No man (woman?). This article is about you being able to write off the whole 5 million, like the people in USA can. 60’000 is the default for countries without a treaty.

Dont the things mentioned in cray’s article still apply though?

The “cray’s article” is the treaty from 1951. It applies, and it says that “if you are domiciled in Switzerland at the time of death, you shall be treated as if you were domiciled in the US”. The estate tax exemption has been going up for years, and you can see the history on the wiki page I linked.

Is there a risk they will abolish this exemption? Sure. But then you should close all your positions in USA and buy the Irish ETFs. Sure, you might as well stick with the Irish ones from the start, but as you said, you get 0.5% taken away every year. Over 30 years that’s 14% difference on your portfolio.

They are held in broker’s name (but segregated) in both cases, you’re not a big enough of a fish to deal with central securities depositories (like SIX, DTCC) directly are you. In US you have SIPC guarantees on top of that. In UK/CH nothing.

Is it clear with IB what kind of assets are under SIPC and which ones are not? You mentioned somewhere that assets managed by the IB US get protection, but assests managed by IB UK dont.

Another thing I am scared about is, somewhere in a post somebody found IB’s “emergency fund”, basically the amount they have to cover ALL clients assets, if they had to and it was a ridicoulus low amount…

Well in Switzerland my shares are held in my name, is this not enough of a gurantee?

If a broker goes bust and misplaces my shares in my name, arent there legal consequences?

The broker’s name is on the books at CSD, not yours, both in Switzerland and abroad

If you want your name there, you’ll need to deal with CSD directly which probably means you’ll need to buy yourself a small bank for a start.

An alternative existing in US is DRS system, where you can opt to transfer shares from broker to the company directly whose stock you bought, and then company’s name will be on the CSD books. It goes bankrupt, well, its stock’s a zero anyway.

Read up on MF Global bankruptcy as a case study

Well, good question. I googled a bit and here it is:

It’s mentioned in the first two points.

- Interactive Brokers (U.K.) Ltd. (“IB UK”) is authorised in the United Kingdom by the Financial Conduct Authority (“FCA”). This Agreement (“Agreement”) governs the relationship between Client (You) and IB UK for trading certain products carried by IB UK, including certain index options, futures and futures options and Over-the-Counter (“OTC”) Products such as Contracts for Differences (“CFDs”), Foreign Currencies, and/or Foreign Currency CFDs (“Forex”) and Precious Metals (collectively “Covered Products”).

- This Agreement does not cover trading in stocks or shares, bonds, mutual funds, or any product carried in accounts held at IB UK’s U.S. affiliate Interactive Brokers LLC (“IB LLC”)

So cash and metal in IB UK, stocks and bonds in IB LLC.

Interesting stuff thanks hedgehog!

I was refering to this from esisuisse

That gave me the impression my assets would be safe no matter what. What is your source for the brokers name at CSD?

@Bojack Thanks for providing that. I guess now there is nothing keeping me from using IB, I just have to decide on a portfolio now

I’m also about to buy VWRL with IB and my only concern about choosing CHF is that IB charges you negative interests for holding cash in CHF and VWRL alas is a distributing ETF; so I should check the distributing days and immediately withdraw or invest the CHF dividends.

I was wandering if the negative interests I could pay if I forgot the dividend day is more than the conversion rates USD>CHF…

Last but not least, maybe with IB you have different costs if you buy it on the SIX (CHF version) or on the LSE (USD version), still have to check this.

The negative interest over one day is probably negligible but anyway VWRL distributes in USD.

You are right, I had in mind that for CHF you had negative interests for any amount, thank you!

Hey fedra, I just wanted to let you know I ended up going with US funds at IB

You mean ISIN US etc.?

No worries about inheritance taxes then?

Me, finally, I am implementing a Swiss Golden Butterfly Portfolio at IB:

20% Gold (bullions and ZGLD)

20% Long term Gov Bonds (CSBGC0)

20% Cash/Short term Gov Bonds (Cash)

20% Domestic Stocks (CHSPI)

20% Global Stocks (VWRL)

Yeah going with US ISIN’s.

Estate Tax has been covered lots of times here, its not really an issue, the ‘limit’ is not 60’000 but 11Mio. Also there is no documented case we are aware of where a Swiss citizen was taxed on his estate, the way you might be afraid of. I guess you have to watch out for changes to the treaty while accumulating but thats about it.

Whats your rationale with the butterfly portfolio, as opposed to a more conventional stock/bond split?

Hi,

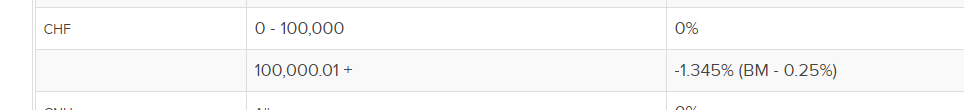

Just to clarify a little bit the US estate tax : the limit is not USD 60K nor USD 11M. You are subject to US federal estate tax if, at your death :

- You are a non-US citizen or non-US resident and;

- You are a Swiss citizen or a Swiss resident and ;

- You have somme “US situs assets” (such as US real estate, shares of stock issued by US corporations, ETF in a US-domiciled fund etc…) and;

- Your “US situs assets” are worth more than USD 60K.

If you are subject to US federal estate tax, your spouse/family/cat need to file the 706-NA form and request the application of the “Convention between the Swiss Confederation and the United States of America for the avoidance of double taxation with respect to taxes on estates and inheritances”

According to this Convention, here’s how the US estate tax will be calculated on your US assets (Article III) :

US “exclusion amount” x (total US assets / total assets if you were a US resident/US citizen) = estate “exclusion amount” for your US assets

As of 2018 and until 2025, the US exclusion amount is USD 11.2M.

So for example, if at your death your worldwide assets are USD 2.5M and you have USD 900K of US situs assets, the exclusion amount will be USD 4’032’000 (11.2M x (900K/2.5M). No US estate tax in this example (4mio > 900K).

If your worldwide assets are USD 100M and you have USD 10M of US situs assets, the exclusion amount will be USD 1.2M (USD 11.2mio x 10%). The US estate tax applies in this example and USD 8.8M (10M-1.2M) will be taxed at a 40% rate.

These examples are of course highly simplified and do not take into account potential deductions etc… In any case, it is true that the US estate tax should not be a concern for most Mustachians ![]()

I hope this was clear enough !

In practice the exemption is still 11M of worldwide assets (just if you’re above the limit, the tax will depend on the proportion of US assets).

I have no practical experience but from what I can read (FR), since FATCA (2014), even non-US banks have the tendency to block the estate’s accounts if there is US assets and wait for the IRS’ green light.

In any case, I would rather rely on law than current practice to plan my estate.

Is there anyone here who has prepared the 706-NA in case of death? What else can be done to prepare ones heirs?