

I myself invest in a portfolio weighted according to GDP and thus deviating from VT/ACWI. My choice of ETFs is mostly influenced by WHT and TER efficency consideration…

Looking forward to your conclusion!

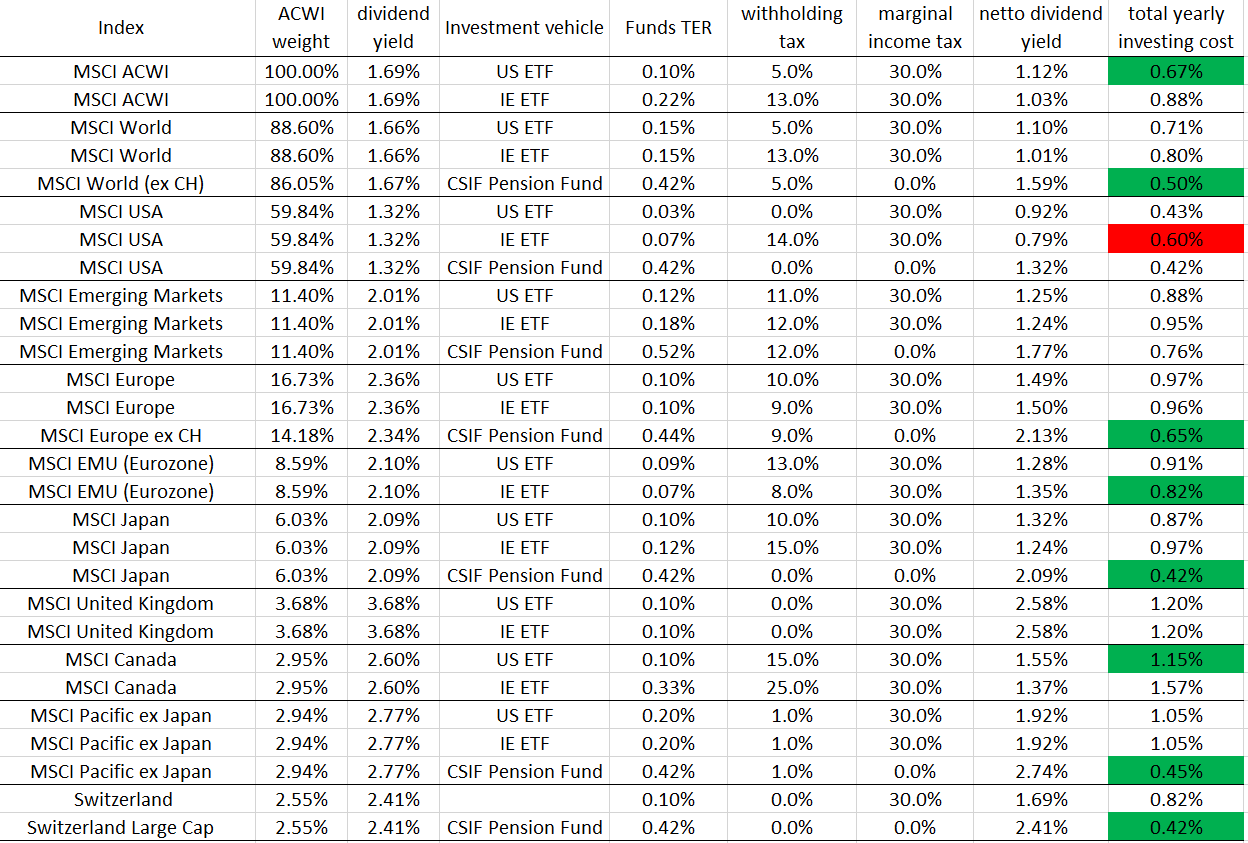

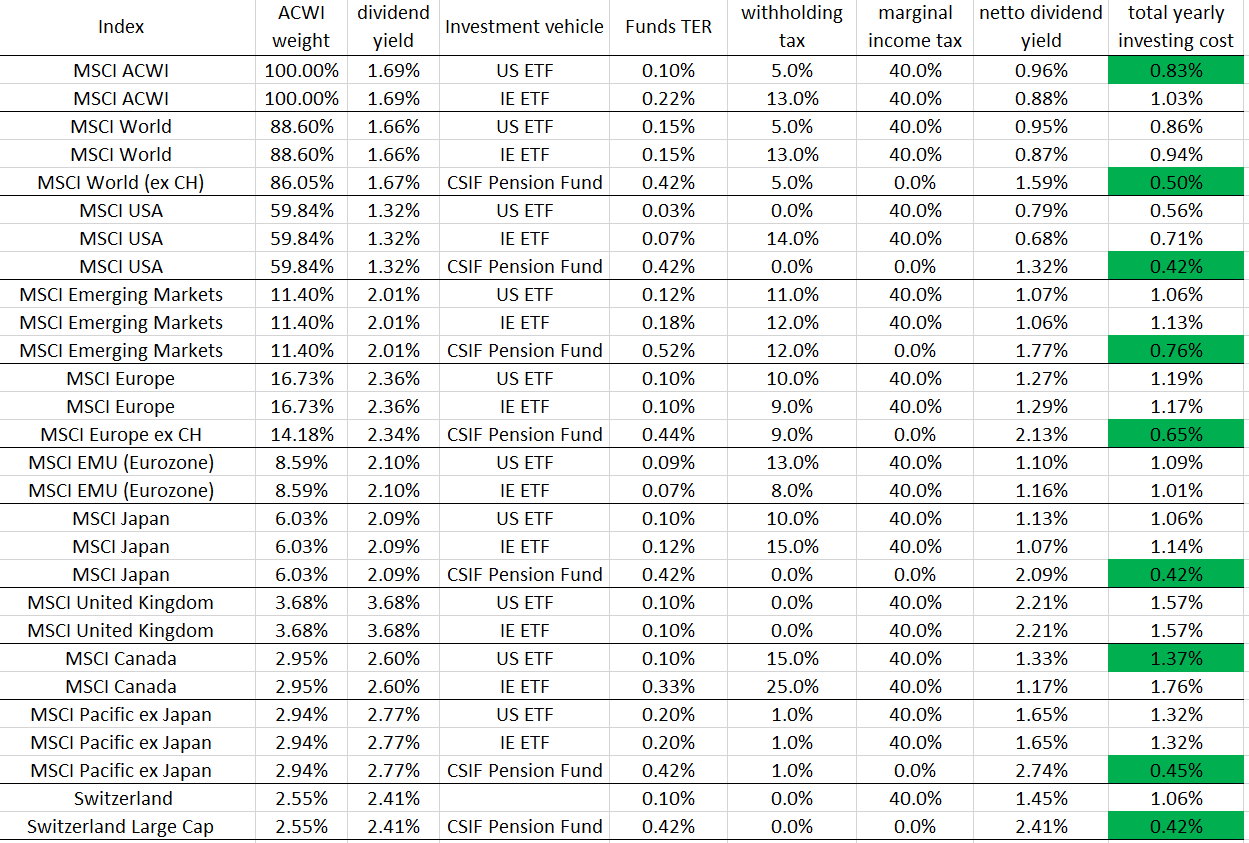

Dataset 5: estimated total yearly cost of investing in various world market segments via different investment vehicles.

3a investing via CSIF Index Funds does not take into account tax savings when you pay taxes in and taxes paid when you take 3a money out. However considering how different these tax rates are, one probably benefits additionally from 3a investing. Wealth tax is also not accounted for, but it should additionally increase advantage of 3a investing.

