This is what I am also doing ![]()

There is nothing wrong with Degiro. Just make a custody account and not a basic account to avoid securities lending.

Wording aside, it is of course factually true that even a very modest wage increase (say 100 CHF a month) would dwarf the costs the costs of currency conversion.

Except… you don’t.

Are you holding the shares physically? Certainly not.

Somebody is responsible to keep records of shareholders. As I understand it, like in other countries, that would be a securities depositary. Do they have your name on record? They don’t. They’ll have IBKR on their records. Who, in turn, and by their own account, merely keep an entry about you in their own books.

Have they ever sent you a physical certificate, account statement or letter proving proving your “holdings” with them? Probably not even that. At least they haven’t to me.

Speaking for myself, as someone who avoids investing in U.S. Stocks, through U.S. brokers or basically touching things with a financial link to the U.S. government (I’ve made a small exception lately but I don’t think it invalidates the general posture):

What I fear coming from the U.S. is their ability to consider money “their” money. They are taxing their citizens even when they live abroad and not a cent of their income is made in the U.S… They have created legislation forcing U.S. companies to release their data to the U.S. Government regardless of where that data originates from. Basically, they consider that might makes right. I’m not mighty enough to fight them so I won’t put my money in a position to be strongarmed by their legislation or an executive order if I can prevent it.

There are countries I trust to be fair in business. The U.S. are not one of them. This is a purely personal stance, though, everybody can and should do their own assessment and invest in accordance to their own principles.

The question is, what could they realistically do? Announce that all US stock is now taxed on sale, or annually, starting from now? I also don’t like how they enforce FATCA on others.

So let me get this straight: you’re not investing through any US institutions? Be that brokers or companies? Or do you invest in VWRL, because it’s in Ireland?

OK, but who does? You know what it’s like in Switzerland or in the EU? At least US brokers are very big.

I would very much like to receive a convincing argument to ditch IB & VT. It would be more convenient to hold VWRL at PostFinance, but the difference in transaction costs plus the withholding tax are holding me back. And if I ever do purchase something only listed in USD (like TSLA), there’s the currency exchange fee.

What I’m fearing, maybe without cause, is some sort of lasting effect due to past transactions. We already have to file a “U.S. person” form when opening most accounts in Switzerland, I wouldn’t want a new question on this form to be “do you own U.S. Stocks or have you owned some at some point in time ?” It just… doesn’t feel worth the risk to me. They’re not the only ones with profitable companies, I do give up on some profit and a lot of diversification but that’s worth it for not putting a foot in what feels like a minefield to me.

I’m at the very beginning on my investment journey, so there’s a lot of room for change of opinion and different feelings as I start sitting on more wealth but my policy is to first invest in individual swiss stocks, travel to a few countries I trust, establish links and relationships there then start a brokerage account there and buy their stocks through it, until my wealth grows more and I get to pick a third country and so on. Canada would be my pick for second country once I feel the need for geographical diversification. Climate change, the availability of natural resources and the language (French speaker here) play a good part in that choice.

I’ve recently given in to Frankly. so I am actually investing in U.S. stocks. I’m considering it play money, though, and most importantly, Frankly. are the ones investing in it and it will be sold when I’ll take them out of my 3A so I’m considering the risk of being classified as a person-with-some-kind-of-tie-to-the-U.S.-that-would-somehow-become-relevant-in-the-future low enough to allow myself this experiment.

Once again, that’s my personal analysis and it’s not devoid of emotional reactions. It fits me but doesn’t have to fit anybody else. We should all choose our own poison.

Thinking a bit more about it: what I’m basically afraid of is that owning part of a U.S. company (as a shareholder) would at some point make non-U.S. financial institutions afraid of dealing with me. Buying an ETF isn’t the same as buying individual stocks: you don’t own the stocks, you own a participation in a fund. That doesn’t solve anything if I were to buy into a U.S. domiciled fund but yes, I guess investing in Irish domiciled funds would be OK with me even if they hold U.S. assets themselves.

I do admit to not knowing enough about the real way that funds work to put any reliability behind this reasoning. It’s only representative of where I stand as of now.

Wouldn’t they only ask it if it meant paying a tax for it?

Btw I think if you invested in VWRL, you should be covered. In the end, if you hold an ETF that holds US shares, then is that so much different from holding shares of a Swiss company, that has a subsidiary in the US? I think you should not intentionally exclude US from your portfolio.

