Just as with any foreign broker I know, I regard the „tax“ documents provided as mostly pointless - if not even dangerous. These documents are simply not made or intendend for Swiss tax purposes, and might be misleading, or, in worst case, let you make wrong statements to tax authorities.

FX Income worksheet looks like a gigantic mess.

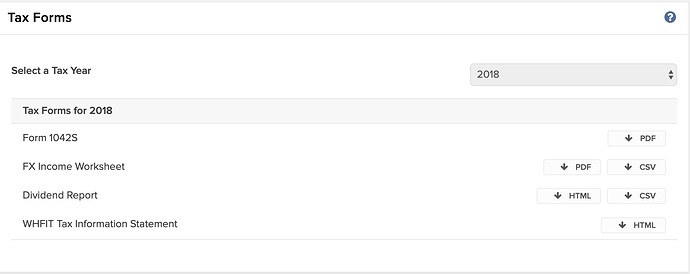

Firstly is not meant to act as proof or „detail“ of your VT trades, but is intended as a summary of your FX transactions for US tax purposes, as explained by IBKR on their website:

„The Forex Income Worksheet is an annual worksheet that provides income and loss information from your completed currency transactions for the year“

Secondly, in it‘s second to last column, it explicitly states and sums so-called „Income“ from currency transactions. In the best case, the tax authorities will ignore it - in the worst case, somebody might be prompted to ask questions as to whether that „income“ was declared and where. Even though, to the best of my knowledge, the occasional exchange of currency for non-speculation/professional trading purposes would not be subject to Swiss tax, but simply disregard.

Thirdly, in my case, it would not even list my VT fund transactions, as these would be in USD - which I have chosen as the base currency for my account. And he FX Income sheet is, as I understand it, not intended to list them - but rather only transactions in non-default currency:

„The Worksheet lists income and loss from nonfunctional currency transactions, including forex trades, trades in securities denominated in a nonfunctional currency, debit and credit interest and other nonfunctional currency transactions.“

I would generate and download a „Trade Confirmation“ statement in client portal: Menu → Reports → Statements

Then choose:

Statement type: Default Statements

Default Statement Type: Trade Confirmation

Period: Custom Date Range

Adjust for you desired period (up to a 365 days), select „Format“ (PDF that you can print out?) and optionally language (possibly French instead of English for you?)

Looks really clean and to the point. If you wish to experiment further, you can even create your own custom statement format - pretty nifty stuff they‘re providing there, I have to say.

A shame these are not customised to your domicile.

A shame these are not customised to your domicile.