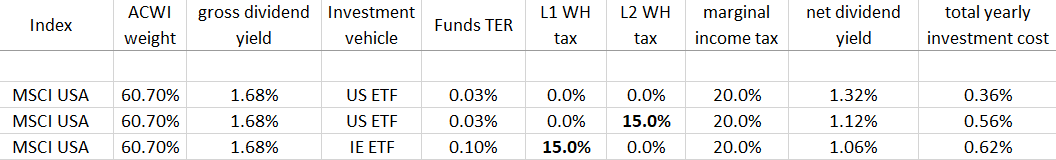

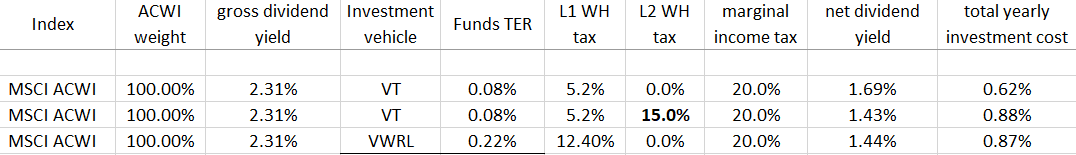

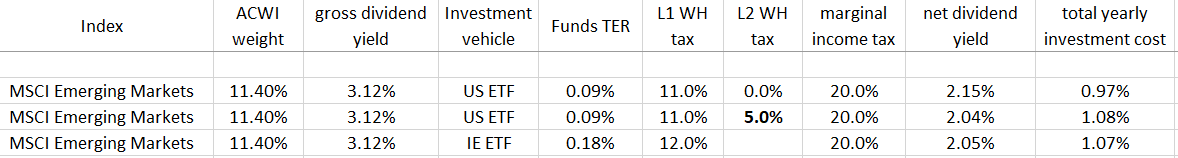

With 20% marginal tax rate:

With 30% marginal tax rate:

With 40% marginal tax rate: 3a investing has lowest costs!

Interesting comparison. Another aspect is that you also save wealth taxes when investing in 3a. The marginal tax rate in Zurich with 400k net wealth is 0.22%, with 700k 0.33% and with 1.4M 0.44% p.a.

Wealth tax exemption is applicable independent of the specific investment chosen within 3a. So i’d say it is not valid to include it in this specific comparison, as this concerns the question whether one should use 3a and not the questions which ivestments to hold in 3a.

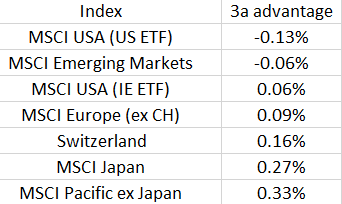

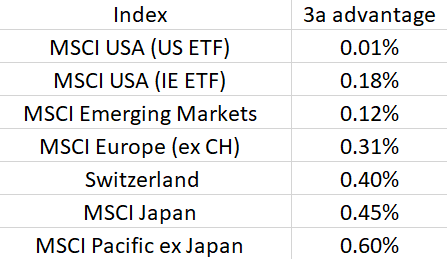

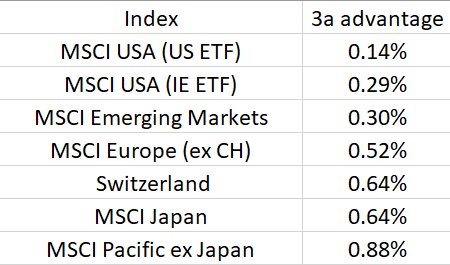

Relative advantage (difference of total costs p.a.) of investing into different geographic segments via a tax sheltered 3a index fund (finpension/VIAC).

With 20% marginal tax rate:

With 30% marginal tax rate:

With 40% marginal tax rate:

Excellent work, Dr. PI, very much appreciate your effort!

That’s assuming the ETFs are dominated by US stocks. If @gre will indeed underweight the US at 34%, it would probably be worth it to use Irish ETFs, or rather, use a US ETF for US stocks and Irish ETFs for all other regions. Due to the lack of an Irish ex-US ETF this requires multiple ETFs. However, if @gre wants to use custom (or GDP) weighting, using regional ETFs may make sense anyway.

Actually no. Except of ETFs on EMU (Eurozone) stocks (Stoxx 50 or MSCI EMU), not even for MSCI Europe, Irish ETFs don’t have a total cost advantage over US ETFs.

You may be right that the total cost is still slightly in favor of US ETFs, at least for some regions. However, the difference is small for most non-US regions. An important aspect is that this only holds true for the optimal case where you get a credit for the full 15% US WHT. If/when you (Coast)FIRE or have a lower income for another reason, you may no longer get the full 15% US WHT credit and then the US ETFs will quickly be worse than IE ETFs for most non-US regions.

