FYI the commentary on the legal change is not hinting at all towards this (it mentions several times that pension needs to be a collective investment, not individual, even 1e, but they expect some alignment across funds so that there would be 10-ish offering that would become standard over time – that’s the reason for limiting the 1e offer to 10)

Also none of the changes in the (failed) national LPP votation from last month were about making it easier for people to invest on higher returns assets. It seems that the government doesn’t really perceive the subpar returns as an important issue at all compared to other problems of the 2nd pillar, since this didn’t even make it into the proposed reform.

The 1e reform took place in 2016 already, and none of the (large) companies my wife and I have been working in have made use of it

So just to be sure. If every individual is maintaining their own account and strategy in 1E account then how come it is collective?

You don’t have free choice of investment in 1e, you pick among a few strategies.

Anyway you can check https://www.newsd.admin.ch/newsd/message/attachments/90046.pdf (page 4, “Es stellt sich ebenfalls die Frage nach der Einhaltung des Grundsatzes der Kollektivität […]”)

edit: what they refer to is the principe of collective plans from Art 1c (Fedlex)

This part I know. We have 1E with 10 Strategies.

But I was mainly trying to say that everyone maintains their individual account and the funds are not used for anything else other than paying lumpsum to individual. There is not even an option of annuity.

So I wonder what collective purpose it serves

Thanks for the link

I don‘t see any indication that 1e becomes the norm. In the contrary, I think it is tolerated but the government will take any opportunity they find to revert it back tonhow it was before… there is loud and clear criticismn that 1e was not collective enough and counter the spirit of the pension system.

Interesting to hear

It’s true that 1E plans are not that big yet.

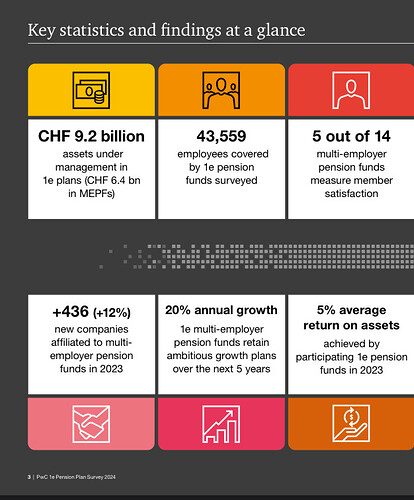

About 4000 companies offer these plans. I think about 9% of eligible Swiss employees have 1E plans. As per report from PWC.

It’s growing in membership but as you said the big 5 of Switzerland might not have such plans yet.

Source -: https://www.pwc.ch/en/publications/2024/ch-1e-pension-plan-survey-2024.pdf

To be honest I don’t really understand why would it be a problem for government?

1E plans cover extra mandatory pension. This pension already is not regulated by BVG conversion rate.

So if employees don’t get BVG rate for conversion (for this amount), why would government have an issue in letting these funds be in 1e ? Only thing such plans do is to reduce the load on pension funds & have eligible employees higher pension (hopefully) in their retirement if their strategies work out better

(a) 1e doesn’t reduce the load on pension funds (PF), it increases it. By removing exclusively non-mandatory parts of the fund, the PF as a whole has less possibilities for cross-subsidies. Basically the system gets less social and more individual. That is good for the high-earning individual (and only those have 1e), but bad for the average or low earner.

(b) The government rightfully wants to protect some people from themselves and doesn’t like 1e because of that little hopefully you put in brackets. What if a new retiree is forced to retire in a big crisis, running out of money rather quickly thereafter because they didn’t understand the risk of their asset allocation? That person will soon enough ask the state for financial support (Ergänzungsleistungen). Same reason why there are some efforts by some actors to abandon the option to withdraw capital altogether (for mandatory parts at least).

And at same time there is so much talk about stopping cross financing because it’s not fair to younger generation.

Let’s see where this goes.

An interesting stat, in 2023, 32 billions are in vested benefits accounts

That’s not very much. And a vast majority of those will be assets that are in the intended use of VB, like early-retirees or people that left CH.

The BSV even has a document titled “Don’t forget your retirement assets” on unclaimed assets available in 9 languages.

Thanks for the link, I had a quick read. It seems like a lot of fuzz for a very small numbers of people that

- have 1e

- change job to a non-1e plan

- consider moving the 1e part outside in the first place

What I didn’t catch directly is whether the new rules on reporting to / of pension funds and VBs would be limited to those handful of 1e moves, as are supposed to be tracked individually, or to all moves outside a pension fund? For example a direct pension to pension move, or a temporary move to VB during job search or a time-out.

For the latter case, it seems like a big overkill. And if the objective of the motion was go give some limited benefits for 1e holders, that whole things looks like a shot in the own foot.

All moves, they also realized they could close the loophole. The only 1e specific thing is the ability to delay for two years I think.

Once Finpension told me that government is trying to make reforms to 1e to encourage more companies to use it

I see this new step as a way to give confidence to people who use 1E plans but also to employers to offer 1E plans. I know others on forum think there is no such inclination.

There was another reform few years back which removed the need for employers to guarantee funds at time of exit. Prior to this employers didn’t want to take this step as it was still the same requirements

I’m wondering how the new law will take into account this scenario:

"It is possible that your new pension fund cannot accept the entire amount

as the benefits it provides are lower than those offered by your old fund.

In this case, the surplus vested benefits must be transferred to a vested-benefits institution."

Regarding 1e-plan, big companies like theses plans because it can improve the balance sheet of the company

It says those will stay in vested benefits account like before.

Reading this thread made me realize I forgot to transfer a 2nd pillar fund myself a couple of years ago. I suppose it is a partly special situation as my position was financed by external funds, so my salary and insurance was covered by a different company than the company I was working for. Later on I received a different contract and got funded by the company I was working for the whole time without physically changing office.

Apparently my 2nd pillar got transferred to a “Auffangeinrichtung”.

No excuses but I want to check what my options are now. I am slightly concerned that notifying my current employer now causes more trouble than not doing anything. Not sure if this happens rarely but maybe somebody was in a similar situation before?

Don’t think it would cause any trouble, it’s probably common for people to genuinely forget about that.

I don’t think assets coming from an “Auffangeinrichtung” would raise any red light.

Reading people’s answers on the topic of transfering assets on this forum, I don’t even think other assets would either, unless you’ve done buy-ins in the interval in which case, the cleanest and most proper way to handle it is to play clean and ask your pension fund how this can be remediated.

I read the following on Reddit today:

(…) every year I borrow around 10-15k CHF from a bank and make a voluntary contribution to my BVG. I can deduct both the BVG contributions and the interest paid on the loan from my taxes, so it’s a double win. And then each time I change employer, I transfer my BVG funds to a Freizügigkeitskonto where I can freely invest the funds the same way as 3a funds.

Effectively, I deduct each year around 20-25k CHF from my taxes (instead of just the standard 7k which is allowed on 3a) and all these money I freely invest in stock markets.

Just as an example of what you definitely shouldn’t do. This sounds very much like tax fraud. And quite honestly, anyone who buys more than their purchasing potential allows deserves to be caught. That is exactly the reason why such grey areas will be closed sooner or later.