My Finpension 3a scheme is in a Quality tracker fund

I’m an open book, aren’t I? ![]()

what about the last 12? You can call it recency bias, but it’s a half generation’s time.

point being, VT is by far the worst in comparison.

12 years is nothing when it comes to stock returns.

Would you have invested everything in Japan in 1988?

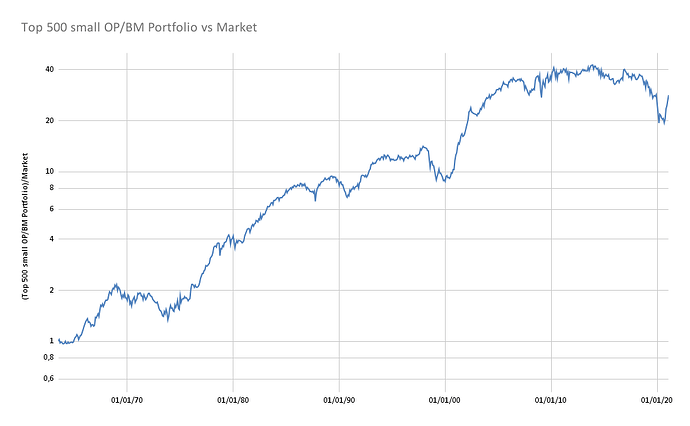

US Small cap value + Operating profitability Portfolio with 500 companies vs total US Stock Market over the last 58 years:

Capt’n Hindsight would be filthy rich by now.

The status of the 70’s are nowhere near applicable today.

I’m in the team of “anything before the internet was born is not relevant”.

I might be proven wrong.

So this time is different.

This time has always been different.

The internet has been around for 30 years now. Why not use the last 30 years?

Tbh I was struggling to find stuff that goes back to before 2000 for a correct comparison.

@wnox are you still around?

Yeah, I’m still here and reading all the replies.

I just don’t know what to answer as I just don’t have the deep knowledge others have on here. Love that my post sparked such a vivid discussion.

Another possibility could be to recreate your world exposure by using different ETF ponderated by country’s GDP and not market capitalisation.