I.e. if I were to invest in regional ETFs because of custom weighting, I would use US ETFs only for regions where there is a clear advantage (US, probably Canada, maybe Japan). Besides being better suited for years with lower income, it also reduces the IRS risk (especially for heirs in case estate tax threshold is lowered). And I rather pay taxes to Switzerland than to the US for non-US stock, especially as the US didn’t do anything for it.

![]()

Just to make it clear. It is a two steps process. Level 1 withholding tax on dividends are paid to the country where the company is located, not to US. Then, when a US ETF pays you dividends, they withhold level 2 tax, which is paid to US. You won’t see these money again, but hopefully get it completely deducted from taxes.

I was thinking about updating this post, but decided not to. Too many variables that affect total investment costs. Instead I decided to outline what I think is a right way to calculate the total investment costs for an ETF.

As a Swiss investor, one is only taxed on dividends, and namely up to 3 times. Let’s consider the whole process.

All companies included in a fund are paying out dividends, which all together make gross dividend yield (in %) D_G. The gross dividend yield of various baskets of stocks, for example built according to MSCI indices, can be found in current index factsheets.

When the dividends are being paid to the fund, Level 1 withholding taxes are being levied by the countries where the paying companies are domiciled. Let’s call the relative amount of this tax t_L1. An estimation of this tax for funds of different domiciles investing in various stock baskets can be found in the previous posts. At this stage, we are left with the amount of money equal to

D_G*(1 - t_L1)

At the next step, fund’s management takes management fees TER from the dividends. We are left with

D_G*(1 - t_L1) - TER

Then, this amount is distributed to the investor. Depending on the fund’s and investor’s domicile, there is another withholding tax on the distributed amount, called Level 2 withholding tax t_L2. So a fund investor receives

(D_G*(1 - t_L1) - TER)*(1 - t_L2)

As for a Swiss investor dividends count as income, it is taxed at the personal marginal tax rate t_m. Finally we are left with the net dividend yield D_N (in %).

D_N = (D_G*(1 - t_L1) - TER)*(1 - t_L2)*(1 - t_m)

The difference between D_G and D_N is the money loss (in %) associated with the investment and therefore it is the total cost of investment:

TCI = D_G - D_N

As you can see, there are 5 parameters that affect TCI, so if you compare different investment vehicles, calculate it for your situation.

However I explored certain examples of interest.

It is more advantageous to invest in US stocks via a US ETF even if you don’t get any reimbursements of level 2 withholding tax. For a simple reason: they have lower TER. But the advantage is slightly lower than the difference of TER!

With full (well, for Swiss residents) 15% Level 2 withholding tax an investment via VT costs you basically the same as VWRL. But with > 15% Level 2 withholding tax (no DTA, no or insufficient tax reimbursement) VT is more expensive than VWRL!

Something that specifically interests me: despite higher TER of IE ETF, it is a more advantageous vehicle for investments in MSCI Emerging Markets if your personal Level 2 withholding tax is more than 5%. And even if it is not the case, investment with an IE ETF is only slightly (ca. 0.09% p.a., i.e. TER difference) more expensive.

For European stocks, IE ETFs are already better than US ETFs despite a slightly higher TER, and if you pay Level 2 withholding tax, the difference increases.

It should be clear from the posts above that, when building a globally diversified stocks portfolio using 3a and taxable accounts, it is advantageous to hold US stocks as US ETFs at Interactive Brokers and Developed Markets ex US as CSIF funds in 3a account (finpension). The question now is: how advantageous it is and if it is worth extra efforts? I will use parameters which are pessimistic for 3a investment (marked red), so an actual advantage should be higher.

Note that I refer to MSCI classification and indices and I won’t talk about MSCI Emerging Markets. MSCI EM is a nicely segregated geographic segment of the global stocks market (10-11%) and, based on a comparison presented above, I decided to invest in this geographic segment via an Irish MSCI Emerging Markets IMI ETF.

