Too many unknowns indeed. I passed on this one.

Ciao all,

my net-nets strategy is taking shape. I currently have 8 stocks in the portfolio (sold CRDS yesterday with a 35% gain in one trading day!). Today I have found another small tiny candidate but I’d like to have the opinon of truer mustachians than me before committing: STRI (https://finance.yahoo.com/quote/STRI?p=STRI).

This one seems legit to me with good downside protection. The only “FAIL” I have in my checklist is the lack of a catalyst. What do you guys think?

You need to be holding for 6+ months to avoid exposing yourself to potential very steep capital gains taxes

That would be buy and hold an f’ing index fund, not mess with net nets and value traps. For the latter you probably want to join something like value investors club or seeking alpha

Ciao hedgehog,

holding for more than 6 months is not an option when it come to net nets. I sell when the stock hits the sell price and I pay the taxes I have to pay. Obviously net-nets investing is not my primary way of investing. I have almost 80% of my capital invested in VWRL and I’m very happy to sit back and relax with it. 10% is cash and the other 10% is dedicated to some “non-true-mustachian” activites like net nets, crypto, p2p, options trading. All of this on top on 2nd and 3rd pillar of course. I feel that this asset allocation is rather conservative and it still allows me to enjoy the EOD trading that is an old passion of mine.

I understood that this thread is dedicated to learning about the net nets strategy and that’s why I’m posting here. Rest assured that I’m also checking seeking alpha but one doesn’t exclude the other in my opinion.

Capital gains taxes, if they chose to levy them, will be on your whole portfolio. And they are very steep: your marginal income tax rate (up to 30-40%) + 10.25% AHV. Options trading as far as I see it is practically a guarantee that you’ll get shafted with CGT, so i wouldn’t recommend that. At least establish your own company to do trading on its behalf then, to eliminate tax uncertainty

“Due to, among other things, the difficulty repatriating cash to the U.S., we may have limited access to the $5.3 million of cash and $0.1 million of bank acceptance notes located in China for use outside the country.”

If you discount this chinese cash it’s not much of a net net. They also seem to have some expensive lawsuits going on. No profit in sight, yearly expenses are comparable in magnitude to cash pile. They do have some fat tax rebates coming in though which compensated losses so far, I’d look up what’s the deal with them next if buying

The tax discussion is indeed a critical one, you are right. I am aware of the five principles of the circular 36 of the tax authority. My understanding is that they are used to decide without further discussion whether you are automatically a private investor. Not complying with all five principles, however, does not (and should not, by law) automatically qualify you as a professional investor. Your case will be reviewed as a whole. Here is tricky and you are also right about the uncertainty of the law. So far, I have never been even questioned on private vs professional but I doubt that making few options trades with very small amounts (mainly selling puts to acquire the underlying at discount prices or trading covered calls to hedge the underlying position) or capitalizing a single “lucky” trade like CRDS (also with a very, very small amount of capital invested) without waiting 6 months would qualify me as a professional investor. I do admit, however, that I have never really investigated this subject in the level of detail it most certainly deserve and I will do it in the near future. Thanks for the heads up!

Yes, it’s decided on a case by case basis. But frequent trading, short term holding and options trading are considered strong indicators of professional trading. You’re taking unnecessary tax risk for inadequate returns IMHO. Try not to sell VWRL then until the end of the year at least to avoid realizing more potentially taxable gains, just in case

If you have 20k+ play money, you could’ve set up shop as a GmbH already and do the trading through it. This would eliminate the uncertainly: companies are always taxed on capital gains, and you could deduct your trading losses over years to come. You’d have some tax planning room: take earnings as dividend or salary or retain. Plus you’d probably gain invaluable first hand accounting and entrepreneurial experience managing it

