Can you show examples of report parts before and after the change?

This helped:

“You have to run a standard activity report, not a customized template, for a specific date, but not too early. Something like after the beginning of the next trading day in US.”

Thank you @Dr.PI !

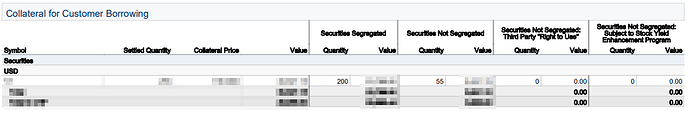

I needed to select the date when the trade took place because at that point, there were non-segregated securities alongside already segregated ones. This way, they are listed. If everything is fully segregated, then it will no longer be shown as segregated or unsegregated in the report.

A post was split to a new topic: Discrepancy between taxable values

Is there a way to adjust the basis for P&L calculations? I transferred some assets and they started at 0%, and I’d like to “transfer” the performance from the previous broker as well.

I think when you transfer positions they ask for cost basis. Didn’t you have to give that input ?

Give it a few days, the numbers will update automatically for transfered positions.

If they are actually transfered and not sold/bought

That‘s for transfers between IB accounts. Not sure if it also applies for transfers from outside IB to IB. But I would guess so as well.

Don’t know, I’ll have to check

It’s already been a few weeks, and I transferred from Swissquote, not internally within IBKR.

UPDATE: apparently it’s possible in their desktop apps:

https://www.ibkrguides.com/kb/the-average-price-shown-for-one-of-my-positions-is-incorrect.htm

I have a simple UBS investment portfolio in Switzerland with 3-4 ETFs each in USD, CHF, and EUR. For each of the 3 currencies, I have separate bank accounts, eg. USD dividends land automatically on the USD bank account, CHF dividends on the CHF bank account. I don’t exchange my currencies and want to keep it his way.

Is it possible to transfer my funds to Interactive Brokers without forcing a currency exchange? (50K USD UBS funds to USD IBKR, 50k CHF UBS to CHF IBKR, 50k EUR to EUR IBKR?

Yes.

Can confirm. You get a different IBAN for each currency. I deposited and withdraw in CHF, EUR and USD.

Not a personal IBAN and not a personal bank account for each currency, but different deposit methods.

I recently wanted to send USD directly (500$) with Yuh but apparently Yuh only allows transfers to IBAN and SEPA countries (which the US isnt).

How did you transfer it? Wise?

The USD depositing was while working abroad and I got bank accounts abroad for daily life and the local part of the salary. Recently, I’ve only withdrawn FX occasionally for online shopping or traveling.

If I remember correctly, they’d provided their US account for USD. I guess most CH banks will charge you a fee for such wire transactions, even when you have a USD account with them.

I once paid a hefty learning fee when messing up my account number, sending CHF to the UK, which got exchanged and then exchanged back to be returned. My mistake and lack of understanding the internaional banking systen, though. Had no issues with IB when correctly assigning the currency and recipient account, though ![]()

As Pi thankfully specified to the other question, these are their bank accounts used to send and receive, not your personal one to replace your house or online bank.

Not received anything.

50 GBP for a little survey sounds pretty sus tbh ![]()

Is currency exchange rate on the weekends worse than during weekdays? It’s a larger amount (around 35k). Should I wait until Monday?

Are you talking about IB? I don’t think there is any FX exchange possible during weekends, as you trade on / send orders to actual markets.

Anyway, it’s not a good idea to trade whatever derived instruments when the market for underlying is closed.

Yes. Wait till Monday and get the real rate

Yes I was talking about IB. I’ll wait until Monday then. Thanks!

So. I made a referral to a friend and then they opened an IBKR account. Account was opened towards end of 2021. During Aug 2021.

Beginning of Nov 2024 , the IBKR shares started appearing on their account. It says “vesting date = 4 Nov 2024”

However interestingly enough, these shares are not possible to be sold. What exactly is the reason? Do they need to hold them for 1-2 years before selling?

I am a bit confused about timeline. I was under impression that vesting date means shares are available for sales. Is it possible that shares are only available for sale after 4 years of opening the account?