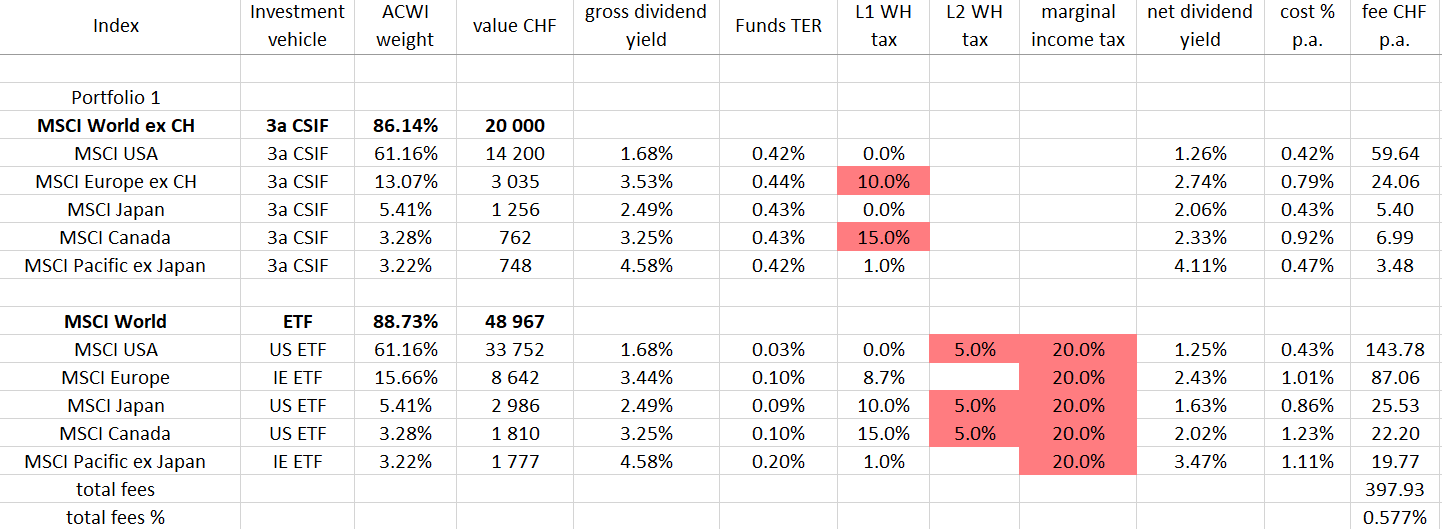

So, let’s consider a simple portfolio 1: an MSCI World ETF in a taxable account (48967 CHF) and CSIF MSCI World ex CH Index Fund in 3a account (20000 CHF). To make comparison easier, let’s assume that both of them are equivalent to the following combination of ETFs or index funds:

Note that our “synthetic” MSCI World ETF has TER of 0.055% p.a. and a preferable treatment of withholding taxes for each geographic segment. For CSIF funds I assumed L1 withholding taxes equal to that of CH based fund in a taxable account, unless it is known that they have a preferential treatment. This is what I mean with “parameters which are pessimistic for 3a investment”.

The total investment cost for the portfolio 1 is 397.93 CHF p.a.

