Stock market is far more certain then lending money to shady companies. They also sell junk bonds if you fancy that kind of investments.

I think if you expect 5-6% with no risk you must be the same kind of stupid as if you expect 15% with no risk

I hope you read it here. It were another proof of this forum’s wisdom

Stonks only go up. Weren’t the stock exchanges last year in an uncertainty or the years before? Just pump all the money into the market, it might crash but it also will recover.

Thank you very much for the valuable feedback everyone

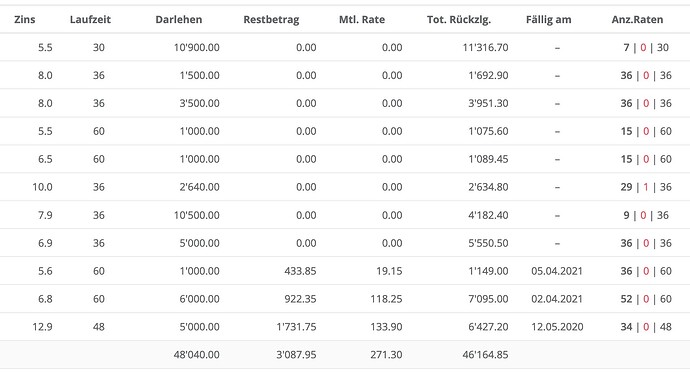

@MeowMeowFuzzyface thank you so much for the update! i was wondering on the loan with 10% interest you are down by 4 francs and there is one payment in red. Does that mean that one payment wasn’t made? what is happening in that occasion? do you simply loose the money?

on the 7.9% loan what is happening there?

Let me check on this and give you some feedback in the next minutes…

Update:

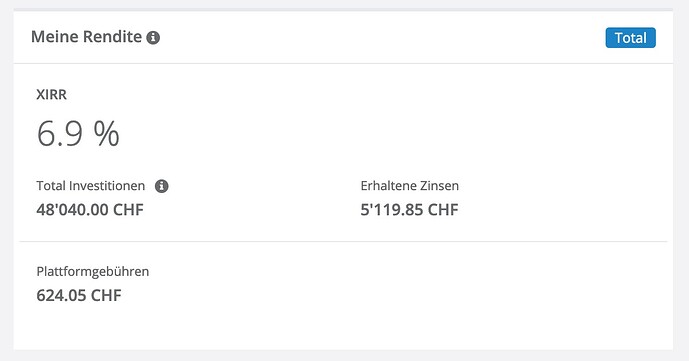

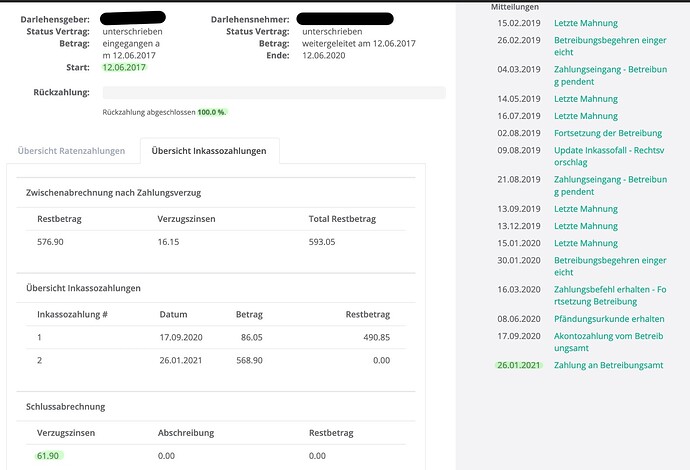

The case is closed (100% I got my money with interest and default interest).

I marked some infos in green ![]()

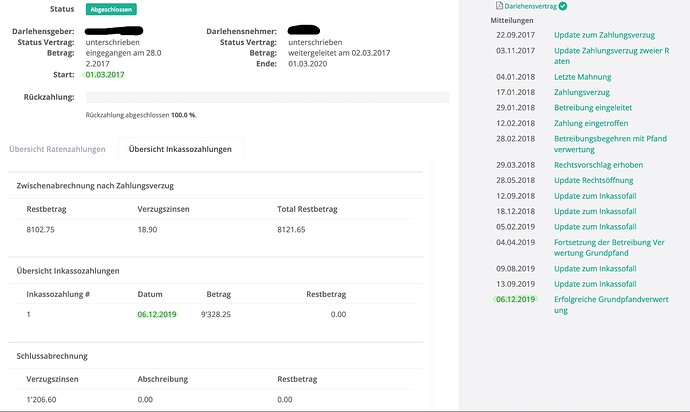

wow haha thats some great and quick feedback! the 7.9% loan though? you mentioned in your previous post that if restbetrag=0 then its payed off but here there is 6K missing somewhere

ninja edit. oh wow! i read now the status updates it took 2 years to resolve!and went all the way to betreibung

