Still depends on frequency, size of portfolio, etc. They also don’t want people to deduct losses ![]()

Forgive me if I’m not following but I don’t understand the talk about hedging for this particular situation. Selling puts, you get a premium. That would be income, not capital gains, and, as such, taxed as income.

Now, buying options (whether calls or puts) would be buying an asset that can appreciate (as well as loose value). That appreciation, if it happened, would be capital gains which may or may not be taxed depending on how the tax office classifies @stra, as a professional investor or not.

Now, in case selling puts makes the tax office classify @stra as a professional trader, which it may (though I’d consider it unlikely if the amount is not really significant vis-à-vis other sources of income), then other capital gains would also be taxed. But the premium coming from selling puts would be taxed anyway, regardless of how the tax office classifies the seller.

Am I understanding it wrong?

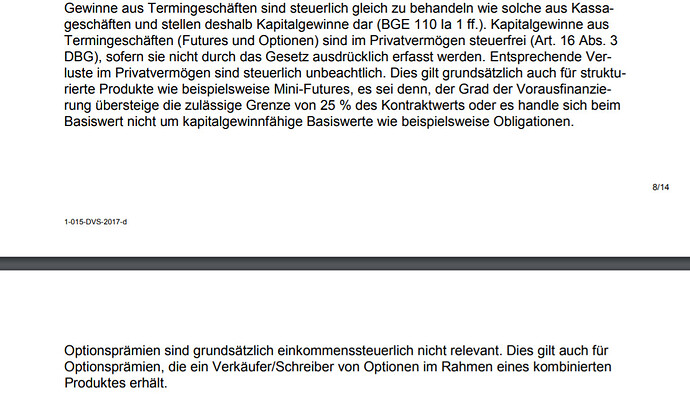

Earnings from selling put options are considered equivalent to capital gains, not (dividend/interest) income, from a tax perspective. The reason is that in both cases (selling securities and selling put options) you’re making money from price differences. See BGE 110 Ia 1 and section 3.4.3 in https://www.estv.admin.ch/dam/estv/de/dokumente/estv/steuersystem/dossier-steuerinformationen/f/f-finanzinstrumente.pdf.download.pdf/f_finanzinstrumente_de_2018.pdf

According to Circular 15 from the Federal Tax Administration:

Les primes d’option n’ont en principe pas d’incidence en matière d’impôt sur le revenu. Ceci est aussi valable pour les primes d’option, qu’un vendeur/souscripteur des options reçoit dans le cadre d’un produit combiné.

So no, unless you are considered professional option premiums are tax free, no income tax is levied.

Anecdotal but in Geneva I have not heard of any of my coworkers being classified as professional traders for tax purposes. And I know they do a lot of personal trades per year (I work for a trading firm).

On the topic of short volatility strategies (in particular cash secured puts and covered calls) I recommend being very wary of your risk exposure. Many of these strategies can be summarised as “picking up pennies in front of the steamroller”, i.e. you make a few % every month and eventually lose everything when a freak event happens.

Not that short volatility is always bad, you just have to understand WHY someone is paying you those few % and what event you are insuring against that WILL happen in the long run.

I would also recommend reading insight from professional volatility traders like the below:

I started doing some small options trades, mainly selling puts monthly to open positions in SPY ETF (S&P 500 index ETF) as a way to get paid for DCA

I’ve stopped and given up on the small extra income because of the uncertainty over being taxed on capital gains on my whole portfolio. Given the relative size of each the risk is too high for me

Good to hear that Geneva does not seem to be too strict [Edit: Geneva resident]

@Ed_Waadt you are right, i found the same document in German file:///C:/Users/efstr/Downloads/1-015-DVS-2007-d%20(1).pdf (it is easier for me than French ![]() )

)

Anyways, I will talk with someone from the cantonal tax-office and let you all know what they officially say.

You’re right, I was too lazy to add the reference to the German text.

But yeah, that’s the rule unless you’re considered a professional trader.

Hi everyone! as promised, I am posting an update after the phone call with an options expert from the cantonal tax office of Zurich. I explained him my intention (to sell options) and he explained me two things:

-

As long as I declare all the transactions of the year thoroughly and they can see from my payslip that I have a normal salary from a 8-5 job, there is no probability that they consider me a professional trader.

-

Even the premium that I may receive from a put sell (or any other option) is not taxed, since it is not considered revenue (Ertrag in German), but it is somehow connected to the capital gains (or losses) of a stock in the future.

So in the end they are pretty relaxed (he even told me not to think too much about it, as long as a have salary job).

So much for “only declare your positions at the end of the year”.

Thanks for the update @stra! Would be curious to know how the cantonal tax office in Schwyz would anser the same questions.

Does anyone know what is actual capital gain tax if you are listed as professional trader? Or gain is simply added to annual income?

Added to your revenues, there’s no specific tax % on capital gains like in France for instance. But you also need to pay AHV and so on on top of income tax.

Any updates on Mustachian options trading profits vs. a benchmark like VT or VTI (opportunity cost of not being fully invested in an index)? I’ve always wondered if the option trading yields are actually worth the effort.

Science does not seem to back magic profits for covered call strategies:

https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.1023.1099&rep=rep1&type=pdf