I was thinking about updating this post, but decided not to. Too many variables that affect total investment costs. Instead I decided to outline what I think is a right way to calculate the total investment costs for an ETF.

As a Swiss investor, one is only taxed on dividends, and namely up to 3 times. Let’s consider the whole process.

All companies included in a fund are paying out dividends, which all together make gross dividend yield (in %) D_G. The gross dividend yield of various baskets of stocks, for example built according to MSCI indices, can be found in current index factsheets.

When the dividends are being paid to the fund, Level 1 withholding taxes are being levied by the countries where the paying companies are domiciled. Let’s call the relative amount of this tax t_L1. An estimation of this tax for funds of different domiciles investing in various stock baskets can be found in the previous posts. At this stage, we are left with the amount of money equal to

D_G*(1 - t_L1)

At the next step, fund’s management takes management fees TER from the dividends. We are left with

D_G*(1 - t_L1) - TER

Then, this amount is distributed to the investor. Depending on the fund’s and investor’s domicile, there is another withholding tax on the distributed amount, called Level 2 withholding tax t_L2. So a fund investor receives

(D_G*(1 - t_L1) - TER)*(1 - t_L2)

As for a Swiss investor dividends count as income, it is taxed at the personal marginal tax rate t_m. Finally we are left with the net dividend yield D_N (in %).

D_N = (D_G*(1 - t_L1) - TER)*(1 - t_L2)*(1 - t_m)

The difference between D_G and D_N is the money loss (in %) associated with the investment and therefore it is the total cost of investment:

TCI = D_G - D_N

As you can see, there are 5 parameters that affect TCI, so if you compare different investment vehicles, calculate it for your situation.

However I explored certain examples of interest.

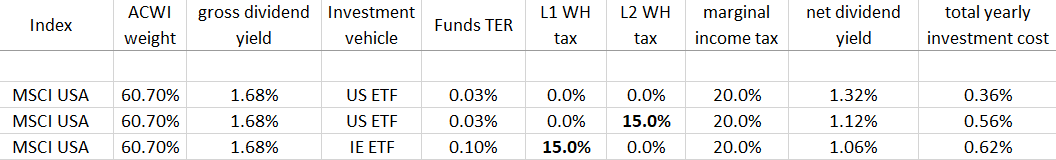

It is more advantageous to invest in US stocks via a US ETF even if you don’t get any reimbursements of level 2 withholding tax. For a simple reason: they have lower TER. But the advantage is slightly lower than the difference of TER!

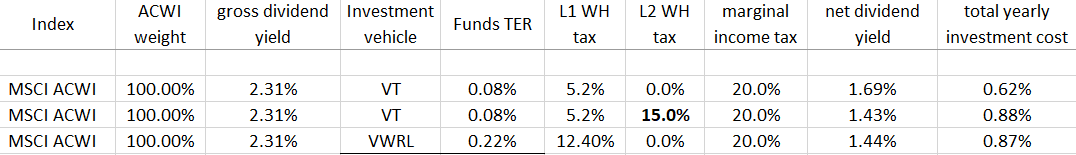

With full (well, for Swiss residents) 15% Level 2 withholding tax an investment via VT costs you basically the same as VWRL. But with > 15% Level 2 withholding tax (no DTA, no or insufficient tax reimbursement) VT is more expensive than VWRL!

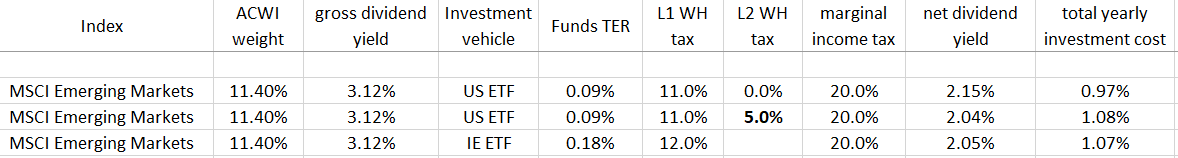

Something that specifically interests me: despite higher TER of IE ETF, it is a more advantageous vehicle for investments in MSCI Emerging Markets if your personal Level 2 withholding tax is more than 5%. And even if it is not the case, investment with an IE ETF is only slightly (ca. 0.09% p.a., i.e. TER difference) more expensive.

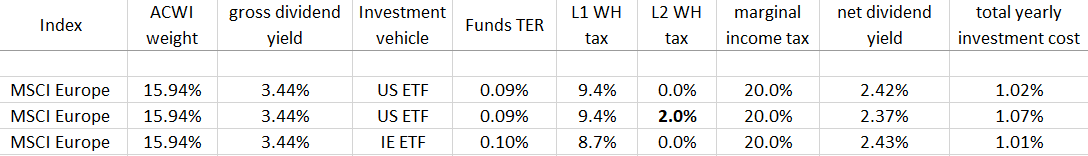

For European stocks, IE ETFs are already better than US ETFs despite a slightly higher TER, and if you pay Level 2 withholding tax, the difference increases.