I am frankly unable to provide you one. If anything, it would probably be a black swan event - something of which “nothing in the past can convincingly point to its possibility” (ibid.).

A catastrophic and unrecoverable hack of civilian and/or trading systems? Somebody managing to detonate an atomic bomb in Manhattan or Silicon Valley? China banning export of electronic goods and components to U.S. companies as a retaliatory measure in a full-fledged trade war, while at the time annexing Taiwan?

Feel free to make your own stuff up.

Everyone pays taxes U.S. securities - unless they prove they don’t (have to).

They’ve even subjected Swiss financial service providers to special rules and regulations to do so (for instance, see “zusätzlicher Steuerrückbehalt USA”). Wikifolio offers Europe-based derivatives on US stocks - they stopped crediting dividend distributions due to changes in US tax law - even though they aren’t based in the US, and neither are their certificates.

PS: It could be something as simple as the U.S. (and its government) legally expropriating, freezing or seizing my assets - and I’m located literally at the other end of a big ocean. Sometimes there’s comfort in knowing I can grab my pitchfork and march to Berne, Berlin or Brussels.

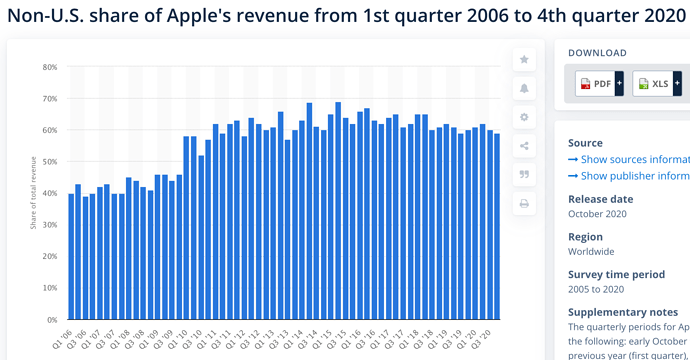

Whatever you do, you will always have 100% of assets in one egg, that egg being the planet Earth. The companies are US-based, but they do business internationally. Take Apple for example: 60% of its revenue comes from outside of the US. Will you skill Apple just because it’s US based?

That being said, I don’t hold VT, but VTI + VXUS. I had in mind, that I could effectively cap the US share to, say, 50%. But I don’t know if it makes sense. The market values all the US companies so much for a reason. Is there a collateral risk? Maybe. On the other hand, US domiciled companies could just simply change their domicile if the US suddenly became a bad place to be.

But what would you realistically do? You would contact a lawyer, maybe the local police. I guess for a Swiss broker it would really be easier to handle. You may have a point.

So can you tell me your broker / ETF setup? You don’t invest through IB and in US-domiciled assets? I guess through VWRL you let Vanguard Europe handle the US laws and you are shelled from it through the ETF, right? It pays the withholding tax, it deals with all the changed, you just hold an Ireland-based asset, nothing to do with USA?

And what good is it worrying in advance? (Yes I know risk assessment; but the impact is questionable)

Even then I am quite sure those things would be announced in a timely manner, and would definitely not be legally applicable retroactively because you “ever in your life held any US instruments”.

So you would have time to act, change brokers, and withdraw any investments from wherever they are.

Well fitting here:

“I’ve had a lot of worries in my life, most of which never happened.”

-Mark Twain

Everyone pays taxes on US securities via the dividends - full stop

That’s the 15% withholding tax, that goes to Uncle Sam.

As to the “zusätzlicher Steuerrückbehalt USA”, I think that is a Swiss thing, to increase the withheld tax to 30%, to “convince” you to declare it all correctly. Only a Swiss broker subtracts that.

And as to any new/additional US taxes, mamy different implementations/options, but if they raise withholding tax for example, then double taxation treaty kicks in, and my Swiss tax will be less. I believe a new/increased taxation on dividends/earnings is much easier to implement “legally” than taking away for example 2% of your shares p.a., as that is closer to stealing/expropriation. That is Cuba-style…

Yes absolutely.

But there is a kind, polite and non-condescending way to communicate with fellow forum members, and there is a prick way to do so.

I would prefer our environment to be more like the former.

