There’s no separate cash account. You just have different currency balances as part of your portfolio.

This is exactly what i wanted to know. Thanks

Hi, i did my first limit order of VT on Interactive Brokers, but before confirm i received a warning popup if i wanted to use the algorithm, what is that? i answered no.

Thanks

IIRC use the algo means that if you put a limit price that is a bit away from the current price, the algo adapts your bid price to avoid your order is cancelled because it is too far away from the current price.

Your limit will still stand. You can say yes to this.

There will be many warnings in the beginning, also for ’ you do not have current market information’ - you can ignore this or take a snapshot, the first few snapshots costs 0.01 but will be waived.

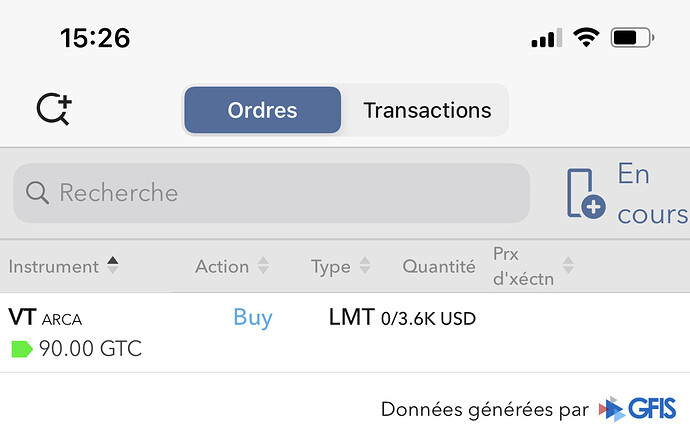

I see VT @ 90 USD, that is my buying price from this afternoon

I placed an order with a specific amount of USD(all my USD cash available ) as i do on Degiro because is more practical and easy, and IB filled the order like 40.3669 shares of VT and then i realized the 0.3669 it was fractional shares, they have some inconvenience?do you usually use fractional shares on IB?thank you

Same, I use the ’ Amount’ function to estimate the number of shares, or do it by hand, and then buy a fixed number of shares.

So you don’t use Fractional Shares because is complicated to do the tax declaration ?

I prefer to keep things “clean” and don’t bother with a few 10s or 100s sitting around until next purchase.

Similar to dividends sitting there until I am buying further.

I don’t know if it complicates the tax return, never tried to put a non-integer into the software (but the “modernity” of the (Basel) UI doesn’t look like it could support that  ).

).

Update to my first post:

Since January 2021 we have opened a joint account with IB and starting invest on VT monthly (each 25th), and stoping invest with Degiro on our VWRL.

Friday 9th April when our VWRL ams.EUR arrived at the price of 96€-share we sold all our shares on our 2 accounts from Degiro.(total of 40k .-)

The objective is to invest the total amount with IB on VT, the big question now is: Should we buy directly VT on IB with the Lump Sum(40k) and then continue with my strategy of DCA each month, or add this 40k to my DCA?

Thank you for all the support.

Cheers ![]()

If I understand correctly, the goal was to switch brokers, not to sell / get out of the market. In that case I think it would make sense to buy back as fast as possible at the new broker (similar to transferring the shares, except that in your case you’re also switching VWRLD for VT).

Ideally the corresponding cash would have been ready in your IB account and you could have bought in the same minute as you sold (that’s what I did when I switched from DEGIRO to IB, but that was only possible because the portfolio was relatively small so the cash was available).

Exaclty the goal is to switch brokers from Degiro to IB and from VWRL to VT.

Whatever makes you sleep/feel better. DCA is ultimately one way of timing the market. And time in the market is more valuable than anything else…

Voilà i did lump sum.