I just don’t know what you are all talking about. There are several employees with 20-60k employers that give you the option to set your own contribution in the 0-15% range. A couple of those contribute a multiple of the mandatory minimum, way above 25% for 55+.

I don’t know there are some differences in each canton and maybe they got a ruling. In the end the average is not zero, so it’s not an issue

However, you are saying that some companies offer more than 25% of contribution (employee and employer part) for employees 55+?

I have never seen that in the private sector and I have also checked some pension funds for lawyers and doctors. The maximum is always 25%.

BVV 2 Art. 1 Abs. 2b specifies the 25% limit. I’m not sure whether this limit only applies to the pension fund as a whole, not each individual, which wouldn’t seem fair but it’s possible. Or more than 25% is allowed as long as the condition in Abs. 2a is fulfilled?

I have checked a little more. It seems that big companies can go over 25%.

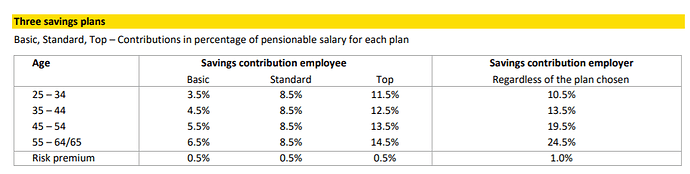

Below is the pension plan for Nestlé:

https://www.fpn.ch/wp-content/uploads/2020/11/Résumé-nouveau-plan-ANG.pdf

https://www.fpn.ch/wp-content/uploads/2020/11/Résumé-nouveau-plan-FR.pdf

But if a small company asks a quote from Axa or Swisslife, normally the maximum is 25%.

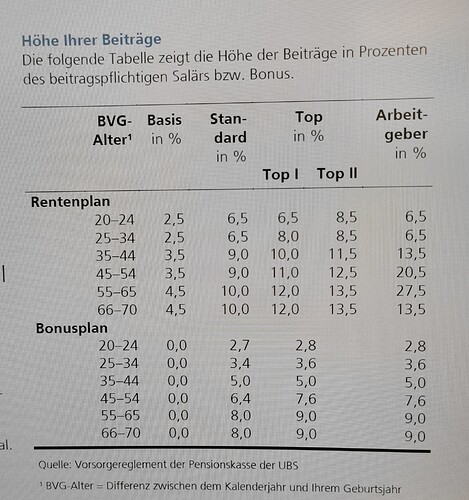

A friend that works for UBS sent me this:

Chosing the Top2 option at 55+ will lead to a total of 41%!

You can also do a buyback on top…

The UBS plan is pretty good. No wonder that some companies are complaining that older workers cost too much.

What I have seen is that some companies with good pension plans have reduced the rate for the younger employee without touching the one for older workers. Then you remember the age of the managerswho make these choices

Besides financial companies, pharmaceutical companies are also known for great pension funds.

I think this is something that should def. be considered when deciding between employees, especially when you are older and companies like UBS contribute 27.5% instead of 9% of your salary to your pension fund. This additional compensation is taxfree aswell.

Nestle seems great when you are younger!

I like all the information that was given. I am interested in this topic. I have a question about the calculation of the “prestation de sortie”, or the value of the pension pot that you see on the yearly statement. In my understanding, the part that the employer contributes is not reflected in this amount. So in the cases that the employer contributes a substantial amount, it would only benefit the pension fund itself, and not the employer. What am I missing? I am transferring from a defined benefits to a defined contribution set-up, and I am digging through the details of the new plan.

In this case, it’s really complex to know. The pension fund will do a complex calculation to estimate the “prestation de sortie”. Don’t hesitate to call the pension fund, they can explain.

For a defined contribution to a defined contribution, it’s reflected. However, one part goes to risk and one part goes to saving.

Thanks for the answer, you are right its based on three types of calculations and the most favourable “wins”. My question was about the defined contribution plans, based on what I am reading the “pot” only increases based on your own contribution, interest, own buybacks, etc etc, but not the employers part

No, the employer money goes in your pot.

