Why not?

1234556789123456

Thanks good to know, that it is more than 6%!

But the TER of 0.97% is very high for the fund of funds. What makes the single funds attractive is that, as far as I understand, I do not have to pay income tax on the dividend of the fund, since it is already paid, as it is direct property where someone lives. The fund of funds would be much more attractive for diversification and returnwise in comparison to single funds if the TER is reduced to something like 0.4%.

Did I understand the taxation of direct property correctly?

The end of 2023 tax value of the UBS SXI Real Estate Funds ETF was 59% of the market price. And 57% of the dividend was taxable (1.45% taxable out of a 2.54% dividend).

A post was merged into an existing topic: Direct Residential Real Estate Funds in Switzerland

Thanks for the answer!

It looks quite expensive with total fees of 1.22% despite the tax saving.

Thanks, so it looks the saving on taxes is not so large on direct single funds.

I want to ask a question about Real estate funds valuation and how to compare them against other asset classes.

Does Price to Cash flow distribution a right metric?

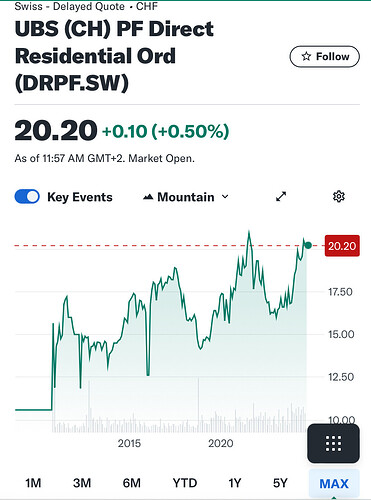

I was looking at funds like SIC or DRPF and the price to distribution multiple is very high.

For example , let’s say a real estate fund has 1000 properties, trading at 100 CHF per unit and have annual distribution (rent minus costs minus taxes) 2.5 CHF per unit. This brings the ratio to 40 times the distributions.

So I want to confirm some assumptions

-

should I assume that 10 years from now, if market continues to value these funds at 40 times distributions then the price of these fund units can only increase at the same rate of increase in distribution yield. Is this right? The rental yield is controlled by government as rents can only increase as per inflation or mortgage reference rates. So I think they are both kind of linked to inflation.

-

any increase above the growth of rental yield would mainly come from multiple expansion. But isn’t multiple already very high? For Equities 15-20 is considered a good range. What is good range for Swiss Real estate?

To me it feels like RE funds are good alternate to cash. But they do come with quite some volatility. Are investors being appropriately compensated for the volatility?

P.S -: I understand that Swiss real estate has appreciated a lot over last 20 years but I am trying to understand the potential for next 20 years