Anyway, s/he has the right to write however s/he likes; and others have the right to respond as they please.

Except you, @Bojack, as you have a small egg on Mars (and maybe even Venus, who knows) as a Tesla share-holder!

Lawyer - yes, If his/her fees are worth it, compared to my holdings. That’s probably a big “if” in the field of banking and securities law, probably even more so in the USA.

Local police will unlikely do anything, unless I can convince them that local law has been broken. Likely they wouldn’t even understand what I’m talking about.

I do. Mostly single stocks in my IBKR account.

- Single stocks: IBKR, can hardly be beaten in price and range of what’s available. Also, the customisable statements are rather convenient for my tax returns (for a non-CH broker)

- Monthly ETF investment plans: German online broker (whoever is cheapest and/or most convenient at the moment. I have more than one broker, all of them without account fees)

- Long-term fund holdings: Paying crazy fees for the privilege

of holding securities through one of the safest banks in the world (European high-street bank, not Swiss though)

of holding securities through one of the safest banks in the world (European high-street bank, not Swiss though) - My third pillar is of course in Switzerland, with VIAC and FinPension.

That makes for four jurisdictions.

Additionally I have been thinking of opening accounts with:

- Fundsmith: I’ve just signed up for direct investing with with them.

- TradeDirect? Looking into opening an account with an inexpensive Swiss broker

- Schwab? Seems to be quite cheap for US stocks, also interested in their Debit Visa card.

The last two don’t make sense from a cost perspective, considering my lowly assets.

Ideally, I would like to split between 3-4 brokers, plus my third pillar.

If I had to choose though, IBKR would surely be among my top 2.

I just don’t feel that comfortable going “all-in” on them.

Mainly MSCI USA quality and MSCI Europe quality. They are European ETFs.

Exactly that: risk assessment. ![]() I can craft my investment policy with that worry in mind. I am happy with mine.

I can craft my investment policy with that worry in mind. I am happy with mine.

If you worry about the winter before it comes, you can pack food and warm clothes. If you wait until the cold catches on you, well… you may sill have time to act, or it may be too late. What I fear are lasting effects, what I do now could have an impact on my future that I’d rather avoid. My risk assessment is that the gains of not exposing myself to that risk outweigh the losses of extra returns and diversification.

On my use of the term “worries”: I’m not loosing any sleep here and not feeling like I’m giving up on something. I’d be worried that smoking could give me lung cancer, so I don’t smoke and am therefor spared the worry. ![]()

Other factors enter my thinking process, like wanting to exert my right to vote in GAs because I’m not fond a world where financial institutions are the sole decision makers in regards to companies’ business (mainly executives’ salaries), though I know my money doesn’t make any sort of real difference in this regard (it’s all about droplets, in my opinion, though).

Those are things that are important to me, they may not be to you. If returns is all you search for in stocks investments, then your approach is probably better than mine.

After read all your advices/opinions i opened already a IB account, also i contacted Degiro concerning the pricing to move my VWRL.ams shares to IB and the answer as not straight.

Monsieur,

Faisant suite à votre mail, nous vous informons que vous devez contacter votre nouvel établissement financier dans un premier temps.

Ensuite, dès réception de leur demande, nous vous confirmerons les frais de transfert sortant de titres.

Enfin, nous pourrons mettre en place votre demande de transfert.

Pour toutes questions, nous vous invitons à contacter le département transferts@degiro.fr

Someone have experience about transfer shares from Degiro to IB? Maybe is simpler just sell everything in Degiro and buy directly thought IB?

Thank you for all your answers and help.

Hi Scorpion

Degiro charged EUR 10 per line + external costs (custodian). When I closed my account in March 2019, the prices (including Degiro + external costs) were the following:

Les frais de transfert sortant pour des positions cotés sont de 18€ par ligne sur Euronext Amsterdam, 56€ par ligne sur le Nasdaq et NYSE, 78€ par ligne sur les places boursières Suisses et 54€ par ligne pour le LSE.

In my situation (transfer to a Swiss bank), it was still cheaper to sell everything, transfer the cash and buy again.

With a line of VWRL, it shall cost you around EUR 20. To be confirmed by Degiro.

Hi Guillaume thank you for the information, so if is this price, we have 2 accounts only with the VWRL.ams, so will be around 40.- to transfer, it seems the best option.