No it won’t, but it is expected to. The rest is either luck or you have to predict the future better than the whole market (which I don’t believe that you can).

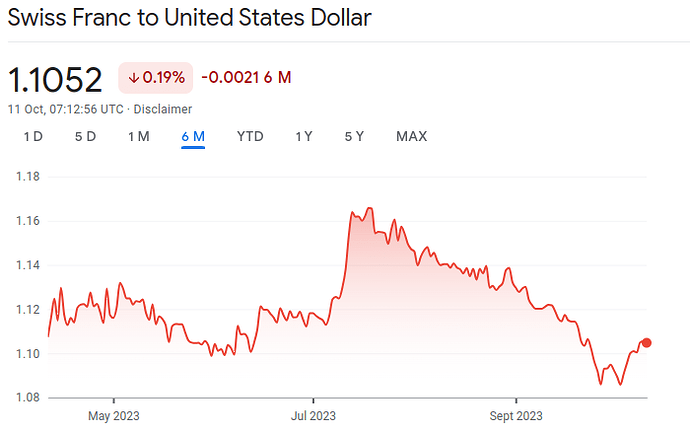

Here are movements for last 6 months? Do they follow the interest rate changes? Not really.

So worst case if FX changes go against me, I end up in same position as if I had invested in CHF MM but I pay a little extra tax. Or if FX changes go for me, I make large FX gains. Sounds like a postive net expectation.

No worst case it depreciates faster than what the market expects and you don’t even get the risk free rate (and pay lots of taxes in your poor return which could even be negative)

Edit:

Also remember that market movements can be due to market expectation changing, which won’t be at the same time as interest rates changes.

Eg early July could have been some release of inflation data in the US or CH, that made market change their view on expected interest rate changes. So I wouldn’t so clearly say it’s obviously unrelated.

The problem with interest parity theory is that it considers FX in a perfect world where interest rates are the only factor. The real world is considerably less perfect and more complex.

FWIW, I do expect short end rates to go down faster than the Fed is saying which would be a negative for the dollar. But monetary policy is only one factor in FX.

I suspect dollar/collateral shortages will result in a higher dollar even as the Fed cuts.

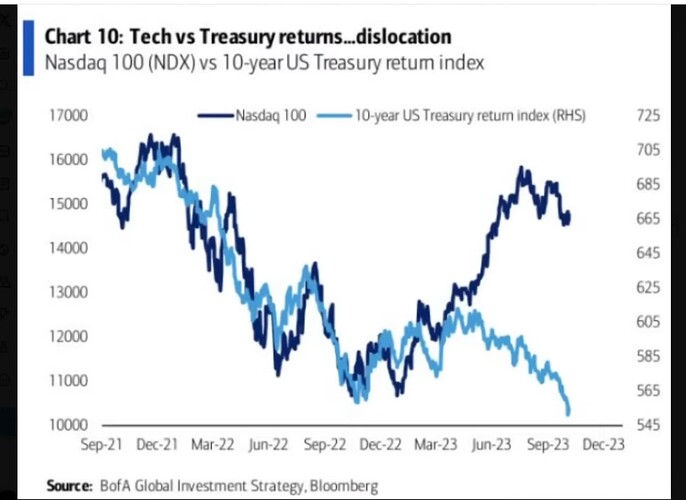

And as the last 3 months shows, you can earn higher interest on a 3 month T-bill and make an FX gain at the same time even as rates rise.

What`s the IB ticker for the US 3 month T-bill please?

Where do you see that 0 coupon bond gains are taxed as income? In my brokerage report it will never show as interest just change in portfolio value.

US ones always have 0.125% minimum I believe.

You can’t generally rely on the income from the brokerage report matching the income you need to declare for tax purposes. Besides the bond issue, accumulated dividends normally don’t show up as income in brokerage reports. And distributions of Swiss-domiciled stocks and funds are not always fully taxable (e.g., capital gain distributions and REIT). You should use the data from ICTax (which is integrated into tax software) as reference instead.

Well, these mature every 3 months so they will always be changing. You can also use ETFs such as BIL, XBIL, etc.

Yes sure, thanks. Do you know what the ticker is that matures in say Jan 2024 is? I can then find others from that.

Use the IBKR bond search tool to find the bonds you want.

You might also be interested in the iShares iBonds. These are synthetic bonds structured as ETFs.

Does the difference in interest rates empirically account for/incorporate a presumed taxation?

After all, when interest is distributed, somebody usually (most private bondholders, with certain exceptions, e.g. some pension funds) has to pay tax on it. That would make sense to be recognised as an observable discount on the interest rate spread?

Given the current geopolitical situation I guess CHF will getting stronger as safe harbor. Without FED or SNB intervention I see CHF getting stronger.

Both USD and CHF are traditional safeharbor currencies. The US has a significant problems that ought to weigh on the currency - but we also know from the experience in Japan that such a situation can be ignored by the markets for a surprisingly long time.

Corporations pay taxes on the net profit, i.e., they can deduct foreign currency depreciation from nominal interest, so I wouldn’t expect any correction based on nominal interest taxes.

From further research (chatting to people in the industry & running a few test bonds through ICTax) it seems like you just pay capital gains on difference between issue price and value at redemption.

e.g. a 3 yr US bond issued in 2021 with 0.125 coupon might have ended auction at 99.75. Since it pays out 100 at expiry in 2024, the tax office assumes 0.25 additional as “taxable return” when the bond expires.

So even if it is trading significantly below par today (e.g. you can buy at 95 thanks to interest rate rises) you only pay the cap gains on 0.25 rather than 5. And of course, on the 0.125 coupons.

I think it’s safe to say your strategy has backfired greatly.

Prime example why market timing does not work.

CHF to USD appreciated more in the last weeks, than your t-bills minus tax make in a WHOLE year + the S&P recovered a lot the last weeks.

So not only did you make a net loss on t-bills converted to CHF, you also lost out on 7% gains of the s&p 500 in the last month, because you kept money out of the market.

time in the market beats timing the market and having bonds not in you local currency makes no sense.

I think you’re getting confused between market timing, asset allocation and risk. What I am doing has nothing to do with market timing.

I’m not looking to invest over a few week time horizon. I’m looking to invest over the long term. If you were to invest for only a few weeks, it would be unwise to invest in equities due to the volatility.

All my money is invested in different assets. Some will perform better than others at different times. I take a portfolio approach so that the total portfolio gives a suitable return at a suitable risk. What you’re saying is as foolish as saying that investing in the stock market has ‘failed’ in the last years as one should have

put all money into crypto to get a much better return.

“It’s not supposed to be an optimal tax strategy, but an optimal investment strategy. I’m happy to take 6% interest and keep my capital, rather than lose the capital that has been lost in recent times with the S&P500.”

Sorry you say something entirely different here.

Also apparently you did not really read what I wrote.

Im 100% invested in stocks globally diversified via etfs.

Why do you think that is different?

I’m 70/30 stocks/bonds.