There is a rule that if you withdraw your pension pot before a vesting period of 3 years after your last contribution, you will need to pay the original income tax you were hoping to save.

It will be a while until I withdraw any funds.

Some inputs on this discussion from my side (based on myself buying-in six-digits amounts before, knowing of a case with near zero taxable income and a case with one partner having a zero income the year prior to retirement, all without any issues):

(1) Yes, many who plan to retire very young underestimate the benefits of pension plans. It is a fantastic way to optimise taxes and serves as bond-like asset with a guaranteed minimal payout. The payout in itself may look bad, but overall with the tax consideration it is usually a fantastic investment. There is really only the one downside that you cannot easily withdraw the funds, but the real estate exception (WEF Vorbezug) should solve that in many cases.

(2) There are no limits on how much you buy-in to your pension plan from a tax point of view (for anyone being employed in CH for a few years). And yes, you absolutely can reduce your taxable income from your work (employed or self-employed) to zero. This makes no sense however, as you then don’t get the tax benefit (and just to save a bit on wealth tax seems a bad deal)

(3) Be aware that income from your work may be reduced to zero, but if married the income of your partner, and your other income streams such as dividends or rental income will likely not be reduced by a negative work income. These income streams are treated separately in many cantons.

(4) The one thing to be careful about: There is such a thing as being over-insured. Your pension plan should validate the maximum allowed buy-in based on your detailed input, considering all other forms of pensions funds available to you (including pillar 3a and foreign ones). Many pension funds nowadays don’t do this and simply state the maximum buy-in according to their plan. It is your responsibility to ensure you are not ending up over-insured, as this would be the argument for the tax authority to deny the full deduction. They also don’t have this information without you providing it to their inquiry, but your plan might trigger such an inquiry (or rather, they will deny the deduction and it is your burden to proof otherwise).

That is interesting! I’ve never heard of this before. I had assumed that the pillar 2 limit related only to pillar 2 and therefore unaffected by pillar 3a (let alone foreign pillar 1 type schemes).

No one cares because it is highly theoretical. As far as I know nearly no foreign pension fund actually matters (qualifies), and pillar 3a can only be an issue if you bought in the maximum amounts from a very young age (well before 25), invested it all and made great returns. In that case your pillar 2 buy-in at age 30 might be limited because your pillar 3a is quite a bit above the maximum you should have at that age. Other cases may occur if you switch back-and-forth between employed and self-employed.

Also: Tax authority will be aware of none of this. I myself have never heard of a tax authority questioning any pillar 2 buy-in when the amount was accepted by the pension fund. The only cases that end up in court is when you finance buy-ins through loans and obviously are simply trying to optimize your taxes.

Edit: I should add that the cases that regularly are an issue is when people switch employers and don’t transfer their full accrued pension amount to their new pension fund (as the law mandates) but keep part or all of it in a vested accounts.

Then maybe none of that applies to me as I only have limited 3a having moved to Switzerland from overseas. The only other pension is the UK state pension.

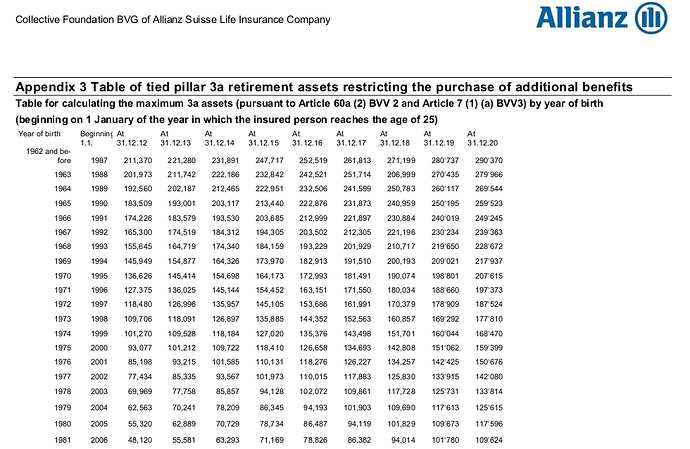

I just saw a reference to this in my pension fund:

