I agree, but this is not a bank account. You won’t use the app more than once a month

Thank you for raising those important points. My comments are as follows:

- All 3a foundations are covered under the deposit insurance; 100k apply always (see also https://www.esisuisse.ch/en/deposit%20insurance/faq)

- Deposit insurance is particularly relevant when cash solutions are offered. In this case, the bank where the cash is held must be checked in detail (Credit Suisse in our case).

- As we don’t depend on a bank, we don’t offer cash account solutions. For this reason, the investments with us are not affected in the event of bankruptcy of the bank (99% of your assets are invested and not part of the bank balance sheet).

- 3a foundations are not permitted to conduct their own balance sheet transactions and are managed by a separate company (finpension AG). Consequently, only client funds are held in the 3a foundation. This is a regulatory requirement to ensure maximum security for the insured.

- finpension is already well established in the area of 1e plans and vested benefits. Many innovative and reputable companies have chosen our solutions (some references are listed on www.finpension.ch).

Best rgds,

Beat from finpension

Thank you very much for coming here to explain how your promising 3A solution works

I’m taking a look at your strategies, in particular Equity 100.

First question: in your overview for 3A funds I see this:

While the funds you invest in are all quoted in CHF. When does a currency conversion come in play?

Second (but maybe you’re not the right person to ask to): why Credit Suisse offers funds with 0% TER? Is there anything hidden? Extra costs on their side?

You can also choose custom strategies

Inside the fund directly, like an ETF which is quoted in CHF but covers the US/world

The TER is zero (like for VIAC), because a contract has been done between Finpension and CS for the fees. These fees are coved by the 0.39% all in fees.

Hi TeaCup,

No this is not correct. It’s not the Bank account that is covered up to 100k but each customer’s cash assets. In case there is a problem with CS, each individual customer has thee deposit insurance priviledge of 100k. You can read about this in the "Mitteilung über die berufliche Vorsorge Nr. 139 on page 3 (https://sozialversicherungen.admin.ch/de/d/6604/download; unfortunaltey only available in German).

The management company finpension AG and the retirement savings foundation have to be completely separated. We want to give our clients as much as possible flexibility regarding the investment strategies but there are also some restrictions of course because of our investment regulations. You will see this in the app if you customize a strategy (eg. restrictions for Swiss equities because of the single stock limits, limit of the gold allocation etc).

KYC has no effect on a pension foundation because you become a customer of the foundation and not of the bank. We would like to make UX as good as possible and therefore do without it. An ID check is only required when a payout is made.

Best regards

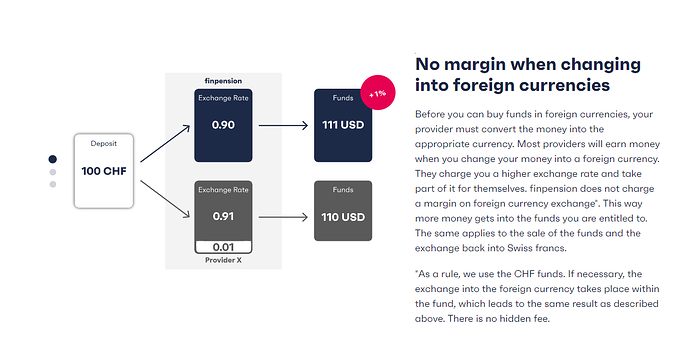

We use CHF index fonds whenever available. There is an exception if you customize your strategy and add for example CSIF (CH) III Equity US Blue - Pension Fund ZB as we have to subscribe this index fund in USD. Otherwise, there is no currency conversion. If there is one, we have a spread of 0.05% which is charged by our bank but there is no margin on our side.

0% TER classes can only be subscribed if you have a special agreement with the bank (institutional fund access; such agreements are usually only set-up for very large accounts). The costs for the use of this classes, custody and transaction fees are then directly paid by the couterparty (finpension) and not charged on the index funds. This is the reason why we can offer an “All-in-Fee”.

Do other 3a providers like Viac or Franky don’t pay VAT? Or do they included it in their all-in-fees?

We found it important for security reasons to completely separate the 3a foundation from the management company so that we only have the client assets in the 3a foundation. Consequently, our fees are invoiced directly by the management company which has to pay VAT. I know that some other foundation have a bit a mixed set-up but cannot give you a final answer about how the mentioned providers handle this.

The currency exchange fee for 3a for VIAC is 0.75% and for vested benefit is 0.5% charged by WIR bank. This is a hidden fee and I only found out by accident.

Ofcourse this could reduce when they do netting and have to buy less USD.

You will have to pay the fee when you buy in and exit… so kind-of sick

Having a compatabile web interface will increase cost on the provider. I know firsthand how painful this is to maintain as a software engineer

Hi Finpension,

If I open vested benefits and pillar 2 with 100k each for a total of 200k - is the entire 200k covered under deposit insurance or is it only 100k?

Regards,

Legin

Is there much point at keeping cash in 2/3a?

Web interface will be available in a couple of months.

Hi leginj,

In the case of a bankruptcy of a bank, the coverage would be only up to 100k per client if you have two vested benefits accounts with the same bank. However, this is applicable only for the cash portion. Securities won’t be affected in case of a bankruptcy.

Kind regards

Pillar 3a assets and vested benefits are not protected by Esisuisse, regardless of which solution you use. Assets are in every case held in the name of a retirement foundation (pillar 3a) or vested benefits foundation (pillar 2). You simply hold a claim against them (much like a bank account). All Swiss retirement foundations are governed by the same laws and regulations. So there is no disadvantage in this regard.

More important considerations include: the financial health of the foundation; whether the foundation actually owns the shares and other assets, or simply holds claims to assets held in street name; the canton in which the foundation is domiciled (if withholding taxes are a consideration).

The currency conversion fees had an adverse affect on my investment performance and I think I will move my 3rd pillar to finpension, but I’ll wait a couple of months to see if VIAC has a reply.

It’s true that they are not protected in the sense of Esisuisse. So, they do not have this 100K protection that will be paid by the 6 billion fund. However, they are still considered as preferential deposits for the first 100K, like cash in bank account. So, in case of bankruptcy, these claims will be repaid earlier than other claims. But it’s true that it is a weaker protection.

This is basically the same for all 3a solutions in Switzerland then?

It is:

See section “Are Pillar 3a (restricted pension scheme) deposits preferential?” here:

That’s my take on it yes since all 3a solutions are under the same regulations. But this is only for the cash of the third pillar. So, for us wanting to invest 99% in stocks, it won’t make that much difference whether it’s protected or not.