Who does that? Never heard of it.

I know for sure because that’s what my parents did. They bought the property from my grandparents for price = market value as calculated by the bank - needed deposit by the bank. So they didn’t need any hard cash nor second or third pillar money for the mortgage because the bank said the difference is your hard cash. They still needed to meet the affordability for the price though.

This was around the 2000’s so maybe that’s why the banks were trying their hardest to give out mortgages.

I also briefly talked to our bank advisor and he said it’s no problem to take over the mortgage even if one would breach the affordability because the property value is now at least double the amount of the mortgage and as long as interest is paid of course. This is what I was hinting to in my previous post.

You are right on the equity part whereby if the market value taken by the bank is higher than the requested mortgage this is your equity however you still need to comply with affordability requirements regardless of how high your equity is. They may go up to 38% affordability ratio if you have a really good profile and are able to improve this situation through redemptions or you can pledge additional collaterals worth several years of interests.

Well that‘s something completely different. It‘s called „Familienpreis“. Doesn‘t work if you buy it from the market.

But the affordability criterium is defined as:

5% * mortgage + 1% * total value + amortisation < 33% * gross income

Eg:

5% * 800k + 1% * 1m + 10k < 33% * gross income

40k + 10k +10k = 60k < 33% * gross income

So you need at least 180k of income to afford 800k of mortgage.

From what I hear in real life, or even read in this forum, I doubt these affordability rules are followed very closely…

Yes, I know.

Yes, all correct. Those are the official criteria but if your 800k mortgage is for a property that is valued at two million then the bank is definitely eager to reach an agreement with the buyer party.

As long as the bank is a member of the Swiss Bankers association they have to follow the rules. They have some flexibility for affordability calculations to up to 38% but passed that no chance unless you’re friend with the bank CEO. Out of the big banks only Raiffeisen is no longer a member and implement their own rules (close to those though).

That‘s why sometimes clients get declined from all banks due to >40% affortability except RB.

ZKB also gives clients mortgages upto 40% provided credit check is done and everything looks good.

please point me to a bank that would allow me to do that, I asked several banks and they all said no

From what I understood, if a house is valued at 1.2 million and you made a deal with owner at 1 million, then bank gives you a loan with 1 million valuation. ( 20% deposit and affordability is calcualated), but after 2 years ( maybe earlier) , you can do the valuation again ( hopefully it is 1.2 million as well ) and now amortisation amount can be reduced ( because house value increased )…

if I buy a property for 2m and only take 800k mortgage, I need to have 1.2m in cash, right? and who are you referring to as the “buyer party”? sorry if these are some silly questions, I’m just trying to understand.

why would anyone give you a gift of 200k? maybe if you’re buying from your family?

I can personally only speak for one bank that I dealt with that is a state guaranteed bank but I’m not going to disclose who it is publicly. Most propably they are not the only one doing this practice though. In the end it all comes down to how willing a bank is on working with a property/flat buyer. Some examples are:

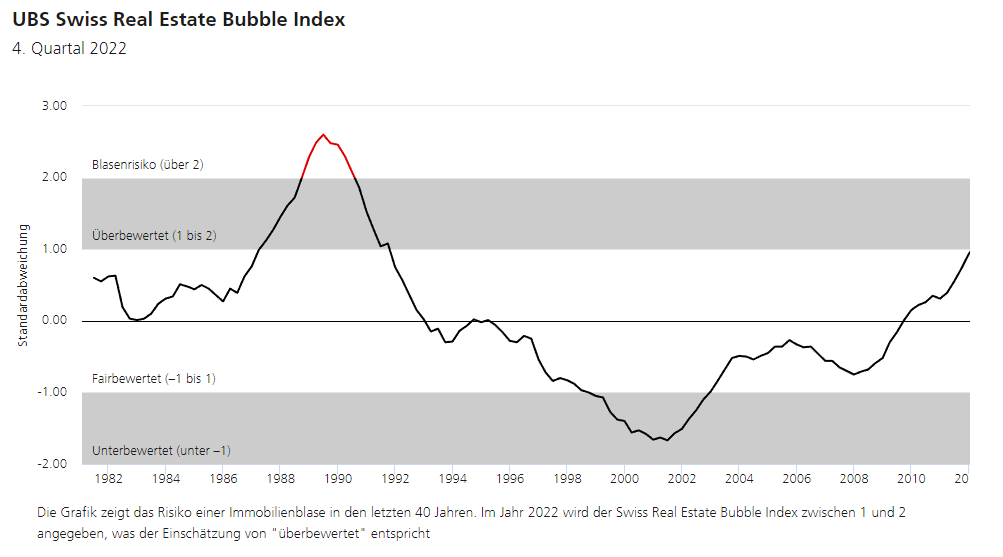

Is the region under- or at least fair valued (and not overvalued)?

Is it a family house that has been given down for generations?

Has the interest always been paid on time for some years if there is an existing mortgage (or decades)?

Is the region, according to the banks prediction, going to at least hold the property prices or even increase in the future?

Are there more than one flat so rental income can be generated?

Is the house in good shape and has always been taken care of in terms of maintenance?

If you tick most of these questions (and these are just some and not all) then the bank is most likely going to be willing to explore options with you on how you can finance a mortgage → able to keep paying interest without default and property not losing value.

EDIT: This does not mean that they will give anyone a mortgage though. The requirements still have to be met more or less there just might be some wiggle room.

Of course on regions where property prices are overvalued according to the banks estimations they are going to hard enforce the requirements because this also means more risks for them.

Yes of course, no problem. I might have worded this a little bit hard to understand but the buyer party is the one who is buying the property and in need of a mortgage. The scenario in my example was as follows:

market value of property: 2’000’000

buying price: 800’000

mortgage: 800’000

In this case you would get 1’200’000 for “free” from the selling party of the property which can be due to switching around the property in the family or bad maintenance that has not yet been taken into consideration of the market value or just pure luck on the free market ![]() .

.

Maybe later. My bank needs 3 years for example.

I think it’s not uncommon. Many deals are done between friends and neighbours, without ever reaching the actual market.

Just a side note: today I got a loan application approved with 38% affordability. Due to higher amortisation (10k/year instead of 6k/year) the affordability will be at 33.3% within 5 years.

That‘s basically the only way of getting something like that approved. Resolve the affordability issue within 5 years max.

I was wondering about the following: let’s say I don’t want to commit myself to sharing a mortgage with my girlfriend. But I will pay her rent for half of the flat. Is it possible to declare this rent (say 1’000 - 2’000 per month) and use it to reduce annual cost, improving affordability? If the property is entirely a rental property (Renditeobjekt), I’m sure they factor in the rent in the calculation.

This is also true if you find “loopholes” like you have a project and you get the market quote for the project, say:

you buy the house for 800k

Invest money and time and create an additional flat out of the structure that you can sell.

Market value is higher after your intervention, bank loan will be granted.