No change (except… my base currency and report will be in CHF this time).

But haven’t heard back from the tax office, since I’ve been quite late with me declaration.

I guess bond interest because you have bonds? I removed that from your custom report but kept the rest the same. Thank you btw. The annual activity report had too much details.

I did as @kilyn for 2019 in VD, simply declared what had to be declared and did not send any detail from IBKR. The tax office did not ask for any documents.

I noticed that the base currency report will use the fx rate at the dividend date for each dividend. I wonder if this is the “correct” way to do it.

I might have had. No harm to include it, if it’s zero, isn’t it?

Most probably not.

I believe strictly speaking I should use the federal tax administration’s reference rate (available on ICTax). Since IBKR doesn’t provide that or take that rate into account, I’d have to calculate and “adjust” the IBKR report for EVERY. SINGLE. DIVIDEND. PAYMENT.

Yeah… not going to bother about that (unless they make me)! ![]()

And neither are the tax office people. I assume the difference between IBKR’s forex rates and their reference rates will be negligible anyways.

For reference, I just recently got an approved amount of ca. 177 chf (in Basel, for 2019).

No sign of the “complete” report yet though…

Hello

I invest in ETFs and individual stocks. I started investing last year. I wish to continue investing only via ETFs and stop investing in individual stocks to facilitate my tax return.

I have currently invested in 7 individual US stocks (2’400 CHF invested) with a current gain of 100 CHF. Is it fiscally risky to sell all my individual shares today and not declare the dividends of these shares in my tax return?

Thank you for your help

Why would you willingly omit income? Why is it worth the risk? Just sell and report the (I imagine super small) dividend you received.

I forgot to specify that I have had the shares for less than 6 months, I don’t want to be considered a professional investor. I read MP’s tax guide, is the individual equity tax return different from the ETF return? I like the investment in value. I’m just wondering about the tax return, whether it’s more complicated or not.

You’re worrying too much, they won’t care ![]() (e.g. I never hold my company stock for 6 months, and I rebalance once in a while that can mean selling stock I bought earlier in the year).

(e.g. I never hold my company stock for 6 months, and I rebalance once in a while that can mean selling stock I bought earlier in the year).

Should be similar, check if the data is in ICTax since it likely makes things easier if it is.

They don’t control or is it authorised to buy and resell shares without having them for 6 months? There must be a limit, wich one?

Everything is authorized, you’re just outside of the safe harbour conditions, it doesn’t mean you suddenly become a “professional trader” for tax purpose, it just means it becomes possible (note that it’s not just at the whim of the tax office, you also have to actually look like you’re doing professional trading, your tiny investment won’t do it).

Even if you sell today, you owned them on 31.12.2020, so you have to declare your ownership & hence the dividend income in your tax declaration.

And forget about being declared a professional investor with a capital gain for the year 2020 of … Fr 100!

Sorry, but that’s ridiculously neurotic.

Are you sure 2300 is correct. Is it not 2400?

https://www.wegleitung.fin.be.ch/wegleitung_fin/de/index/np2020/np2020/berufskosten/berufskosten-nebenerwerb.html

„ Nebenerwerbseinkommens, mindestens CHF 800, jedoch höchstens CHF 2’400, geltend machen. “

There are a lot of posts about getting the professional investor status but does anyone actually know someone that got it ? ^^

I did some research on the literature available on that topic and I found that doc from PWC from 2019 : Important points

- In the last 5 years less than 100 people were classified as professional investors in the whole Zurich Kanton, i.e. less than 20 per year out of the 1 million people living there

- They point out that it is really difficult to be classified as such by the tax authority without your consent

- The investment strategy that will get you the closest to the status includes doing a large volume of transactions relying on leverage and derivatives with the only purpose of speculation and which lead you to massive profits in comparison to your usual income.

To finish they cite the example from the case law of a Trader from Aargau who claimed by himself the status to the tax authority to be able to lower his taxable income by means of the losses he accumulated from derivative trading in the range of 10s of thousands (not a small player then). This was refused to him as he did not earned anything from this activity.

You can draw your own conclusion from this but I guess nothing really justifies the number of posts on that topic given that the vast majority of people having trading accounts here are mostly trading ETFs. And even if you were to trade options once in a while I don t think that it would be enough to get the status unless you are pretty good and make a business out of this (i.e. better than most hedge funds managers)

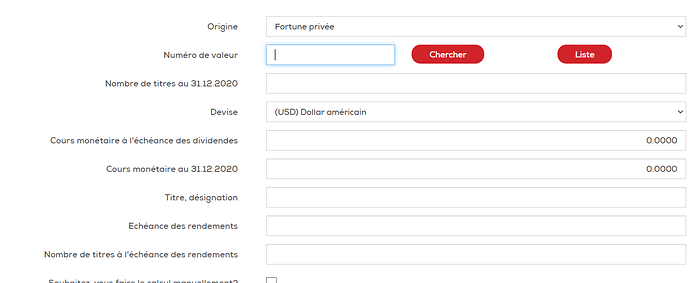

Please i need some help for my tax declaration. I’m not able to find out the “Numéro de Valeur” for individual stock like NIO. Does someone know how to fill it out?

Search by ISIN in ICTax?