There is a recent post from another forum member which exactly describes this issue - on a renewable SARON contract, short renewals each time, at one point the bank increased the margin unilaterally.

Since it was not locked in there was no recourse against it.

Yes, I saw that and found it strange as if the margin was good enough why change it. Maybe there really is a good reason due to regulations but maybe it is just a profit grab.

Either way, it’s not very customer friendly.

Those proposals look great from what I can see on the web (I am also preparing my mortgage renewal)…

May I ask with which bank / Organism ?

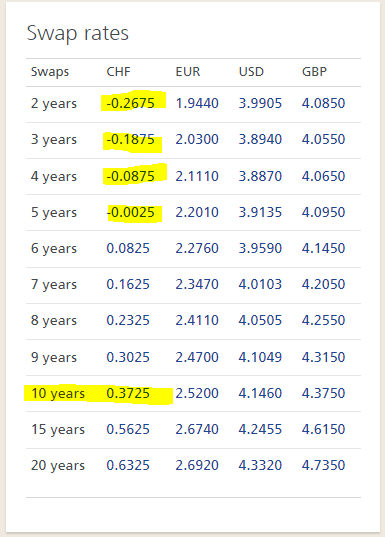

i would go for SARON if you want short term, or for 10 @ 1.31 if you want long term

Blocked my tranche with 7years @ 1.6%-0.35%(discount)=1.25% with a Cantonal Bank

With the recent news of the federal court blocking tariffs, the yield of CH obligations is shooting up today (+50% for the 10y), and I am afraid it will stay up or keep going up. Even if there are indications that it should go down in the next months I didn’t want to risk it, as 1.25% is ok for us (only 0.1% more expensive that what we currently got). And I followed the saying “pigs get fed, hogs gets slaughtered”.

Fixed my 2nd tranche at 0.15% for 3 years on Tuesday (these are employee rates of a financial institution - not available to the general public).

Current situation:

- 430k at 0.8% until 10/2029

- 570k at 0.15% until 05/2028

sums up to CHF 358 / month for a 1M mortgage. This should be illegal ![]()

I don‘t think so. 0.00% in June and -0.25% in September would be my guess.

How much discount did you have on your interest rate? i‘m also working for a financial institution but i only have 0.5% discount. How did you manage to get 0.15%? ![]()

We pay +0.1% over the banks internal refinance rate for fixed mortgages and 0.2% margin for Saron mortgages. There‘s several limitations around it but overall a great employee perk.

Basically free money!

I’m starting to wonder whether it would be more profitable for me to get a job as a UBS cashier when my mortgage is up for renewal: I get a cheap mortgage and a nice pension fund!

If you get a job at UBS -: higher 2nd pillar return, lower mortgage rates

All problems solved . This should be part of everyone’s FIRE program ![]()

But you’re also required to do all your banking and investing with UBS as well no? High fees, high fees everywhere…

I am pretty sure the fees is nothing compared to benefits.

Investing with UBS might add few basis points to the custody fees but the benefits on Pension fund & mortgage deductions can be a lot of money.

Well, overall the benefits are higher.

Instead of buying ETFs on monthly basis one can purchase these less frequently (e.g. quarterly), for example.

Some offer I saw today for a very good application (not a bank employee) 1.13 for 10 years / 0.6% margin on Saron.

The low margin is only applicable as long as you are an employee and most banks have some policy in place that after a while of leaving the company (can be months or can be years) you revert back to your normal customer margin for the remaining duration of the fixed mortgage or from then on with SARON mortgages.

When you retire, you keep the employer special conditions (free accounts, low margin on mortgages) for the rest of your life. So make sure you work there before retiring ![]()

Sadly, I expect this is only for normal retirement and not FIRE sort of retirement ![]() otherwise, I’ll send you my details for a referral

otherwise, I’ll send you my details for a referral ![]()

As I understand it, an idea would be to keep a low % activity in a non-stressful job. Kind of barrista FIRE. Make sure you reach the threshold for Pillar 2 elegibility.