If you are in the non-profitable case, expect to sell at a discount…

That’s “OK”. Current value is a bit below ~1m. It needs to drop more than 30% to be in loss and if this happen, I can move back and become once again main main residence.

So let’s say you have a fixed rent in your contract for 3 years. Now if next year the index rate goes down and your tenant asks to reduce the rent due to the lower index rate, would the contract still be valid and he would not be allowed to reduce it? I’d assume that he would get a lower rent if he brings it to court.

Yes, the rent will go down as the index rate does it. The only obligation is that he needs to stay for X years.

Hi there

Can China take down the entire RE market?

Thought this could be of interest. However I do not think it is a sustainable trend. A lot of flats are built in the peripheric areas where noone really wants to live

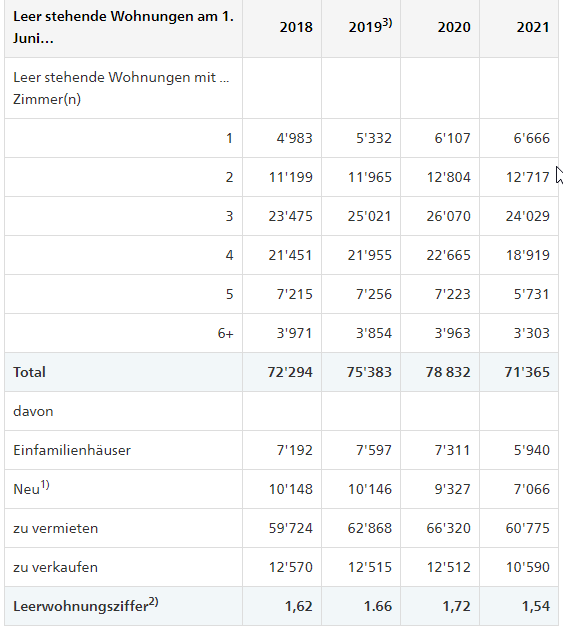

You always have to check where the news are coming from. In this case ZKB, who of course also want to give more mortgages. It’s funny that in almost every article about empty flat, Huttwil is mentioned. Yes, they tweaked the statistics by just removing flats which couldn’t be rented in the last 3 years. Still, if you check the official statistics from BfS, the picture looks slightly different:

You can find a map on that page. Even more interesting are the Excel sheets. Turns out that empty flats in new buildings are a problem is some cities (percentage wise, not so much though):

- 365 in St. Gallen

- 272 in Martigny

- 257 in Sierre

- 228 in Bellinzona

- 166 in Lugano

- 123 in Küsnacht (ZH) - nobody wants to live next to Tina Turner?

- 115 in Romanshorn

She doesn’t live there since a long time. 123 seems like a lot until you consider that it’s only 2.84%, and an outlier in the whole Zürisee area. There could be many factors contributing, not only weak demand.

When you look at the whole country, it’s only 1.54%. And there are only 5’940 empty houses in the whole country.

Off-topic, but are you sure? Latest information I found was that the landlord of her Villa Algonquin changed, but she is still renting it (from June 2020).

Back to topic: yes, 1.54% is not a lot. Not sure if I trust those numbers though. Both in Zurich and Basel I’ve seen several houses which were not rented and run-down (most probably some inheritance conflicts). Of course, this is just my personal bias.

How are empty houses / flat used for b&b accounted?as empty I guess. So I wonder if all these houses are as well truly on the market as well. Like my parents inherited the apartment on the floor above them and will use it for air b&b…so it’s empty, but not for sale.

They only include properties which are on the market for sale or for long term rent (>3 months). It’s written directly in the main page of the link posted above…

So he says: “Renting is better than buying, but I bought a house which works for me and who cares about everything else I said before”

Pretty much, yes. The important point was that buying is often not a financially driven decision but more a question of convenience and life situation.

Please rewatch the last part. He bought something in the woods because no rentals were available there.

@lorenzogm haha I wanted to write the same.

A few problems that I have with this video. First, he says that the expected return of index funds is 4.28%. Will it really be that low? What happened to 7%?

Then he uses this number, and the depreciation, to arrive at 5% total cost. But this total cost assumes no mortgage, I guess? Mortgage changes the equation, as you require much less equity.

And yeah, he sprints through the numbers. I’d like he showed a table with calculations, so that I can pause and analyse it.

I spoke with a few people with mortgage, and they say that they’re happy with buying. They would not be able to rent a similar place: it’s either not available or too expensive. Plus, covid made big houses/flats more expensive, so they made nice gain on realty valuation.

The reasoning that he gives for buying a place close to nature, because he has home office, also applies to me. I also wanted to do this. But in my case I have to think about my gf, and the buy price is just too high, even in a remote area.

He is talking about real return.

I think you should all rewatch the video as it seems you missed half of it. He also talked about being leveraged with a mortgage.

1% maintenance

1% property tax

3% difference in real return to stocks

If you have a mortgage, then you have to add interest. Which still leaves you with 5% total costs.

Yes and it changes what? The average USD return of S&P 500 over the last 50 years would be something like 10% nominally or 7% adjusted for inflation. Yet he says they expect 4% in the future. The same applies to Swiss stocks. Long term CHF return was around 7% with near-zero inflation.

You could stop telling people to rewatch. I heard what he said. He was saying that rent is better, but then he ended up buying because of special circumstances. Doesn’t this apply to many people? I think you can’t just look at the average. The point is, each case is different and there are many variables at play. Being able to use your pension money as collateral changes the equation a lot. Also, current availability of cheap loans may not last. If we’re to expect inflation, it would be smart to short currency => take mortgage.

But you need much less capital. So you can minimise alternative cost vs stocks and replace it with 1% mortgage interest. Which brings costs down to 3%.

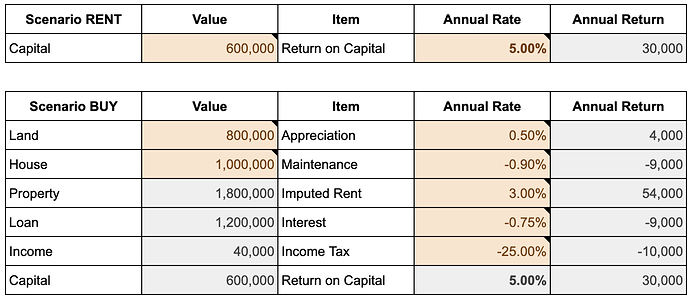

@Cortana you can go ahead and question any numbers in my calculation. I assume 5% stock return and even then it’s a wash. Once you’re able to get more than 5% annual return from capital, does the renting scenario win. And this 5% has to be achieved including whatever money you have locked in the 2nd & 3rd pillar.