Both will generate a non taxable capital gain at redemption

I see this argument many times since inflation is a bit higher, I’m not sure what the point is. Fixed income/bonds will be better than cash, have low volatility and helps with wealth preservation.

Yes it should often be part of a diversified portfolio (as it will dampen the volatility of riskier asset classes). Why always bring that up? To induce fomo?

On ictax I cannot find the first bond Btp Tf 0% Dc24 Eur IT0005474330

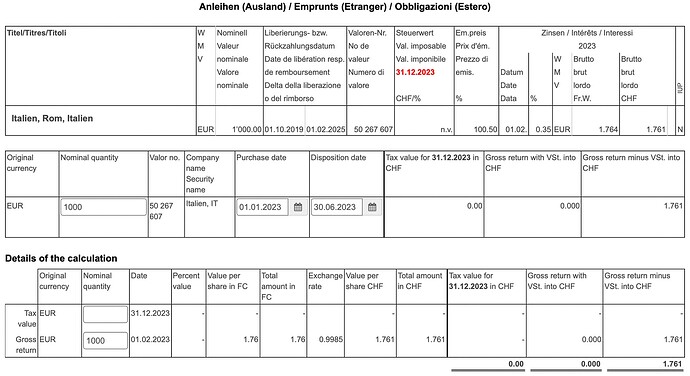

while the second Btp Tf 0,35% Fb25 Eur IT0005386245 gives this result (that I don’t know very well how to interpret)

@Cortana @Guillaume_GVA thank you very much for your confirmation

Could you please signal me if there’s any official document (preferably in English) where that is stated?

Thanks a lot

The taxation of bonds is described in the SFTA circular n° 15. Only available in our official languages.

Here’s your reason:

This new user tried to create multiple posts with links to the same domain

I managed with some US treasury notes that were issued during covid times (~0% rates).

For example the 3-year US91282CCC38 with a coupon of 0.25% issued in May 2021 and maturing May 2024 (around when 2023 taxes are due ![]() )

)

So if you bought 1 year ago it would converge to par (~5% return) with coupon of just 0.25%. So roughly on 5.25% return you paid marginal tax on just 0.25%.

At fun Geneva 50% marginal that’s 0.125% tax on 5.25% return.

I think this is due to nature of TIPS. Otherwise the rule is that >50% of the total returns of a bond (from time of issuance to redemption) needs to come from discount for IUP rule to apply.

Thanks for sharing. Interest information for Inflation linked bonds.

I’ve been researching the SGOV ETF, which focuses on short-term (0-3 month) Treasury bonds and currently offers a yield of over 5% annually. Observing its performance graph, it appears the price resets monthly after the dividend payout.

Given that dividends are taxed in Switzerland, I was wondering about the feasibility of the following approach:

- Buy SGOV on the 1st of the month (or shortly after the dividend payout when the price resets).

- Sell it before the end of the month, just before the next dividend payout, to avoid the Swiss dividend tax.

This would involve manually buying and selling each month, but if done through a platform like IBKR or another low-cost international broker, transaction fees should be minimal.

Does this logic hold up? Are there potential downsides or factors I might be overlooking? I understand this requires consistent effort, but purely from a tax-efficiency perspective, it seems like it might work.

Curious to hear your thoughts!

Well, it’s a straightforward tax avoidance.

That’s like the textbook case of what they won’t like ![]()

Or buy BOXX which has a similar exposure without the need to mess around.

Reminds me of this textbook case ![]()

Thanks! BOXX seems to handle the task without extra hassle of monthly buying/selling. I wonder why more people don’t use it. Earning 5% net “after income tax” on my USD personal cash reserves sounds good to me!

There’s also CAOS which is mostly BOXX + tail risk hedging.

Because this is exactly the kind of thing that breaks first when things get broken.

Can’t say I really understand those products, but that was my gut feeling, as well. And high fees, in addition.

What are alternatives to park USD for a short period of time, when the focus is highest safety and liquidity, then returns, not taxes.

The big money market funds aren’t available. IB offers some 4% on USD, currently, and their deposit swap programs provides some additional deposit insurance, if I understand it correctly. Treasuries?

Wasn’t there a thread on options? I remember reading some discussions, like the ones on CHF, but couldn’t find it.

The OCC is there to keep it together. It would need to fail essentially. And when that would fail, we have other problems to worry about.

It just does boxspread trades. Nothing crazy.

During exceptional market distress I could see some funky graph movements for a while, but nothing more. It holds SPX options afterall.

It also already holds over 4 billlion in assets, so quite a few people are using it.

The fees pay for themselves. Fees don’t matter for such a product when the return is straightforward and stable + tax-free. You can directly estimate if the fee is worth it compared to a t-bill etf. Looking at a comparison with SGOV, it returned roughly 0.1% less, but the tax free-ness gives you a return advantage of 1.15%! at 5% and 25% marginal tax-rate.

Only for anything above 10K, so 10K sit around and do nothing

Maybe I’m too conservative. When googling online searching box spread the search results just don’t spark joy. What’s the next best, even less crazy thing?

I (asking for a friend) was thinking of a bit more than 10k ![]()