Someone once shared a case on the forum which implied if you withdraw (for example) after 3 years and 1 day, the tax office could challenge if the substance of the voluntary contribution was truly retirement provision as opposed to gaming the tax system

If you can forecast a 4%+ return surely you can do 10%+ in the markets ![]()

My thinking as well.

No court ruling, but tax authority SZ has an item here (10). It says “Die Frist von 3 Jahren beginnt vom Tag des Einkaufs an zu laufen.” and refers to a public publications "Mitteilungen

über die berufliche Vorsorge des BSV Nr. 88, Ziff. 511, Frage 3

By the way: even with 4 years, buying in before amortizing easily beats amortizing now (assuming a high pre-tax interest of 2%) and even an (risky) investment with rather ambitious 7% return per year due to the 30% tax savings.

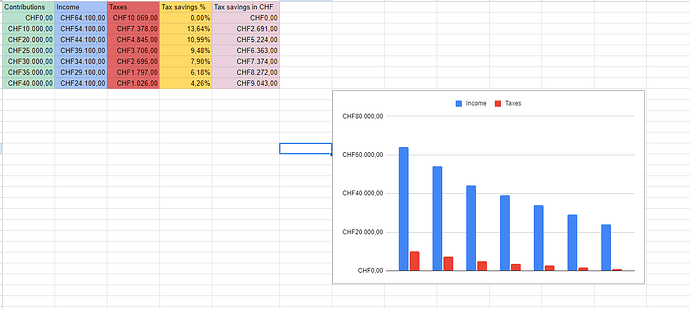

Just some quick and dirty calculation:

| 2023 | 2024 | 2025 | 2026 | 2027 | ||

|---|---|---|---|---|---|---|

| Buy-in | 1% | 100’000 | 101’000 | 102’010 | 103’030 | 104’060 |

| Withdraw and amortize | -5% | 97’879 | 98’857 | |||

| Amortize now | 2% | 70’000 | 71’400 | 72’828 | 74’285 | 75’770 |

| Invest | 7% | 70’000 | 74’900 | 80’143 | 85’753 | 91’756 |

Absolutely, it’s over the long term that ‘free funds’ might trump pillar 2 investments.

Sample calc:

70 * 1.07^15 = 193.132207850

vs

100 * 1.04^15 = 180.094350551

The pragmatic way of dealing with this boils down to doing low five digit purchases each year and more significant after-tax contributions, to get the best of both worlds.

Maybe you should look at: Art. 79b para. 3 BVG

The pension fund is the only way you can benefit from Stock gains that have already happened - thats the difference. You can’t retrospectively buy shares, but you can certainly based on Stock performance derive what your pension fund will do (over the full year) and then still increase your share of what they realized.

It is still applied pro-rata.

So if the running year’s been “good for the fund” and you decide to chip in mid/end October let’s say -

The theoretical 4% p.a. would become only ~0.66% on that extra money you added.

(or ~2% for your June purchase)

The pension funds I know fix the interest a year in advance

In my experience those presets have always been “preliminary” (and mostly equivalent to legal min. 1%).

Only at the end of the / start of next year the “actuals” got announced. ![]()

Ultimately don’t the pension fund trustees decide how much to credit to members’ accounts, vs. how much to increase reserves? Influenced by, but not directly depending upon, market return

You could conceivably get inside information from the trustees

Would you mind elaborating how exactly one (without insider informations) can forecast what rate the pension fund will give?

Thanks a lot for all the answers and discussions!

And @Daniel, thanks for this step-by-step guide:-)

Step 1: Calculate the potential tax savings

I did this already for 2022, but not in detail, before I invested 25’000 CHF in my second pillar last year.

So I think I will not get around to investing some of my time to know it exactly:-)

My gross income for 2023 should be 155’000 CHF in total, off my job plus renting out apartments.

Net income should be 64’100 CHF, with renovations to my apartment buildings already deducted.

By contributing 25’000 CHF to the second pillar, I should be able to lower the tax bill by 9.4%, or 6’363 CHF, as you can see on the list below.

Step 2: Calculate other potential savings that could result from a lower taxable income (health insurance premium reductions, scholarships, etc.)

I guess you can’t get premium reductions if you have such a high gross income? There is nothing else to deduct in my case.

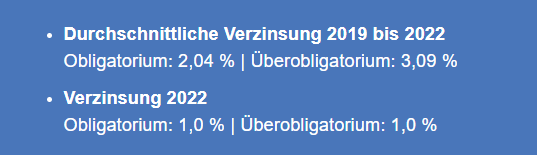

Step 3: Calculate the total interest you would earn from your pension on the voluntary contribution.

