I am sure that the tax officer requested asked to withdraw X CHF (~1000 CHF) whikle my wife was unemployed. May it was due another reason like the waiting a month or 2 to receive the unemployment benefits, but I do not remember that she has to wait.

For their exact reasoning, the cantons that do it in practice today, could probably explain it best:

“Je nach kantonaler Steuerbehörde wird eine Staffelung als Steuerumgehung taxiert. Ihre Steuerbehörde kann Ihnen für mehr Information am besten weiterhelfen.“

Säule 3a gestaffelt beziehen: Wie sparen Sie Steuern? - Pax

„Wie viele 3a-Konten man eröffnen kann, ist gesetzlich nicht limitiert. Erst im Rahmen des Bezugs limitieren die Steuerämter je nach Kanton die Anzahl Konten, womit der gestaffelte Bezug Einschränkungen in Form einer Zusammenrechnung einzelner Bezüge unterliegen kann.“

Mini-Artikel-Serie: Säule 3a - Wie viele Konten darf man haben? - PensExpert

Change in future ?

" Le conseiller national PLR Andri Silberschmidt demande désormais une simplification. À l’avenir, il ne devrait plus être nécessaire de répartir les fonds de prévoyance sur différents comptes pour pouvoir les percevoir de manière échelonnée. Au lieu de cela, il veut aussi permettre le retrait partiel d’un compte. C’est ce que prévoit sa motion, dont le Conseil fédéral a recommandé l’adoption mercredi, ce qui est plutôt rare."

https://www.parlament.ch/de/ratsbetrieb/suche-curia-vista/geschaeft?AffairId=20243067

Excited to see who is against that and why.

“No we want to keep an idiotic system that causes lots of unnecessary costs because we’ve always done it this way since our forefathers founded this country in 1291” or some such usual nonsense.

Hey, it works for the Eigenmietwert…

The Eigenmietwert counterbalances the deductability of mortgage interests and value maintenance, it’s not as clear cut as allowing partial withdrawals on 3a.

… philosophically yes, although interest deductibility is a pleasant gift to the banking industry as it encourages people to take on more debt than otherwise, pay more interest, and pay the debt off more slowly, or not at all.

I think CH doesn’t want to encourage people to buy houses and that’s why this Deemed rental income rule exists to discourage people.

In the end with strong tenant laws and good quality housing , owning a house is not really necessary in Switzerland.

There are more disuasive topics than the deemed rental income to block the purchase of real estate:

- scarcity of real estate in certain areas

- constantly rising property prices

- limited use of the 2nd pillar

- 20% equity + notary fees (I understand that some canton have not)

- the median salary in Switzerland is around CHF 6’800/month in 2023

- a couple earning two median salaries (CHF 163’200/year) with savings of CHF 100’000 can afford a property of CHF 500’000. Not impossible, but hard to find in most Swiss regions (source UBS https://www.ubs.com/ch/en/private/mortgages/purchase-price-calculator.htmlcaculator)

- Difficulties to buy a real estate as a single person with a median salary and without external assistance (i.e. gift from family/parents)

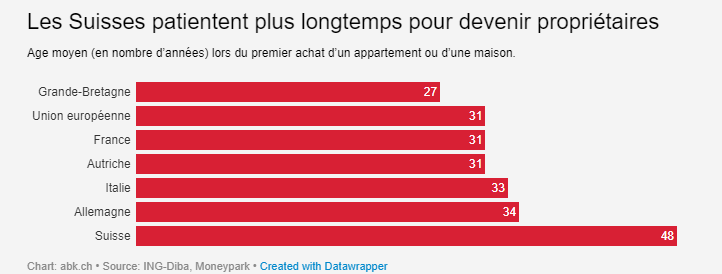

- Average age of 1st purchase (source https://www.swisslife.com/fr/home/blog/europeens-revent-de-devenir-proprietaires.html)

But it’s another debate, let’s get back to the 3rd pillar ![]()

The proposal was adopted by the national council a few days ago, let’s see what the council of states will decide (probably this winter). It seems that opening more than one 3a account solely for tax purposes won’t be necessary in the future. ![]()

Thanks for sharing