Silence is (digital) golden.

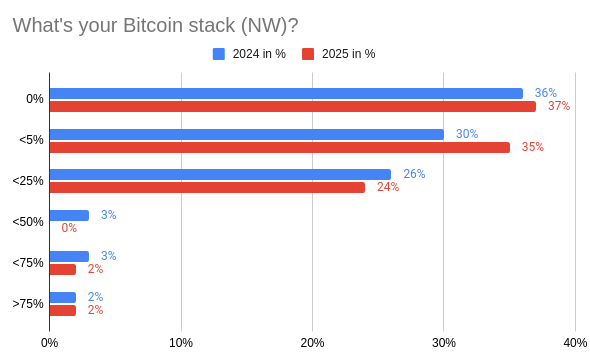

2024

n=66

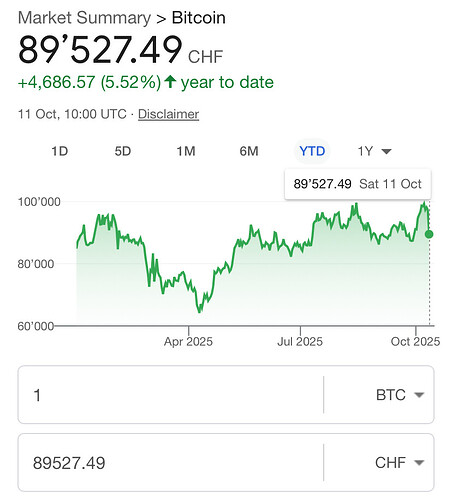

BTC price ca. 90k USD / 80k CHF (18.11.2024)

2025

n=62

BTC price ca. 111k USD / 90k CHF (03.09.2025)

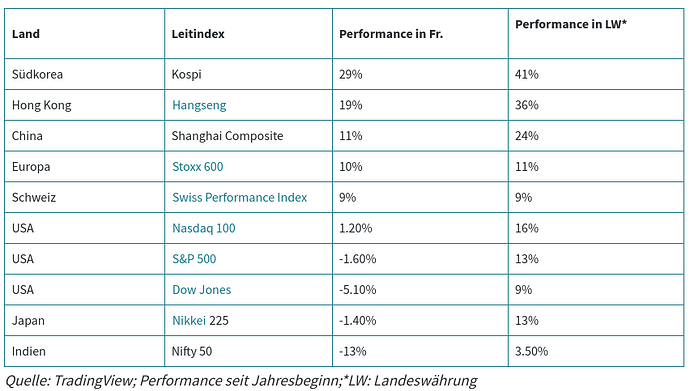

And how did it look like last week?

detalis ![]()

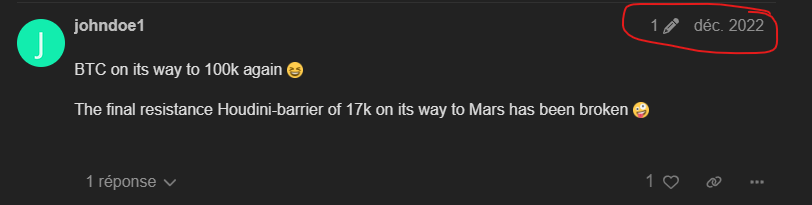

Don’t be so defensive, lets set the new gold standard as 6 months, and here we have 28% gainz in BTC and -0.08% in CHSPI.

ouppsieee ![]() (… but not my first time)

(… but not my first time)

This might me more representative for Swiss investors. I don’t quite understand the Bitcoin trade yet.

Normally I would expect BTC investors are counting on Govt authorities to mess up. But when the mess happens , BTC falls instead of going up?

I see two points that may explain part of it:

-

believers in the fundamentals of Bitcoin don’t trade it. They buy and hold. The price goes down due to the effect of traders, who don’t see Bitcoin as an hedge versus government controlled currencies but as a quickly growing asset going to the moon. They treat it as a risk asset and sell when the situation appears riskier to them.

-

There is leverage in the system. When stocks go down, levered people need to sell assets to meet their margin requirements. They sell Bitcoin too. Since there are investors who also buy Bitcoin on leverage, when Bitcoin goes down, they in turn need to sell assets to meet their margin requirements. Rinse and repeat.

Every time it happens, the same questions arise. For a bitcoiner, it doesn’t matter (except you are over-leveraged). The bitcoiner believes that after 5yrs the price is always above (and that’s why Saylor makes 5yrs+ contracts on borrowed money).

So IMHO, TradFi fills their bags (because as usual they are always late to the party) and some insiders make shady things (but it’s not a bitcoin exlusive thing).

That was happening during the bank crisis of 2023. Afterwards, crypto was traded rather synchronously with growth stocks.

"A whale on Hyperliquid, a crypto derivatives exchange, opened massive short positions just 30 minutes before Trump’s 100% China tariff announcement.

He closed the trades for $192 million in profit, all in one day.

The accounts were created this morning, funds withdrawn within hours.

Someone always knows." (on X)

Totally not insider trading! (Edit: just as in stocks, not a dig on BTC)

As BTC is not a security at the moment it’s not illegal to scam and do insider trading ![]()

Really? Or you are kidding ?

Not kidding, as far as I understand it’s unregulated so it doesn’t fall under the governance of securities, undisclosed information etc. Not a lawyer.

Securities stuff like insider trading indeed doesn’t apply in many cases*. That said fraud is still fraud even if the current current US administration deprioritized prosecuting it.

Fun fact, in the US folks are pushing to regulate crypto through the CFTC (which does commodities and futures), and for commodities and futures insider trading is kinda allowed. In fact in some sense the original intended trader of e.g. futures was an insider (e.g. a company consuming the commodity in their production processes, or a farmer producing some crop).