It seems that I signed up for a Newsletter of N26. I got an invitation for a survey where they talk about their launch in Switzerland in 2019.

I hope we don’t have to wait 5 years until we can transfer CHF for free…

It seems that I signed up for a Newsletter of N26. I got an invitation for a survey where they talk about their launch in Switzerland in 2019.

I hope we don’t have to wait 5 years until we can transfer CHF for free…

ahah, what are the advantages compared to Revolut?

They are only panning on offering €-Accounts to Swiss people, at least for now. So I guess you can wait for a long time until you can transfer CHF

If you want an € only account I would have a look at DKB Active. Other than not being a “sexy fintech” it’s overall better than N26.

N26 interest: 0.0%, DKB 0.2%

N26 withdrawals €: “fair-use free” (3+/mont) DKB: Free unlimited from 50€

N26 forex withdrawal: 1.7%, DKB: Free

N26 forex spending: Free, DKB: Free

it seems that you get your personal IBAN unlike at revolut. And you may or may not have the possibility of EUR and CHF account at the same bank, but otherwise I agree with Thaek.

I am with N26 (through Italy) since 1.5 years and I find it quite good until now. Before applying with them I had also a look to DKB but opted against it for the 700 Euro/month transfer (to stay active). I’ve also read that people transfer “him und zurück” the 700 Euro to remain active, don’t know if it works and if it will last.

I think it’s quite similar to Revolut; they use different currency conversion rates (N26 uses Mastercard rate, if I remember correctly) and I had read of people having bad experiences with Revolut with currency conversion rates during weekend or with some “exotic” currencies…

I’m doing this between DKB and Revolut. Works fine and also is not explicitly disallowed.

The EUR IBAN for Revolut is personal.

Indeed that’s what they did now. Today N26 announced (eg on finnews.ch)

N26 continues expansion and launches in Switzerland

● After successfully launching in the US, N26 continues its global expansion

● From today, customers in Switzerland will be able to open a free eurobank account

with N26, for borderless banking within the Eurozone

I got an email from them because I am on the mailing list. They offered a 10€ welcome gift, but I don’t see why I should sign up. I already have revolut and DKB. For me they are a bit late to the party.

Yeah me too. Even Zak looks better.

Me too but I’ve closed the DKB account. They don’t offer any support in English and I don’t speak German ![]()

N26 has full support in English, Spanish…etc…

Yes and I think they are also quite slow in updating the app/services. I started with them at the beginning of 2018 and opened a Revolut account in may this year.

Revolut’s app is more advanced and also the portfolios in different currencies is a big plus imo.

Only minus I’ve seen so far is the lacking of possibility to set/change daily limits for transaction amounts (payments or withdrawals) which with N26 you can set/change on the fly… with Revolut you can currently set only a monthly limit which is the same for payment and withdrawals.

Apart from that, right now I only have 40 EUR left on my N26 card and I think I will close it by the end of the year in order to simplify things.

The only real benefit I see is the business account with 0.1% cashback on €. The business account is basically the same es the normal account (they labeled that it’s for “freelancers”). The only difference is that you receive the business card on which they can charge higher fees because of EU Regulations. So they can give you the cash back. So there is no reason to sign up for the normal account, everyone should get the business one.

Also here is my invite link: https://n26.com/r/danielm1380

Haven’t found out what the benefits of referral invites are.

I can really recommend Dkb - backed by a major bank and no risk issues etc. Revolut is a great for fx and apple pay but their security setup freaks me out.

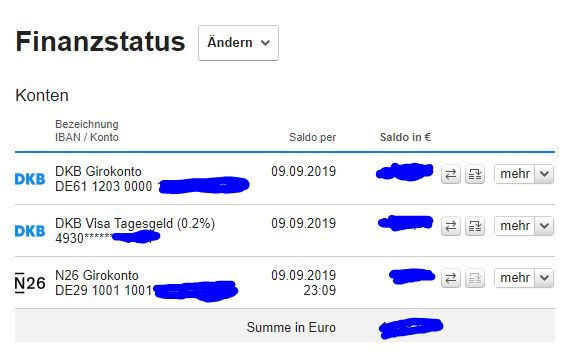

You can also add your N26 account to DKB web/mobile interface, which is really nice:

DKB has an inactivity fee.

No inactivity fee @DKB for the account, maestro & cc (that i have seen on any of my statements).

from Dein neues Girokonto mit kostenloser Visa Debitkarte - DKB AG

Grundsätzlich erhalten alle Neukunden mit Eröffnung des DKB-Cash für 1 Jahr den Status Aktivkunde. Damit profitieren sie mit der DKB-VISA-Card vom weltweit kostenlosen Bezahlen und Abheben an Geldautomaten. Erfolgt ein monatlicher Geldeingang von mindestens 700 Euro, bleibt der Aktivkunden-Status erhalten.

and

Zahlungen und Bargeldabhebungen außerhalb des Euroraums oder in anderen Währungen sind für Aktivkunden ebenfalls seitens der DKB AG kostenlos. Für Kunden ohne Aktivkunden-Status fällt für diese Transaktionen ein Auslandseinsatzentgelt in Höhe von 1,75% des verfügten Betrags an.

Or also here: Kunde

Also here: Vorteile mit dem Aktivstatus - DKB AG

If I got it correctly, you won’t have to pay if you use it in europe only. but you miss some of the advantages.

Exactly. 1.75% surcharge on FX or non-EEA payments.

No inactivity fee if account is unused.

1st day: A-> B

5th day: B ->A

both theirs?