BND is on ICTax so you don’t have to worry much. Right?

From what I remember BND usually has wrong reporting on ictax, but it’s in your favor.

(Distributions should be split between qualified and not qualified and iirc they weren’t in the past)

Thanks. now I’m more confused. ![]()

I never received an answer in the support ticket, so I attached the same statement multiple times.

Hi everyone,

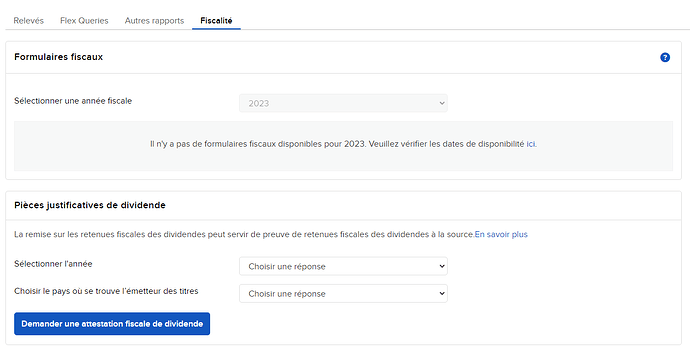

Just to ask you if, in your humble opinion, it’s normal to not have anything here ?

Tax declaration is just something that makes me scared everytime…

Just have a VT line on my account with automatic reinvesting dividends.

Thanks.

Sorry, I was reshuffling a bit.

See above.

Hello,

I ask myself about tax declaration and IBKR…

Just gone to my IBKR to check my account statement, and as far as I can see : nothing…

Just one live with VT and automatic dividend reinvesting.

So nothing to declare ?

have you read this post ?

Your question (IBKR, tax report, tax return) was discussed extensively since 2020 at least. You’ll find all your answers here.

Yes, but not absolutely clear to me.

Report 2023 is missing or does it show there is nothing to declare in my VaudTax application ?

Hi everyone,

question: how shall I declare the cash available in the IB account and the respective interest?

Shall I add a bank account “InteractiveBrokers”? if so, I don’t have a physical IBAN tho.

how do you deal with it?

thanks

At least in ZHprivateTax you can enter the IBKR account number even though it’s not an IBAN. If an IBAN is required in the tax software you’re using, check what other types of entries are available. Maybe you can select a generic ‘Guthaben’ or ‘Übrige’, which doesn’t require an IBAN.

Don’t rely on the report (or the absence of report) from IBKR to prepare your tax declaration.

Obviously, if you own shares of VT or anything else on 31.12, these must be declared, as well as the corresponding revenues from dividends.

Use ictax.admin.ch as official source of data (end of year price and dividends), for example this link for VT.

I just downloaded my 2022 tax documents from IBKR: None of the 4 documents even list the positions held at the end of the year (that you need to declare in your Swiss tax return).

I’ve never used the “Tax Reports” provided by IBKR but always created my own (though they won’t taxable dividends in accumulating ETFs)…

Interactive Brokers primarily act on US market and primarily care about US customers. Which is understandable. So, the documents that IB is providing you are prepared according to US (and UK, seems to be) standards. They may be useful for you or may not. This is your task to prepare reports for the tax declaration, not IB’s.

The only document the tax office requires you to attach is dividend report for DA-1. No other document is needed (unless they ask you later).

That’s not true; they are actually more popular outside the U.S., where options are generally limited. Around 80% of their customer base is outside of the U.S., as are most of their new customers too. The real reason is that producing country-specific tax statements is an extremely complex task to get right, for which they probably have little appetite, as it comes with high risk, high costs, and limited impact. And their core strength is pricing, which is kind of the opposite of offering extra options and services. In some countries, it is, however, a legal obligation for locally-based brokers (France, for instance).

That being said, someone here initiated a ticket on IBKR to produce Swiss tax statements, and any customer can vote to push it to the top of the priority list. I did and I invite anyone who has not done so to do it as well. Hopefully, Switzerland is probably an important market for them (they have a branch in Zug).

Yes, let’s keep voting this one up!

Thanks for sharing. It’s kind of strange that they have added such a constraint.

I can only explain it with assumption that Zurich authorities are assuming that people with stock portfolios will have steuerauzug from their brokers and hence only one line item.

For my own return, I just prepared a tax statement myself using information in ICTax and IB and added it as steuerauzug (manual). Hence only one row for full IBKR ETF portfolio.

We can exchange notes once our returns are finalized. It would be useful to know for next year

can you post again the link here? Maybe we should ask _MP to send the link in a newsletter or something like that. I didn’t upvote it as well ![]()

The feature request is here

It is still leading. 12 more and we are at 100.