So this is not ESPP, it’s more like deferred stocks but you need to buy into them.

So just to be sure

- you can buy X number of shares

- you will pay current market price -20%

- these shares would be only given to you after 3 years

- after three years , you would get minimum 2X shares

- Was it clarified what would happen to dividends during the 3 year period?

- What happens it you leave the company? Would you get refund of what you paid to buy shares?

- When exactly the free shares be rewarded ? At beginning of period or at the end of period ?

For example . Let’s say price is 600 CHF. You buy 10 shares for 4800 CHF. 1200 would be discount and also taxable.

After three years. You would get 20 shares. If the price remains the same, you will have shares worth 12000 CHF. If price drops by 50%, you will have 6000 CHF

Right?

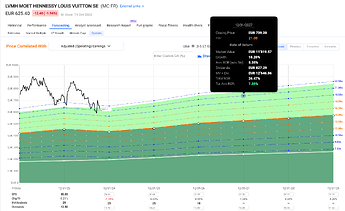

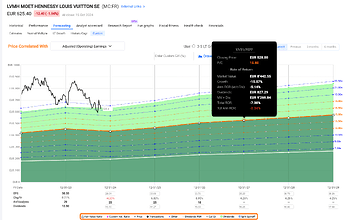

If this is true, I don’t see many risks. LVMH is not a random company and it’s not going away anywhere anytime soon.