Why does it state this in my “Pensionskassenausweis” the last few years, and if I google the rate, I find documents for different % in the past?

![]()

I found the following rates on the official site:

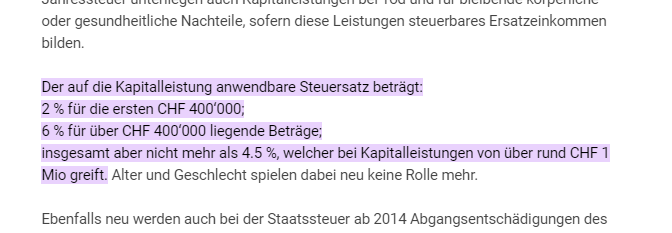

Step 4: Calculate the capital withdrawal tax you would pay when you withdraw the benefits to finance your home.

According to the official site of my canton:

So for 2023, it would be 2% of 25’000 CHF, so 500 CHF.

Step 5: Compare the potential savings plus interest (steps 1, 2, and 3) with the capital withdrawal tax to find the real return.

3 years: 1% of 25’000 CHF = 25’757 CHF = 757 CHF in interest

2% of 25’000 CHF = 500 CHF

Savings 2023 = 6’363CHF

That gives a total performance on my initial 25’000 CHF investment of (757 - 500 + 6’363 = 6620 / 3 = 2’207) 8.828% per year.

Step 6: Compare the real return with the potential returns you could get with other fixed-income investments (e.g. bonds, medium-term notes) outside of the pillar 2. If the real return achieved by contributing to your pension fund is higher than the potential return you could achieve with other fixed-income investments, than contributing to your pension fund makes more financial sense.

I think 8.828% is pretty much unbeatable, and this is with the minimum interest rate of 1%!

Even if you take an 8% growth per year as guaranteed while invested in a widely diversified ETF, I would end up with 6’493 CHF in interest compared to 6’620 in tax savings.

The numbers will change to worse if I add the last year’s payment of 25’000 CHF due to a wider time frame, but after all, it’s a very good rate I get for my money; even 5 % would be more than worth it considering the fact it’s almost guaranteed with a" Deckungsgrad" of 100.1%.

In conclusion of the facts above, I will contribute the following 2 years:-)

The main reason for this post was that I didn’t want to make any stupid mistakes and overlook some obvious disadvantages.

And next year’s contributions will have an even better return because I won’t be able to deduct any renovation costs from my tax bill.

Always depends on the case. 2021 was a clear case as we clearly passed the Corona recession and shares went up a lot; already mid Summer. Besides this, a few pension funds were extremely conservative with reserves during Corona and they sat on excessive reserves. Ultimately, longevity reduced. Hence, it was a combination of good asset returns, reserves and technical interest.

At the Moment, we have a comparable situation for CS staffers. I am not but if I was, I would now go all-in on the pension fund. Coverage ratio was already very high in Dec ‚22. in the meantime, the technical interest must have gone up. And even if it didn’t - 30% reserves and you lose 1/3 of your staff leads to 40% reserves. I wouldnt be surprised if the CS Pension Fund payd another 6-7% this year.

General rule: positive Investment year and loss of employees is - if the pension was already well funded - golden and can lead to a few years of very high interest rate.

This is an important point that many miss. You need to compare to comparable ‘safe’ investments. If you want to compare against equity, then you should add an equity risk premium to the hurdle rate.

Absolutely. It is absolutely pointless to compare fixed-income (guarateed return) with stocks (no guaranteed return). Obviously the assumption is that a pension fund is part of the fixed-income (bond) portion of the total portfolio, with there being a separate stock component.

I am curious to ask why would this be considered tax evasion?

The rule is that if you contribute voluntarily then money is locked in for 3 years. If you withdraw after 3 years then what is the issue? I am bit confused why would tax office make a law and then start judging people for using that exact provision of the law.

In this scenario, it seems that the OP already has a mortgage , so one can argue that this is manipulation of taxes. But let’s imagine someone doesn’t have any mortgage and they just contribute voluntarily to reduce the tax burden. And then after 3 years they decide to buy a house - why should this be a problem?

This part " 1. I will save about 30% of my taxes due to the contributions." is not possible, because refunds can’'t be deducted from income tax.

You will need to refund all the money before doing buyback.

Because OP explicitly plans this as tax evasion (as you seem to recognize yourself).

Completely different scenario, perfectly legal.

It wouldn’t. There’s a big difference between tax evasion and tax avoidance.