And the 7.9% case ![]()

I always got my money back with the interest & default interest, but you need patience ( on the right side you can see all the action they (cashare) took to get the money for you back ![]()

being that that was quite in the begging of the platform having to go through this must have been quite anxiety inducing .

so either you have nerves of steel or don’t really care about an amount as this or both : )

really appreciate how open you shared your experience here

If you need some more information or screenshot, let me know.

Yeah, I have nerves of steel ![]()

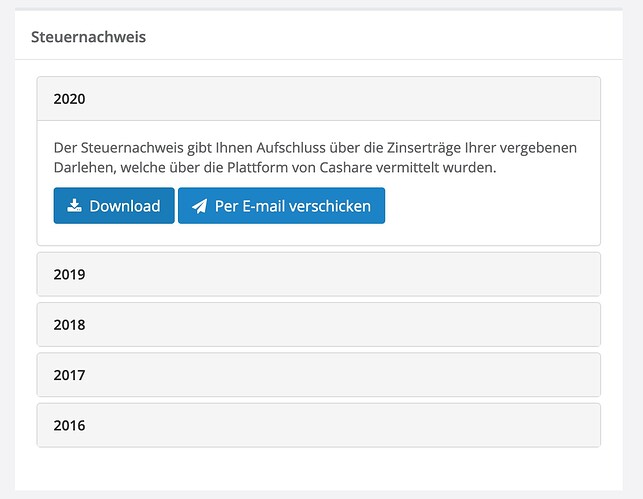

Some other cool stuff – they prepare a tax document for you with the interests and relevant informationen for the yearly taxes.

I also can provide some personal feedback/information about investing, since 2016, in startups on companisto.com.

Some good and some ugly stuff

If you are up for it you could write a review about the site, your experience ,your strategy, what you wish you knew from the start, lessons learned . earnings, losses , recommendations (not a financial advisor etc) and compared to similar experiences if you had any.

And you can post it separately so it doesn’t get lost here maybe, and who knows a year from now i will be bying Your book : ))

ninja edit; i was referring to cashare, the start up topic is a whole either equally interesting if not more ,by itself

Also finally some alternative investments here : ) 99.9% of the forum can be summarised to" buy VT etf and go about your life" which probably is a wise approach

I’ve invested in two Startups on investiere.ch but it’s more a long term thing.

I also have an account on investiere.ch – but the min. investment sum is rather high for beginners – 25k or 50k. (Not invested)

I looked at those platforms but I am pretty sceptical.

I mean why would a start up which has a good product need a bunch of private investors if one renowned investor will do it.

Or better expressed, if professional investors said no, there must be a reason (same for p2p lending).

From the company perspective I think it might be easier to deal with a lot of small unorganized shareholders than a single big one, the latter will likely take a more active role in the company and influence future decisions With crowdfunding the original owners are almost guaranteed to retain control I think.

But yes, there’re a lot of terrible deals as well.

On the other hand, A-round investors are also often seen as consultants to the start-up founders, since a lot of start-up founders do not bring all the necessary knowledge and aptitudes to make a business thrive…

Just reminds me at all the funds who made you invest into planes/containers. Most often, if it goes wrong you are at the end of the food chain, and second no professional wanted to put money into it.

It was 10k a year or so ago when I did my last investment, might have been raised by now.

Yep that’s what I understood too.

I mean I also don’t even count these investements towards my net worth, so if they return something in a few years the that’s nice…

I am a pretty big fan of p2p lending and besides the facts that I just love the idea of cutting out the banks I apreciate the fact that it generates a pretty steady stream of income around 11% (EU) resp. 6% (CH).

Sure there is risk involved, the biggest one that the company can go bankrupt, so I research them well and stick to the established ones. In combination with other traditional investments and some cryptogambling it evens out pretty nicely.

I have invested around about 10% of my wealth in the last 3 years in Creditgate 24, cashare, Mintos, Bondora and Estateguru, all companies that are around for a while. Sure, there are some nervewrecking defaults of loans (around 5%) but if you can ignore them returns are still pretty good. Also not all is lost and you’ll still get some some out of those eventually, it just takes more time.