I read something completely different in the article. Saxo is not bankrupt, but the existing investors want to sell what is performing less well. Or am I not picky enough and question too little? I’m always a bit cautious with Inside Paradeplatz. In any case, I wouldn’t compare it with Flowbank, as they had too little equity and problems with FINMA which is not the case with Saxo.

IP is a great resource, but I would take everything with a grain of salt. Lukas Hässig tends to over-dramatize a bit.

I think the deception for Geely is the fact that they won’t be able to obtain a juicy IPO exit as expected.

So they prefer resell SaxoBank as it’s more a long term investment and not a quick capital gain transformation as anticipated.

In other words: In the long term, the owner will change and the new owners will possibly increase the prices again, as they also want something from it.

I am also not saying that they are getting bankrupt. But when a bank is looking for a buyer this means that current owners are not interested in the asset

Whatever the reasons could be, it creates uncertainty

Is it possible to buy US ETFs at Saxobank? E.g. the VT? I always thought that this was not possible, but I read somewhere (can’t find the page or the forum anymore) that it should be possible now.

Does anyone know more?

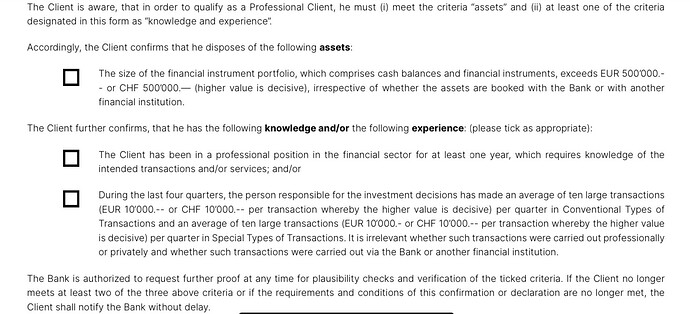

It‘s not possible, unless you qualify as professional trader with them (minimum 500K account value and certain number of trades).

Thanks for the quick reply. Can I find this information including all requirements somewhere in the Saxo Bank terms and conditions?

Just send them a note and they will send you a document.

They have a waiver that you would need to sign which basically would help them classify you as Professional client. This helps them indemnify themselves if you end up losing money buying US ETFs. US ETFs don’t provide the same documentation like UCITS and that’s why they need to protect themselves.

I don’t have Saxo account anymore

Thanks a lot! Which broker do you use? IBKR? Swissquote? Both? Others?

IBkR & SQ

I phoned Saxo Bank this morning and received confirmation (verbally and now also by e-mail) that I can trade the VT ETF as a retail client.

That’s great. I am a Saxo client and until 2-3 weeks ago I could not trade US ETFs. Now I checked and I see I can.

Interesting

Looks like they changed their policy

Thanks for sharing

Yea, you are right, I don’t have the exclamation mark next to the US ETFs in my watchlist anymore either. I did not notice when that disappeared.

They are going with the times, pretty good. I am still mostly on IBKR but I do still hold one ETF with them. But at some point I’ll sell that. But I assume they are becoming the best Swiss broker.

Not really Swiss though 51% Chinese holdings for now.

HUH. That’s a big change then.

I’m still hesistant to believe that, because they made ads with that in the past and then restricted it anyway.

How do you mean? It officially is a Swiss broker, legally.

Who ultimately owns it is secondary.

Well. I just wanted to share that Saxo’s ownership is not really Swiss. I know they are regulated by FINMA and are registered in CH.

So when we say Swiss broker - what does it mean?

Regulated by FINMA OR

Ownership in Switzerland

The answer to this question would define who is Swiss and who is not.

For example Tiktok is Chinese or American? For me it’s Chinese TikTok

Just to be clear. There is nothing wrong with Saxo . I just felt a bit uncomfortable with ownership structure.

I mean do you care that Allianz is not Swiss but regulated by FINMA if it wants to operate in Switzerland? I get that Chinese ownership isn’t attractive, but yes, I was talking about legal entity in Switzerland and falling under Swiss regulations (FINMA).