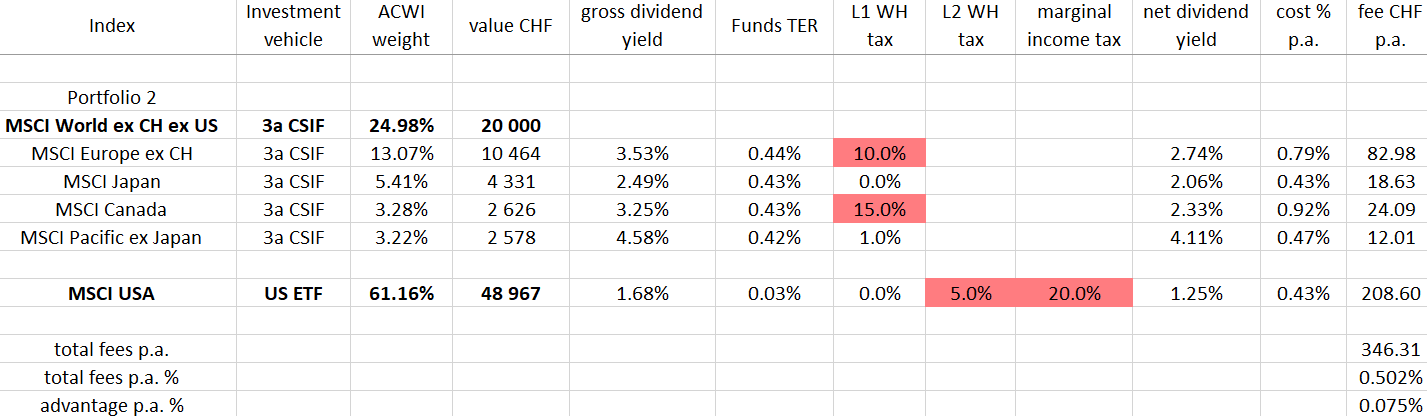

Now we consider an “advanced” portfolio 2. It is correctly weighted geographically, and both taxable and 3a account have exactly the same value. However now the taxable account holds only a US ETF on US stocks, all other geographic segment are held in 3a account as CSIF index funds. The 3a account is therefore a synthetic “MSCI World ex CH ex US” fund.

The total investment cost for the portfolio 2 is 346.31 CHF p.a. The advantage of the portfolio 2 is 51.62 CHF p.a., 0.075% p.a. with respect to the total value of both portfolios or 0.258% with respect to the value of the 3a account.

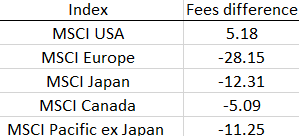

And this is how much we save (negative numbers) per geographic segment with portfolio 2:

Now the question is: is it worth to create a synthetic MSCI World ex CH ex US fund in a 3a account using CSIF index funds? For me it is clearly worth. Even this conservative estimation shows an advantage of such approach. Real savings should be higher.

But there is another important non-financial consideration. Namely that holding ex US stocks as a US ETF means that one pays US taxes that US is not entitled to receive: withholding taxes on dividends distributed by companies domiciled outside of US. We are always considering that we are getting reimbursed, at least partially, withholding taxes paid to US, but this is not exactly what happens. US does not reimburse our withholding taxes, instead we are paying less taxes to Switzerland. So we are giving money to US and taking it from Switzerland. As a good Swiss citizen, I would like to avoid it. So I invest into Developed Markets ex US via CSIF index funds. This need some calculations, but nothing complicated.

I am doing the same. I only hold VTI at IBKR and cover the rest with my 2nd/3rd pillar investments.

Not only because of withholding taxes, also because of income taxes. ExUS has a 1-2% higher dividend yield, so you you’ll reduce your income taxes by splitting it up that way.

How do you handle the differences in sizes of your pots vs. target allocations?

E.g. If your 3rd pillar is 10%, or 60% of your total investments?

Your 3rd pillar invested in ACWI IMI ex-US should represent 45.5% of your invested wealth.

It will rapidely become unbalanced so you will need to balance it with other ETF such as

| VT | US9220427424 | Vanguard Total World Market | 72,4% |

|---|---|---|---|

| VERX | IE00BKX55S42 | Vanguard FTSE Developed Europe ex UK | 13,6% |

| VWO | US9220428588 | Vanguard FTSE EMERGING MARKETS | 9,6% |

| AVUV | US0250728773 | AVANTIS US SMALL CAP VALUE | 12,0% |

Be creative and find your way!

First, you can always use VT ETF or MSCI World ex CH Index Fund to invest “unbalanced” funds.

If you have “too much” in 3a, that is relatively easy. 3a: developed ex US + MSCI World, taxable: US, MSCI Emerging Markets doesn’t really matter where. That would be the most optimal allocation. A system of 2 linear equations to solve, I would say ![]()

In extreme cases, when 3a account is much larger than taxable, one can have Emerging Markets only in taxable and MSCI World ( + Emerging Markets if needed) in 3a.

If you have a bit too little 3a, you either complement US stocks with Developed Markets ex US ETF, or buy VT. If the difference is quite big, one can for example buy MSCI Europe ETF in addition to US (+ Emerging Markets) in taxable account.