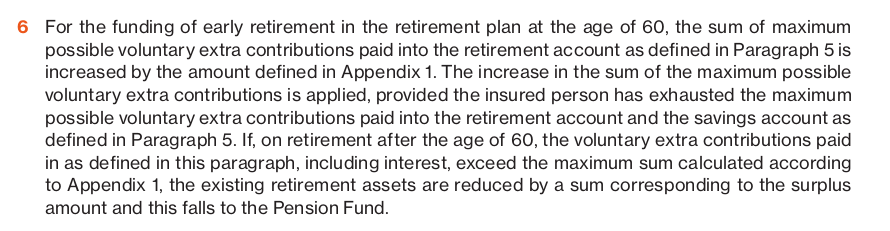

An insured person may pay voluntary extra contributions into the retirement account (Article 5) and/or into the savings account (Article 6). The maximum possible level of voluntary extra contributions is determined according to Appendix 1. The maximum sum of voluntary extra contributions is reduced by an amount corresponding to the level of pillar 3 assets that exceeds the limit mentioned in Article 60a Paragraph 2 BVV2, and to any vested benefits that the insured person was not required to pay into the Pension Fund. The voluntary extra contributions are credited to the insured person as retirement assets or savings assets.

A quick google search showed this table (I guess with a bit more searching you can get to the real source):

Now these limits are surprisingly low. For example, if you are born in 1980, then that’s 20 years, say, of contributions in 2020. With a limit of less than 118k, that’s less than 6k of 3a contributions per year and that’s assuming you had zero growth for 20 years!

Another gotcha is forfeiting your funds if you contribute too much (or the fund grows too much):

40 years old, but probably ~20 years of contribution to the 3A, so ~6k per year ![]()

Oops. Yes, you are right. But even then, it seems to be a full contribution assuming zero growth.

No, it assumes growth matching the minimum BVG interest, if I remember correctly. However, it assumes contribution starts at 25 (like BVG retirement contributions).

This is the latest official table: https://www.bsv.admin.ch/dam/bsv/de/dokumente/bv/anleitungen/tabelle-berechnung-3a-guthaben-version2022.pdf.download.pdf/Capital3epilier_d_2024.pdf

Ah. OK. I see they are increasing it each year. I think I should be safe then!

Told you so ![]() And even if your are above that 3a threshold, the real question is if your pension fund is properly assessing your potential buy-in and asking all the right questions to confirm the final buy-in amount. I wouldn’t recommend to answer anything that isn’t true, but in my experience many lazy pension funds don’t ask for details, even some big ones.

And even if your are above that 3a threshold, the real question is if your pension fund is properly assessing your potential buy-in and asking all the right questions to confirm the final buy-in amount. I wouldn’t recommend to answer anything that isn’t true, but in my experience many lazy pension funds don’t ask for details, even some big ones.

In any case it only becomes an issue for the last buy-in if you truly would want to buy-in the maximum allowed, as you can still buy into your pension despite being above the expected maximum pillar 3a amount, just not the last couple thousands that your pension plan would in principal allow.

I wouldn’t want to risk it in case there are any adverse tax implications or if the excess amounts end up forfeited.

Unfortunately, since the max contributions rise with age and I want to retire early, the limits are a real restriction. I guess the only way around is to get promoted and dramatically increase my wages!

Just an update: so I filed my taxes at the last minute and 2023 was the first year of out-sized contributions. I screwed up the calculation a bit so ended up with higher contributions vs income than planned. To avoid this, I re-engineered my cashflow spreadsheet to make accurate tax calculations instead of the back of the envelope it had previously.

The upshot is that I have zero Federal tax to pay for 2023 and about 10k of canton/gemeinde. This amount is technically completely offset by withholding tax on dividends (in fact WHT exceeds taxes) so I will see how the tax authorities respond to this.

In the run up to the end of 2024, I started paying into the PF again. I will spread over the last 3 months of the year and make an accurate tax calculation in December to avoid over-contributing. I’ll be aiming to pay 15k of taxes. Potentially some of it offset by foreign withholding taxes.

Isn’t the threshold for federal 32k, married, anyway? How can those be 0, and canton at 10k?

Or is there some huge difference in your deductions?

There’s a large difference in tax basis between federal and canton.

So the countdown to retirement begins?

3…2…. 1…… FIRE

OK. So I got my tax return back. The pension contribution was accepted.