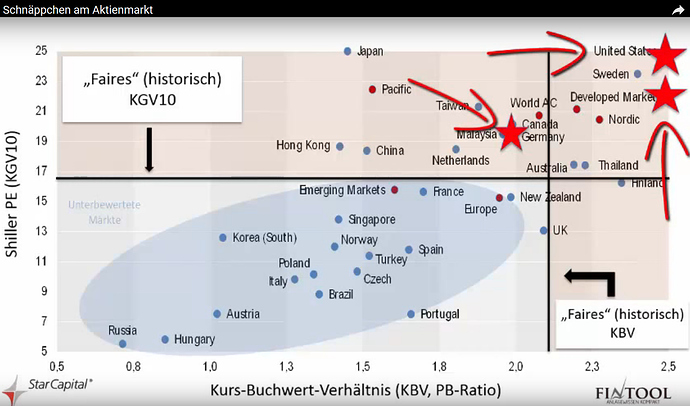

maybe not at the core of net nets, fintool made a nice pot in 2015, plotting country wise stock markes in Schiller PE vs. Price-Book ratio:

some great deals available in Russia, Hungary & Austria^^

There is actually an MSCI Hungary with 3 constituents…

Meaningless plot as you don’t take into account rates and trashiness of each market into consideration.

I think you might be putting it a bit too succinctly. The chart certainly lacks several dimensions (e.g. political risk, other risk factors) and should thus not be relied upon as the sole guide for investments. This wasn’t intended, I assume, seeing that @nugget mentionned that the plot is well-aged (2015).

The main point that value investing brings up stands: Does it make sense to recommend start investing according to market capitalization when some of these markets are historically high priced? The answer may not be clear-cut and thus should neither be recommendations of how to set-up a portfolio.

if you horizon is long enough: yes. because: who cares.

From the practical view: almost any ETFs other than the mainstream ones from Vanguard, IShares etc come at considerable additional costs like higehr TER, spreads, tracking errors, tax inefficiencies, risk of being closed, and less diversification. The extreme example is that MSCI Hungary, made up of 3 (!) constituents.

Is overpaying for assets really the Mustachian way? MMM seems to be pretty sharp regarding what he is ready to pay for real estate, tools, etc. Often principles from real life are left outside when entering the stock market.

Jack Bogle makes the same point about valutations and the consequences for returns in the next 10 years.

Lack of returns in the starting phase do have a considerable effect. I am not sure the attitude “because: who cares.” really does justice to those advised.

This is a red herring. The discussion is not about risk, as your plot did not take it into account.

Well, a lot of us would like to be financially independent within the next 10 years, so I would say that the horizon is indeed an issue, and yes, we care.

my “who cares” refers to the long term horizon and the passive investor’s disinterest into stock valuations. with long term reffering to multiple economic cycles i wont try to not-invest because prices are high [known as market timing].

I’d also rather have 4% in returns than having cash idling around.

check out this:

that’s of course an entirely different story which i am explicitly not referring to ![]()

please go ahead and find some nice non-market-cap weighted funds that are as interesting as the big vanguard funds and report here!

- http://www.etf.com/RSP This ETF tracks S&P 500 companies in an equally weighted manner (TER of 0.2%). According to Joel Greenblatt (in this book) it has overperformed the S&P500 by 1-2% annually. Stockcharts website seems to confirm that. since 2004 the performance is the double of the S&P500.

Did I talk about market capped funds? You can easily wander into “faires”-territory with VWO (Vanguard Emerging Markets ETF).

You are talking about anything but value investing.

Today I sold my position on Richardson Electronics (RELL) at a price of 9.4 USD/share. I had opened the position in July 2016 at 5.25 USD. That makes a performance of 80% in two years, or 34% per year.

What motivated you to sell and not to hodl?

First and main reason :

The stock price has reached the Net Tangible Asset Value of the company (i.e : tangible assets minus liabilities) so there is no more margin of safety.

Second reason :

Sometimes if the stock price has a positive momentum I will wait a little more to profit from the momemtum with a trailing stop order, but here it was not the case. The momentum seems to have stopped and the price becomes volatile. Without any collateral in the net tangible assets of the company, i think it is risky to hold the stock (i.e more downside than upside).

Third reason :

The company does not have a great record of earning power, so ciao.