You would start with 0% capital gains in france, after resetting your tax base here. France can‘t tax you on selling, when the shares you sell dont have gains on them. And ideally you comvert to accumulating funds beforehand, to avoid dividend taxation (not quite sure how France treats them though)

Of course any future gains will be taxed, but this gives a looot of cushion and pretty low tax.

Another hairbrain option I thought of was to buy a small apartment in a mountain resort in Valais as to use as my primary home using 2nd/3rd pillar and base myself there for 183+ days a year. Like that my financial base is still CH so I avoid becoming a French resident and paying capital gains tax on my withdrawals.

I could rent it out the Swiss apartment during some of the peak weeks when I´m in the French chalet to cover the mortgage cost (and vice versa with the French house)

It also means that I wouldn´t need to then re-pay the French chalet mortgage (currently on a Swiss saron interest-only payment) as I could keep the Swiss mortgage as I wouldn´t be leaving the country.

Bit too hairbrained?

Good point, but even if I start at 0% gains, I would be withdrawing 4% on the basis of capital gains, right?

Yes, in this case 4% of total asset value at the start, regardless how that came to be, then adjust by inflation as you go. Capital gains and the taxes in the future that would accrue, would need to be taken in account though.

You‘d need to do some math on that

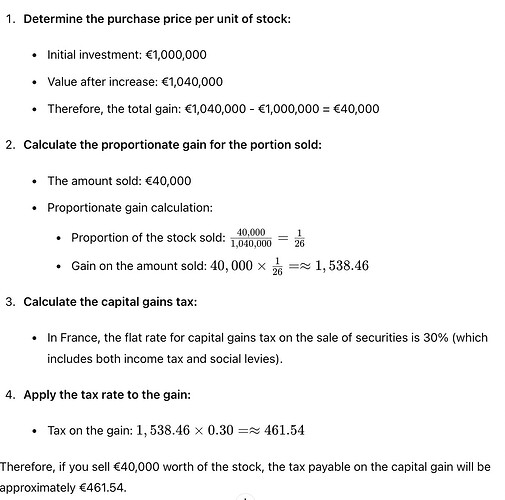

Maybe I misunderstand how this 30% tax would be applied. Using ChatGpt, it tells me the following, which seems MUCH more reasonable. Is this accurate? Seems too good to be true.

1 Like

Seems spot on.

As you sell evenly and only 1/26 is taxable gain.

That share will increase by time though and when the stock market has returns.

On the other hand, if the market has a downturn and you end up in minus, you dont pay tax and may even realize losses that you can use to offset taxes at another time. There I don‘t know the french tax law though, but I highly suspect this to be the case.

First off, kuddos for taking your situation into your own hands and giving proper focus to your mental health. I’m definitely rooting for you.

Sounds optimistic for a 3.5 years timeframe (+350k on Swissquote, +195k for 2nd+3rd pillar). I would assess if things working out in that timeframe is mandatory for my mental health and plan contingency measures in case they don’t pan out, in order to protect myself and my couple (mental health issues put a strain on relationships if not handled properly, which I encourage you to do).

That’s part of my plan too. You probably won’t be able to live off of mountain leader income solely but it can meaningfully supplement your passive income. Multi-days tours are more profitable than shorter hikes so that sounds good too. If not done already, I would thoroughly study where it’s more interesting to do my training. As I recall (but may be wrong), Swiss aspiring leaders can’t practice in France while aspiring leaders coming out of a French school can practice in Switzerland. Take this with a huge grain of salt and do your own verifications (again, if not done already).

+1 to this. The Jura part of the Vaud canton is also attractive for mountain leading (especially in winter, it’s really great for snowshoeing while the Alps are better for ski touring, which is outside of mountain leaders portfolios in Switzerland).

Those are not necessarily that cheap. Those who seem to be are often in older buildings with high maintenance costs and/or heavy renovations required. I’d be sure to obtain the whole picture of recurring costs before committing to buying something. The option can seem attractive. There again, I’d make sure my partner is on board with it and check with them if they’d rather have the appartment be elsewhere (for commute or family reasons).

1 Like

Does France have a tax free amount for capital gains?

The UK used to have quite a generous tax free limit which meant that if you were active, you could easily make a large portfolio tax free by crystallising profits up to the tax free limit each year.

On France the flat tax on dividends or capital gains is by default. 17,2% of social charges you can’t skip and 12,8% of taxes.

You could opt out to use your marginal tax rate but you need to estimate it.

Also it is good you could avoid the PUMA tax with your partner activity or your part time activity.

My cousin as a similar plan in another ski resort except he will rent weekly or monthly his chalet on AirBnb during the ski season and downsize in a small flat nearby.

It could give you lots of cash-flow by doing a similar approach.

I will not recommend to pay off your mortgage especially if they are long term with a fix low rate.

It will give you some leverage and lower your tax on the rental incomes otherwise you will get hammered.

1 Like

So many amazing inputs here, thank you all for helping shape my exit strategy! I feel so much better mentally having a plan and feeling supported by this awesome community. Thank you all!

Based on all the inputs, the key takeaways and changes I see are:

- Keep the mortgage if I can rather than repaying it to maintain flexibility and cash flow.

- If that’s not possible, consider downsizing to a smaller home (or buy just what we can afford with existing home equity).

- Capital gains tax will be paid, but it will likely be manageable at around 1-2k annually based on a 4% withdrawal rate.

- PUMA will likely be paid on the income from capital gains to cover healthcare (around 2-4k annually).

- It might be possible to escape PUMA entirely if I have some part-time activity or spousal activity.

- I will need to optimize the portfolio for cash flow and reduced tax.

Several mentioned living closer to my partner’s job in Geneva. However, we both love the French Alps and have a great community here and ideally would stay here. Moreover, she wants to cut down to 80% when I retire and will be able to work two days a week from home.

7 Likes

Hi Alan,

Congratulations on your plan, and I hope you’ll get better with your mental health. All the inputs are good but I would advise you to find a good Fiduciary specialized in “frontalier” I believe they have many cases like yours, and I think think France is full of “niche fiscal” and other “assurance vie” that optimise taxes. I think a professional would be very helpful. In Switzerland I deal with VZ and I’m very happy with their services.

Good luck