The money you will have is: employee contribution + employer contribution + interest + buyback - fees - risk part employee contribution - risk part employer contribution

I had to check my documents again. If you register a new company, you also have to register with Ausgleichkasse. This is the Ausgleichskasse of the canton your company is domiciled, and I guess it’s (again) different between the cantons. For my 1st company, I received a letter where I had to send them the information about Pillar 2 provider (including contract number) and UVG provider (including contract number). According to my (back then) tax advisor, Ausgleichskasse is already checking if the contract you signed with P2 is legal. If they really do or not, I can’t tell you. On the other hand, most of the P2 providers will not offer you a split of 0/100% because they know it will not be accepted. But of course I’m talking about small companies here, which leads me to:

You can’t really compare large enterprises to a SME business. They have way more leverage to agree on tweaks with P2 providers and tax authorities. Also, they won’t offer those favorable conditions for all of their employees, so in the end they might end up with 30/70 distribution if you look at the overall workforce.

This. It will lead to questions during a revision of your books, which is usually done every 3 years.

Indeed. You can also remove the coordination deduction (Koordinationsabzug) and insure from the first CHF, which increases the P2 contribution.

This is, unfortunately true. I compared a lot of different P2 providers (again, as a SME company), and there are huge differences. It’s not so easy to really dig through the jungle, especially if you haven’t cared to check about P2 before.

It’s nice for the employees (also the Nestlé example), but it’s unfair compared to smaller companies. The big players can save taxes by contributing up to 40%, while the small ones are capped at 25%. But ok - I guess that’s just the way it is.

I don’t see the point in those limits. What’s the harm if we reduce retirement poverty?

I think it’s not about reducing retirement poverty only. Let’s do some calculations for fun:

Assumptions

- no limit on P2 contributions

- you are the employer (AG or GmbH)

- you are the only person being employed

- 10k monthly income

What can you do?

- contribute 60% of your salary to P2 (employee part)

- pay 6.4% for AHV/ALV = 640.- to Ausgleichskasse

- pay 10% taxes (let’s assume a low tax canton like Zug) = 1000.- to tax authorities

- employer matches your 60% = 120% of your annual income goes to P2

The employer saves profit taxes, and you will get more money in your P2 and it’s tax-preferred. Do this for 5 years, then you leave Switzerland and just pay out the whole uber-mandatory part.

I know, it’s exaggerated, but there will always be someone trying to trick the system

It’s essentially the same reason why pillar 3a is limited. Very high limits (or no limits at all) only benefit high earners, who shouldn’t be at risk for retirement poverty at all. In a way it would counteract tax progression, especially if it can also be used to buy very expensive real estate. For pillar 2 it’s even worse because not every employee has the same options due to the employer’s choice of pension fund (plan).

This thread made me very depressed!

After 10y accumulating with a company that contribute to the minimum, I definitely need to go and look for a better job/employer.

How old are you, how much do you have in your pension fund and what are the current contribution rates (you/employee)?

38 yo now and contributing 5% and 5% with my current employer since 27yo.

I currently have > 102k but including 2 buy back in the non obligatory part.

My target is to move it all to Viac when doing my next job move.

Don’t feel depressed, I don’t have a decent P2 neither as a trainee lawyer

But this thread is really interesting, especially for my future job ! I will ask a shit lot of question about P2 to my next employer.

I can confirm that I have switched jobs recently and I asked many questions about the 2nd pillar. The HR person was quite puzzled and unable to give me answers right away. Then I used the worse conditions of this plan as compared to my previous one to negotiate a higher fixed salary. Also you look knowledgeable!

Lately I am giving a lot of thought to contributing more to pay less taxes but with a YoY performance of about 1-2% it only makes sense if I buy a home in the next few years. And we all now that the spreadsheet tells us that buying a home does not make sense financially --it can make sense because of other reasons, though.

My plan contributes 9.5% for 35-45 year-olds and I can contribute either 5.5% (my current choice) or 9.5%. The Kordinationsabzug is 10k. It could be a lot worse.