I wanted to expand on comments that I have made before.

I have started to write in how the situation with borrowing rates can be represented as a mathematical model in my mathematized theoretical mind, but have run into a lack of information about how certain things are actually working. Please read and help me if you are a pro and can help me to figure it out.

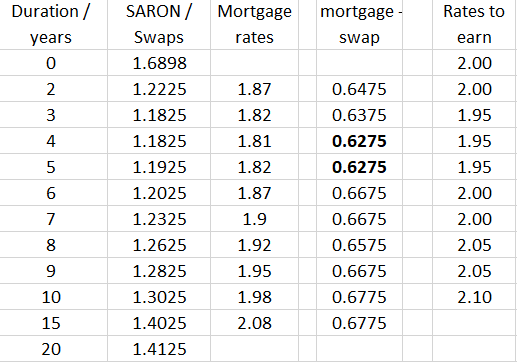

So, there is one interest rate paid when banks and other financial actors borrow money overnight: SARON. This is a “true”, unconstrained value, determined by establishing an equilibrium of offer and demand in a free market with a multitude of participants.

There are also swaps. These are rates which are applied when financial actors are borrowing money for a longer term and they are fixed for the whole duration. They are also “true” values determined by equilibria of offer and demand in a free market.

Now, the first question: what is the relationship between longer term swaps and the currently predicted evolution of SARON over this term? I can imagine following scenarios:

- There is NO built-in premium in longer term swaps.

The value of swap rate is determined solely from the predicted evolution of SARON. The exact procedure (should be something involving taking roots of compounded SARON over this term), is not important. What is important that in this scenario, if the prediction is correct, the total interest paid “step-by-step” in SARON rates will be equal to the total interest paid as a swap rate.

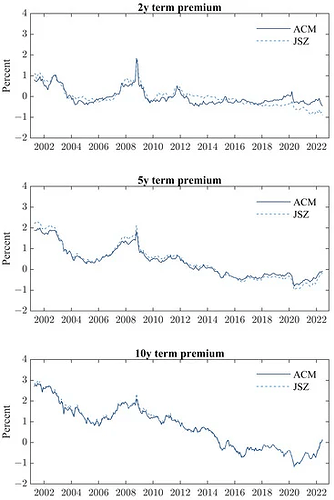

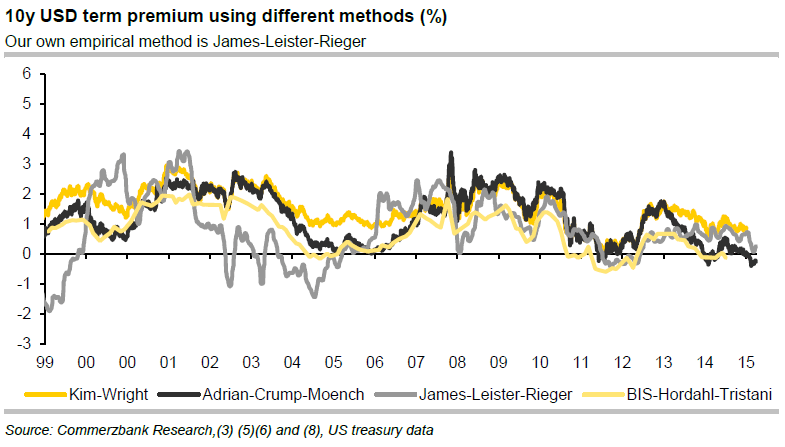

- There is a built-in premium in longer term swaps.

In this scenario, the lenders hedge their risk in variability of future returns AND the borrowers accept it. If the prediction of future SARON rates is correct, the total interest paid “step-by-step” in SARON rates will be lower than the total interest paid as a swap rate.

- Thinking about it again, I can even imaging a scenario with a built-in discount in longer term swaps: if the prediction of future SARON rates is correct, the total interest paid “step-by-step” in SARON rates will be higher than the total interest paid as a swap rate.

Now the question is: which one of this scenario is valid? I tend to think that due to the symmetry of the market (lots of participants want to lend and lots want to borrow), the symmetry of risk for both sides (either side might overpay or underearn) and market efficiency the scenario with no premium should be the real one. But I lack the knowledge at this part and hope that someone with a professional knowledge can clarify this question.

Many thanks for reading.

PI

P.S. I see now that @logitacher and @0xLambda had a similar discussion, but I don’t think that my question was answered.