Is there any reason why rebalancing applies to directly buying stocks? It was mentioned several times by many people in the discussion. With a cap weighted method there is no rebalancing needed. Or does it mean you plan to use equal weights or a different weighting method?

There are

- components which are coming and going.

- free float that can change from time to time

But these concern only few components and are rather rare events. What will hit you most is reinvesting of dividends and investment of new cash, because then you have to do hundreds of small transactions.

Ok so you are a portfolio manager as your main job - so that means that you are a huge exception. Most folks aren’t and should thus at best buy some equal weight / market weight global etf etc.

On the point with salary cap: yes mgmt is usually the way to go. Study on the side to be ready for such a big challenge or start to mentor interns etc. Work life balance can be achieved in mgmt if you are principled and have a strong will.

If you are still 100% sure that you have hit a dead end on the career development / salary side then you are also a big exception there too.

I don’t think he’s a portfolio manager, otherwise he would not talk about salary cap.

I also think that for portfolio managers it’s most of the time the best to buy an ETF replicating an index as well. First, you don’t have any special insights as a portfolio manager, or you are not allowed to act on it. Second, portfolio managers often don’t have time to do research in their free time or they don’t want to spend it on this. Third, I’d say more than 95% are not able to consistently beat the market. They are not able to do it in their job, why would they be able to do it in their free time.

Did you think about the possibility that some people just don’t want to do mgmt positions? There are also lots of people who are not made for mgmt positions, they could study all their life and would still be pretty bad at mgmt.

I started a lower mgmt position around 9 months ago and studying, reading and internal leadership courses were absolutely useless in my opinion. The only useful thing was to meet and exchange with other leaders.

Well knowing certain frameworks of mgmt and some best practices is pretty much what a typical MBA is about. Some folks are hesitant to enter that domain if they don’t feel properly prepared / trained. That being said, I agree nothing beats real life experience.

Just to be clear, I did not intend to say that you don’t have the skill for a mgmt position, this was just a general remark ![]()

Sorry misread that paragraph about your role.

Ok you are so truly convinced that you can’t improve your salary without compromising your work style / preference.

Let’s hope everyone else has done a similar deep introspective before they sort their priorities in terms of direct/ non- indexing vs incremental saving the way you do.

Come on! As it was said here, some people watch football in their free time, some people optimize their stocks portfolio to save 0.01% of TER. It’s a hobby!

I always try to split my position between multiple providers whenever possible. (For example for S&P 500 I buy both VOO and IVV instead of picking one).

With the advent of low cost passive ETFs, we no longer need to pay 1%+ on holdings.

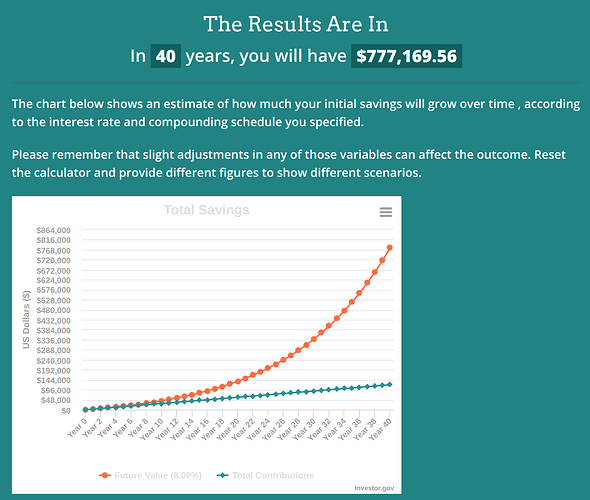

But some ETFs still charge, say, 0.3%. While quite low, on a $1MM portfolio that still adds up to $120k over 40 years and that’s before loss due to compounding.

For the buy and hold investor, would it make sense to just buy the underlying (or say top 100 holdings of the underlying) and save the ETF costs?

EDIT: I put the numbers into a calculator and it gave the loss over 40 years as:

(assumptions $1000k portfolio. 8% return. 0.3% expense)

I guess there are some arguments against:

-

Hassle of dealing with a lot of companies. One way around this is to take just the Top 100 in the index (if more than 100). This usually accounts for a huge portion of the value.

-

Difficulty and cost of re-balancing. You can deal with this easily by simply not re-balancing at all and saving on those expenses too. Or using the IBKR re-balancing feature to easily do the re-balacing. You could do this, say, once per year. Combined with #1, this would also be much cheaper than the ETF.

-

Hassle of re-investing. I’m anyway re-investing each month my dividends and interest, so this is no incremental hassle. In retirement, you can just let this flow to cash and use it to pay your expenses.

-

Hassle filling in your tax return. The initial loading of 100 positions is for sure a pain, but if all values and dividends are automatically pulled in future, then the maintenance isn’t too bad or at least not paying $20k per year bad.

- Withholding tax on dividends.

Have you ever tried reclaiming tax withheld from countries like Germany or France?

No. Have you? If so, what was the process and what did you find difficult about it?

I saw a news alert that it is now all digital: Germany and Switzerland welcome the digital filing of tax reclaims from 1 December 2023 | Deloitte Luxembourg | Tax | News

It was for the specific ETFs I was looking at. I agree the super cheap ones that are 0.03% you lose only $77k on $1MM.

why do you think that?

See: Newbie question on German individual stock dividends, IBKR - #13 by wolle

Besides the paperwork this also involves a 30 EUR fee to IBKR (per stock or dividend payment, not sure). I never went any further than this, as I do not have that big DE positions.

I, however, went through the process several times in Denmark, the required documentation is less, you just need a stamp from the Swiss Steueramt that you are a tax resident of Switzerland and statements from the broker.

But the process takes forever, still waiting to get my submission from July 2022 processed…

I guess that makes sense. There are always new companies created and old ones disappear.

So you could do the re-balancing, say, annually via the IBKR re-balance feature.

Worse case you have 100 sales and 100 purchases. With a bit of hysteresis, you could likely keep re-balancing transactions to a minimum.

Yes, I started out with that concept and stopped (after 11 positions). To much brain space, decision making and too far from a real index as long as you’re not rich yet.

I anyway have over 50 individual stock positions and average over 50 trades per month, so moving to 100 positions with annual re-balancing would be a significant simplification for me ![]()

I have never done it - after having looked at it.

That said, I admit I wasn’t aware of new rules from 2023 - will take a look into it.

It still sounds like a bit of a pain for small positions though - and is for multiple countries.