Hi everyone,

I have the impression that this topic has not been widely discussed but still very interesting for anyone who would like to buy a house or apartment. I am in that case at least.

I find myself in this situation:

- With my wife, we will buy an apartment which costs approx. 770’000.- CHF.

- We looked mostly at banks but also at 2 insurance companies.

- 1 Insurance company offers lower interest rates but requires a 3rd pilar.

- Based on many researches in this forum, such 3rd pilar products are not recommended. Lack of transparency, performance, etc.

- BUT… would you change your mind if the interests are lower? That is the question I need to find an answer to. Maybe you can help

I got the following offers from 3 companies (the top 3, I contacted others as well):

- Caisse de Pension de la Poste / Pensionskasse Post

- UBS

- Vaudoise Assurance/Versicherung (VD)

I requested the same offer with 2 mortgage slices (‘tranche’ in french):

- 2/3 with a fix rate, 10 years

- 1/3 with a fix rate, 5 year

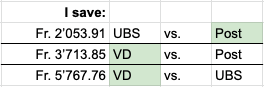

Here is the comparison:

- UBS: 10 years = 0.93% / 5 years = 0.81%

- Vaudoise: 10 years = 0.78% / 5 years = 0.52%

- Poste: 10 years = 0.89% / 5 years = 0.66%

Within the first 5 years, I could save the following amounts if I prefer 1 company over the others (assumption: I pay back my debt every month, direct instead of indirect payments):

The only problem I have with the offer from the Vaudoise Assurance is that they request an indirect payment via a 3rd pillar. The indirect payment is approx. CHF 6600.00.

Based on various offers I got from la Vaudoise as well as other insurance companies, the following could be possible:

- Two 3rd pilar accounts (1 for my wife, 1 for me)

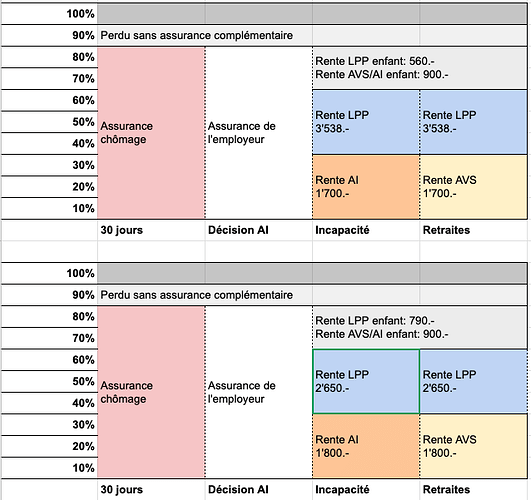

- Get insured in case of death, incapacity of work and exemption of paying the ‘prime d’assurance’

At this stage, I am 50/50. It does sound like a smart move. or is it not? With such 3rd pilar, that is what is offered (1 of many similar examples):

- Annual insurance premium: 3’480.-

- Saving (épargne): 3’150.- (40% stock market, 60% bonds)

- Insurance: 329.20.-

The coverage is the following:

- Capital (death): 117’000.-

- Incapacity annual annuity: 6’000.-

- Exemption of paying the ‘prime d’assurance’ in case of incapacity

If I retire as planned in 2055, that is what (= total) I will pay for this 3rd pilar (that’ll be the same for my wife, of course):

- Saving: 107’100.- (the company guarantees 55’071 which is nothing)

- Insurance: 11’192.- (this is generally less expensive than buying an life insurance without a 3rd pilar account)

Based on their estimation, the moderate case (performances between 2 and 4%) would generate a capital of 177’810.00.

If I would invest the 3’150.- myself and hope for a return of 3% on average, I could expect a capital of 182’500.00.

Based on these calculations, I do have the tendency to think that the insurance company is not the worst solution.

Do you have another opinions? I would love to hear them! Thanks.

Please note that I will also be a father which pushes me to think about protecting my family in case of problem (illness, accident)