Apart from splitting, to put in VB in Schwyz, emigrate and hace lower tax on withdrawal? One can leave in VB till 70, but his pension fund will pay out at 65 (exactly) → so to have more time.

At what Umwandlungssatz would you decide for the capital withdrawal?

Offering an overview of my situation which branched off from what @Be_good_be_happy did early.

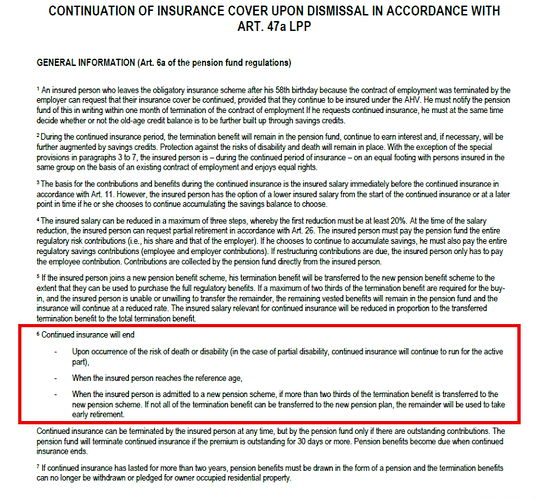

My pension fund’s regulations:

Art 12 Versicherte Personen, die nach Vollendung des 58. Altersjahrs aus der obligatorischen Versicherung ausscheiden, weil das Arbeitsverhältnis durch den Arbeitgebenden aufgelöst wird oder der Arbeitgebende die Auflösung des Arbeitsverhältnisses initiiert und dieses mittels einer Aufhebungsvereinbarung aufgelöst wird, können die Weiterführung der Vollversicherung oder nur der Risikoversicherung im bisherigen Vorsorgeplan und Vorsorgewerk gemäss Art. 12a beantragen.

Art 12a Freiwillige Weiterversicherung bei Kündigung des Arbeitsverhältnisses durch den Arbeitgebenden

- Wahl zwischen reinem Risikoschutz und selbstfinanzierter Weiterversicherung

- Wahl von 100% oder 75% des massgeblichen Jahreslohns

- Wahl des Eintrittes des Rentenalters

- Möglichkeit einer Teilpensionierung

- Möglichkeit zum Einkauf weiterer Leistungen

- Pflicht zur Leistung der Arbeitgeberbeiträge

- Pflicht zur Leistung von zusätzlichen Zahlungen im Sanierungsfall

- Pflicht zum Bezug von Rentenleistung, falls die Weiterversicherung mehr als zwei Jahre gedauert hat

When I was let go, during the notice period and in my first month after 58th birthday, I could have selected the following options in line with options stipulated by the pension fund’s regulation

- transfer capital to new pension fund if I have new job

- transfer capital to vested benefit account

- withdraw capital and pay 8% tax at source

- retire and get a lifelong annual pension of 4.56%

- stay insured and continue paying risk premium and admin fees

- stay insured and pay risk premium, admin fees and both employer and employee contributions with the option to get an annual pension at 5.4% in 2031

@Be_good_be_happy chose 5. or 6.

I chose 2 (and split capital in 2 for potential staggered withdrawal)

Why did I not chose 4 (retire and get lifelong annual pension)?

4.56% percent lifelong dividends was indeed a juicy proposition until I considered the income tax I would have to pay (quite high if I get another job/salary for the next 6 years), my heir missing out if I die early, the lack of option to pay the capital into a new pension fund (with potentially better conditions) and the lack of freedom to withdraw capital at a convenient time.

Edit: specified the timing for my option.

5 Likes

Good morning and thank you @dom.swiss

I do not have the option of taking rent @4.x% as the pension fund

doesn’t let me stay (as I was let go, I cannot be part of the pension fund). Also, my pension capital is too low to sustain me on the rent + these actuarial calculations are based on 20 years more of life!!.

There is no option to transfer as highlighted by the fund; however the federal regulation permits the deferred withdrawal during the transition period up to 31 Dec. 2029. Cheers Partha

Can you become self employed and then force pension fund to transfer?

You’d need to have enough income to be able to transfer 2/3 of the funds.

Can you give more details?

If you’re self employed, won’t your contribution level (which likely determines how much you can move) be determined by your salary?

Thank you. How much does that cost?

I did look it up - looks complicated though. Appreciate leads if you have. Best regards, Partha

- Apply for self-employed status recognition:

- Submit an application to the cantonal compensation office (Ausgleichskasse).

- Provide evidence of your independent work, such as:

- Invoices issued and received

- Client agreements

- Business expenses

- Lease agreement or business domicile proof

- Civil Liability Insurance certificate

- Register with social insurance:

- Affiliate with the Old Age and Survivors’ Insurance (AVS/AHV) fund.

- Contribute to the first pillar of the Swiss pension system.