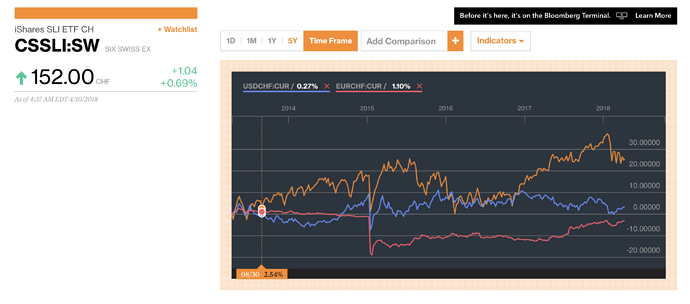

Then CSSLI is definitely a wrong product for you. Although it’s technically denominated in CHF, most of their profits are in USD and EUR, so have a guess where things go when CHF rises, look at some plots of them together

What you attached (blue) is the price of USD in CHF

Thanks, screenshot fixed.

Well, if anything, the previous chart was more informative to me  . It was comparing the SLI with USD price in CHF. Now we have SLI price in CHF vs CHF price in USD and CHF price in EUR. How to read such a chart?

. It was comparing the SLI with USD price in CHF. Now we have SLI price in CHF vs CHF price in USD and CHF price in EUR. How to read such a chart?

So, the first one was correct. There’s was SLI price in CHF and USD price in CHF, so it showed inverse correlation between SLI and USD (denominated in CHF). Why then did you want me to change it? ![]()

Sorry, I wanted to figure out what “CHF” means so I went to Bloomberg to check. Then I just shared that info that CHF means “USD price in CHF”. That explains more what you’re trying to show

My only income is from my invested money so I can’t imagine another strategy, can you?

In fact my question was more a theoretical one: how come that an ETF with more expenses is chosen over another one tracking the same index but with less expenses? I hoped to learn something new about how to evaluate ETFs in general (thinking I overviewed some other substantial characteristic that made the more expensive one more desirable. Fact is I always start granting investors some minimal IQ). No intention in fact to buy neither of them.

Maybe TER was higher in the past. Don’t assume that if a competitor lowers it people will instantly jump ship, maybe CH doesn’t tax capital gains but most other developed world countries do. And then there are non insignificant transaction fees, since you’re not in Kansas anymore. And for what? 0.10% savings in TER. That’s nothing compared to taxes that are like 1%

Besides, iShares might be considered more trustworthy and more “homie” on US market than UBS. I guess average American investor prefers to invest via American brokers and funds, even if they’re more expensive than others.

There is a twist in your reasoning and ill try to point it out precisely:

regarding the long term value of your portfolio, there is no difference between removing dividend distributions or selling shares worth an equivalent amount. this renders your argument void:

but the dividends are taxed at up to 30% in CH, other than the sold shares. I i was currently retired and recieved chf 100k in dividends, 16k would be taxes. if i got the 100k by selling shares, i would pay zero taxes.

the truth lies in between since hardly any company refuses to pay dividends. however, this shows you why a dividend strategy for a swiss based investor is questionable, and picking high dividend stocks is equivalent to increasing the tax bill proportionally, with no compensation whatsoever. it is not pareto-efficient ![]()

But I read from Hedgehog in another post:

For swiss stocks, 35% is withheld by ESTV and claimed back by declaring stock in your tax declaration.

For US taxes, you file W8-BEN with IB and they will withold just 15% from US dividends, which is fully reclaimable hassle-free with DA-1 on tax declaration. For other countries it can be a combination of DA-1 and extra steps for above 15% withholding.

I’m confused ![]()

You get the withholding tax back in exchange for paying the actual tax (to make properly paying taxes the cheaper solution).

dont be confused, my number was rather a rule of thumb. hedgehog’s numbers are correct.

ok to fully cover it:

swiss domiciled dividends are taxed upfront 35%. you can lower the tax burden to your income tax level by declaring those dividends as income. you will then effectively pay your income tax level on the dividends.

US domiciled dividends are taxed (on US side) at 30%. due to a tax treaty with CH, you can with some brokers (IB for example) reduce that to 15%. however those dividends are still considered as income by swiss tax authorities (unlike selling shares) and swiss law wants you to declare those so they can tax them appropriately.

=> better not focus on dividends when investing, unless you have other dramatic reasons for it (i would not know any)