Dear everyone;

I just finished reading all the blog articles. A really good source of information. The forum sounds astonishing as well. Many thanks to all contributors.

I saw many messages regarding poor 3A insurance contracts. Well, here I come! I moved to Switzerland back in mid-2018. My partner and I both signed individual SwissLife Flex Save Duo contracts. Contract is 37 years ending 2055.

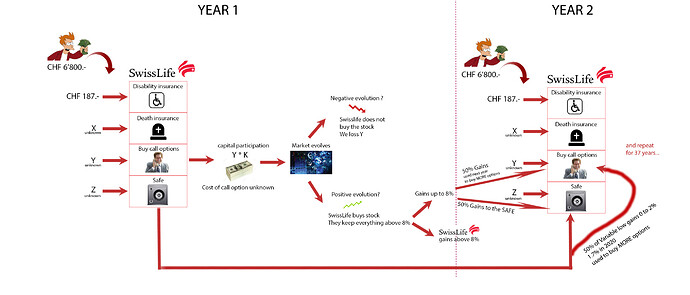

The biggest issue I have with this product is that I do not fully understand it, that is to say, I never managed to calculate back the expected outcome for a defined growth scenario on SwissLife document. But I really wanted to benefit from tax reduction

- We pay max. premiums of approx. CHF 6’800.- (3 payments up to now)

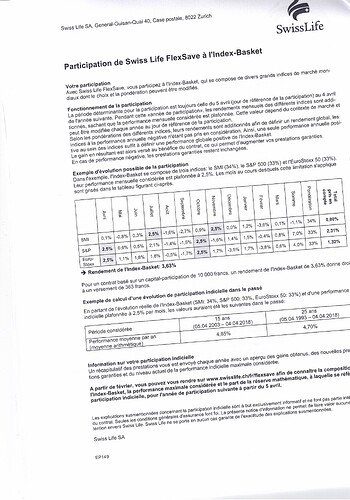

- The capital is invested in index funds (SMI: 20%, S&P500: 20%, EutoStoxx: 20%, Nikkei: 20%, FTSE 100: 20%). The portion of the full capital that is invested VS secured is something I didn’t find.

- The monthly gains are capped per index fund from 0% (no loss possible) to 2.5% max (the gain is the addition of the index funds gains individually capped rather than capping the addition of the index fund gains.)

- Also, the annual gain is capped to 8%.

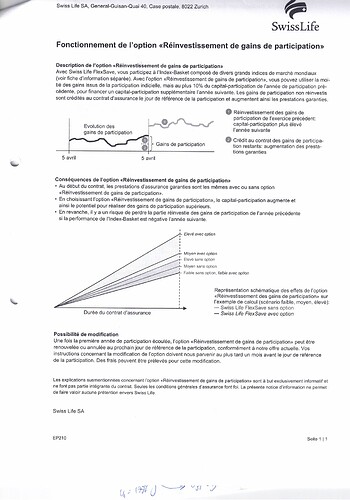

- 50% of annual returns are re-invested, 50% secured.

Based on their index basket and capping the average return per year over the last 15 years was 4.85% and over the last 25 years was 4.70%.

Included insurances:

Inability to pay the rents, is CHF 187.- taken of the CHF 6800.- premium.

Death, premium is variable based on death probability tables and not detailed in the contract

Home option (all paid premium can be considered as your “fond propre”) when buying home.

After 37 years:

Cumulated premiums: approx. CHF 250’000.-

Guaranteed capital after 37 years: CHF 208’450.-

(Total insurance premium around CHF 42k)

What I do not understand, at all (from my SwissLife contract)

Bad situation: invested 1.25% & secured 1.4% : CHF 217’491.-

Medium situation: invested 3.25% & secured 1.9% : CHF 370’571.-

Good situation: invested 5.25% & secured 2.4%: CHF 894’938.-

Now if I had taken at the first place every single premium in a 100% index-based investment in an average 5% pa I would end up with CHF 687’819.- which can be considered rather conservative on index funds for 37 years but rather good by SwissLife contract. I do not understand how the “good situation” from SwissLife is calculated ending around CHF 900k vs my calculations at 5% ending CHF 688k and I cannot stand not understanding my own product…

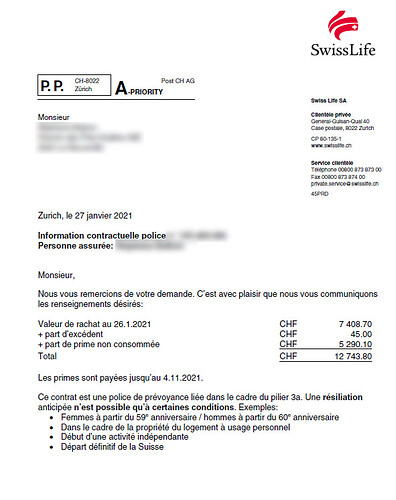

If I leave SwissLife now in 2021, the buy-out value is CHF 10k + gains. VS premium paid of 20k up to now. Starting investing at 5% pa with those remaining 10k and upcoming premiums brings me after 37 years to CHF 627’868.- which is CHF 60k lower than if I didn’t sign the SwissLife contract. (Well that’s just 10k lost at 5% over 37years).

It hurts seeing 60k gone, especially because we both have (my partner and I) the same contract meaning it is 120k gone. But I feel great seeing this 3 years-in rather than 10 years-in.

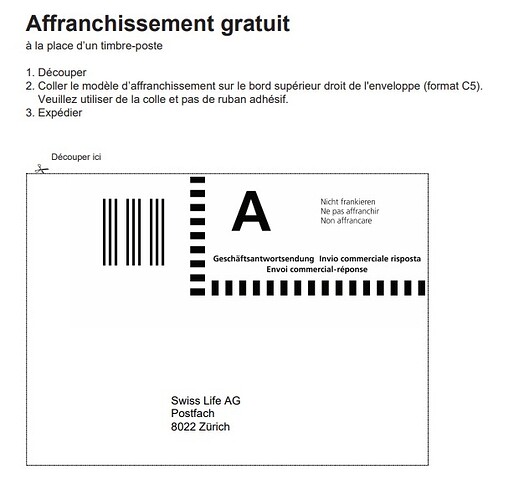

Now before taking any action, I would feel better if I could fully understand how this SwissLife contract invests the capital. I attached few pages from the contract, does anyone have any idea?

Many thanks and have a great day! ![]()

Stephane