Then enter the data manually?

It might be obvious, but have you removed the spaces?

In Neuchatel’s tax software when I put NIO’s valor as 43286578 it comes out correctly.

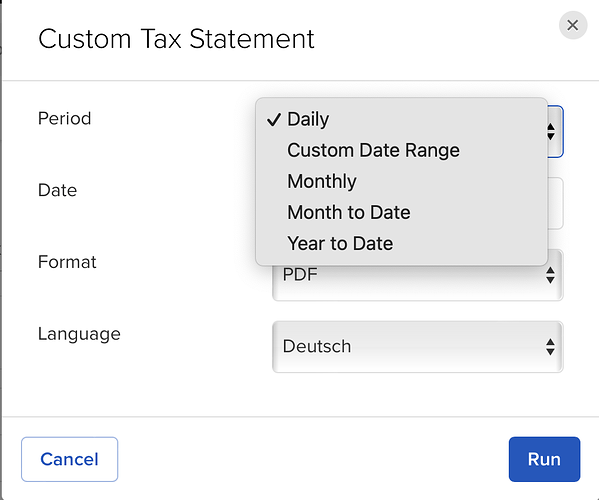

Hi while doing this it asks me whether i want daily or monthly statement under custom statement menu. It doesnt allow me to create custom data range. Do you know why? @San_Francisco

That’s not very intuitive, but that is only for the report template creation.

When you run the report generation, you’ll normally have the choice to use a custom date range.

I crated a custom report (years ago), showing all the funds I have, the dividends received, plus the interests. When I run it for 2021, I get all the expected sections in the report (amount of each funds, dividends, withholding taxes), but the interests section is missing. I tried several times, also from different browsers. Maybe it’ll work tomorrow.

When I am doing it, “Broker Interest Paid and Received” is a section separate from “Dividends”. You can also list separately negative and positive interest.

For taxes I was generating a report with sections

- Account Information

- Positions and Mark-to-Market Profit and Loss

- Combined Dividends

- Combined Interest

- Withholding Tax

- Forex Balances

for the whole year. I have switched my base currency to CHF to generate this report.

Hi, I’ve made a custom report with the values you listed for tax purposes in Canton Zurich. What ‘period’ value do you use to generate your report? E.g. December plus any months that you received dividends / monthly? Thanks for your clarification. ![]()

Custom Date Range —> 1.1.22 - 31.12.22

I‘m interested what sections you show to the tax authorities… they don‘t need all of them, do they?

Edit: whoops, should have read San Francisco‘s post regarding the sections ![]()

Yep - though I seem to remember that you may have to adjust the date range for non-trading days (such as New Year’s day).

Does anyone have a suggestion how to handle dividends from accumulating share class funds held at IB? (In acc share classes, dividends are reinvested in the fund and not distributed, but still taxable.)

My former UK based broker provided a statement which included such dividends.

In 2022 I moved my holdings of this fund to IB and I cannot find any similar statement. I sent a message to IB 10 days ago. Since then I read that the concept of accumulating shares does not exist in US. Knowing IB customer service I do not expect them to help.

I assume I will need to complete the breakdown by position and purchase date in the tax return software. Or alternatively provide some similar supporting calculation.

Good point about accumulating ETFs. I am sure I noted this once or twice but it may have been on another thread (possibly the one that this thread was split off from, see above).

If you don‘t report the individual items in the tax return, you‘d have to account for accumulated dividends/distributions in such funds manually. I‘m not aware of IBKR reporting them (though I may have seen distributions from capital gains reported - but these were actual distributions to fund shareholders).

As long as the fund is in ICTax, you simply enter the purchases and the dividends are calculated automatically. If the fund is not in ICTax, I’d suggest asking ESTV to add the fund as soon as possible to avoid problems.

Until now it was just handy to check the box in the tax return software “statement from broker” and enter the totals from the IB report.

I guess I now need to manually enter the positions and purchases for all my stocks and funds at IB.

Or alternatively I calculate it off-line for this fund using the ICtax webpage and attach it as support

Thanks @Voodoo and @San_Francisco. Yes, I see that 01.01.22, 02.01.22 & 31.12.2022 were non-trading days. So these cannot be included in the custom date range statement for 2022. So do you just submit it to the tax authorities without those dates and it would be fine?

What’s there to hide?

Of course.

If I had 20 items on my IBKR statement (including, possibly, multiple purchase transactions) and only one of them was an accumulating fund, I’d just attach a note…

“Depotauszug von Interactive Brokers U.K. weist zu versteuernden Ertrag für thesaurierenden Fonds nicht aus. Zusätzlich zu versteuernder Betrag: CHF xxx.xx (x Anteile IE00BK5BQT80 Vanguard FTSE Developed World UCITS ETF per 30.06.2022)”

…and include it in my tax return the most unambiguously looking way possible (remember, someone will be reviewing your tax return. And they’re probably neither a IBKR customer themselves nor able to read your mind. But may still wonder if and where you included it in some total or not. And they probably won’t be too motivated to make much of an effort to find out).

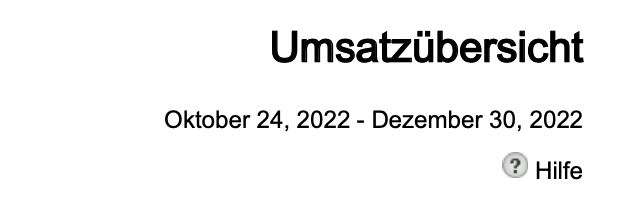

It’s a non-issue. If I choose a custom range of Jan 2, 2022 through Dec 30, 2022, the generated report will nevertheless be titled

Activity Statement January 1, 2022 - December 31, 2022

In other words: Jan 1 “activity” is automatically included in Jan 2, and similarly for Dec 31.

Which may be kind of weird from a UI perspective… but is convenient. ![]()

Strange… ![]() mine doesn’t do that. I actually just opened the account on 24.10.2022. So my exported statement shows… (german version)

mine doesn’t do that. I actually just opened the account on 24.10.2022. So my exported statement shows… (german version)

Nothing. But have you ever looked at the full report they provide? I wouldn’t want to be the guy reviewing that PDF at the tax office…

Additionally, complex things tend to promt questions, and avoiding them also helps me to save time