But still, even with all these considerations… I imagine guys like Messi, Neymar and Ronaldo pay 50% of income tax. So their income is 20 million and tax is already 10 million, so their best bet at savings rate is a miserable 50%  And how to “improve” their savings rate? Earn less!

And how to “improve” their savings rate? Earn less!  (or try to cheat the tax system, as they all do apparently)

(or try to cheat the tax system, as they all do apparently)

hehe, lets now worry about saving rates and retirement plans of Messi, Neymar and Ronaldo

Our formulas should make sense for people with gross income between 60k/80k - 200k/250k CHF per year [EDIT: in Switzerland  ]. That is where I guess most people on this forum are.

]. That is where I guess most people on this forum are.

Pretty sure if you make 200k in many European countries, you give away half of it

qualified my statement by adding an edit

@covfefe I have used your formula and I get a saving rate of 58% due to the inclusion of the employer contribution to 2nd pillar.

I have included the taxes using the quellensteuer I paid each month but didn’t take into consideration lower taxes due to pillar 3a and other deduction. This means that the SR would increase later with these adjustments and maybe get closer to a 60% while I got 64% with the initial method I have used.

My approach::

- I use net salary hitting my bank account

- I recently starting to exclude all taxes but also have a yearly savings rate calculated including taxes

- Second pillar contribution: Excluded, I don’t count on the second Pillar for my FIRE goals since it’s unclear how to access it incase I stay in Switzerland

- Assets: Yes large purchases like cars would count as expenses but also the sale of a car as income.

I think they would greatly benefit from some form of expense tracking…it’s crazy how many footballers end up broke within few years of retirement while having a garage full of luxury cars

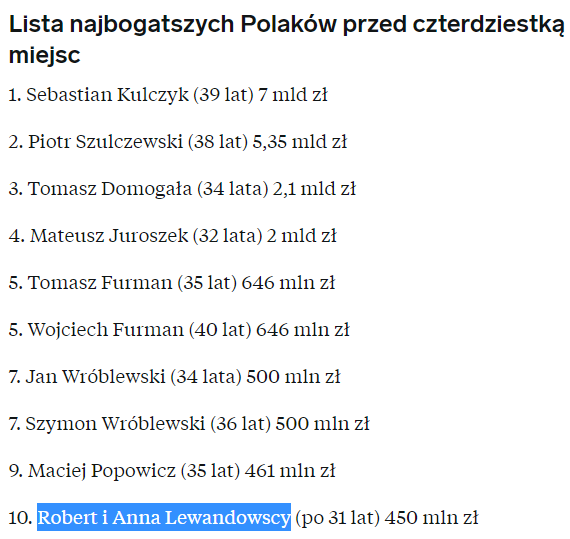

I know one footballer who will be fine. The list of richest Poles under 40yo:

That list is from 2019. In 2020 they already have 500m and are placed #80 in top 100 richest Poles.

The nice side-effect of including 2nd pillar in savings is that the rate automatically goes up with your age

Many interesting answer in just one day. Great!

I did expect to hear different approaches, but I am surprised how different people use their savings rate (if at all), and what it means/states for them. And I agree that comparing savings rate in any case makes no sense. That’s also why I did neither post mine nor asked actively for anyone else’s. The only benchmark is your past self.

The biggest difference in view/impact is clearly the second pillar question. To those who do not include them in their income: Do you also not track as part of your net worth? Even if you never plan to buy a house (enabling you to draw the money), you could declare yourself self-employed after you FIREd and draw it for your new business, before liquidating that business shortly thereafter (bit tricky but possible).

The other big aspect concerning myself: I use the savings rate calculation to reverse engineer my expenses. As such, I must include everything in the income that I consider my own expenses (that I would have with or without the job). So I do include benefits like the SBB GA, (and would also include health insurance if paid by employer), or I would underestimate my expenses. That is also the basic reason why I exclude a car (called it acquired non-financial assets, but so far that only ever has been cars): If I include it, not only does it skew a large part of my (yearly) data points, but I would not be aware of my regular expenses.

Personnaly, I just consider the 2nd pillar as a bonus at the end. Anyway once FIRE, as you suggest, I can do whatever I want with it (invest it via VIAC/Finpension, by a house etc).

So right now, not calculating it as a part of my income, nor of my Networth, and I will see in the end what comes. Knowing that it exists, I can calculate pretty tightly for my FIRE goal.

Why I am doing it like that : Lazyness. I can’t look up the numbers easily on internet, And I have to ask for the final Abrechnung every year. I trust them that they calculate the meager interests correctly.

The one perspective it could help to take a look at from time to time, is to perceive it as the “bonds” part of your entire NW - so you can go more/less risky (equity etc.) with portfolio parts outside of it.

My strategy is full stocks outside of 2nd pillar, so not relevant for me but yeah, for someone else it could be.

The only problem is that you can’t use it to buy stocks when there is a crash…

I call 2nd pillar as perma-bonds in my portfolio ![]() as opposed to cash or bonds as separate entities.

as opposed to cash or bonds as separate entities.

something similar to owning your apartment and/or buying REITS. You don’t sell your apartment to rebalance in a crash.

My way of calculating:

Net worth

All accounts in all currencies + stocks + real estate crowdfunding shares at acquisition cost.

No 2nd or 3rd pillar, so when I contribute I see a drop in my net work. I do this at bonus time so I don’t feel it.

Crypto was out because it was insignificant, not it has become 2.5 kCHF so I might start to track it.

Profit and loss

Income: Gross salary minus 2nd pillar contributions, gross bonus, gross dividends. Capital gains are not tracked here but are part of NW.

Expenses: social contributions, taxes, tax at source (on dividends), trading costs, and in general all the money that goes out of my bank account except for 3rd pillar contributions or any other investment.

Savings are then calculated as income-expenses (the amount I have been able to keep from all the money in). However for the savings rate I use (income-expenses)/(income-taxes-social contributions) which yields a higher figure. In my case 54.7% for 2020. If I don’t deduct taxes and contributions from the denominator I get 39.2%, so quite a big difference.

I join the others in saying that the most important metric is the evolution of this figure rather than its absolute value.

Mine is pretty simple.

- Net income received in my bank account - All Expenses

I have a saving rate including taxes as expenses and another one without.That’s about it.

The more I read, the less sure I am, how to best calculate it. In the end I don’t think it matters to much.

First, determine what percentage of your income you currently save (Savings Rate). Here your savings should include all retirement contributions, any employer matching contributions, as well as savings outside of retirement accounts (i.e. savings in taxable investment accounts).

Source: https://www.forbes.com/advisor/retirement/the-forbes-guide-to-fire/

I couldn’t agree more!

Your current expenses depend on a lot of factors: residence, income, benefits, etc. These factors may totally change once you retire. That’s why I think you can replace current expenses with planned future expenses once retired (which should remain fixed). Then compare this to your current savings.

When future expenses are fixed, what matters is simply saving as much as possible, no matter the current expenses or savings rate. For example, I have decided that I need 3000 once retired and I compare my savings against that.

But looking at current expenses is for sure important, not to fall victim of lifestyle inflation. I think that’s the point of savings rate.