In the “Portfolio” tab, on the right of the “Excess liquidity” amount. You have to expand the section.

I quote myself… maybe with a cash account you’ll see a very low amount (or even 0) but it will be much higher once you switch to margin

Yes, I see 0. I just wonder, if you have a margin account and start with 0, can you do it like this?

- buy 100 VT @ $102 for $10’200

- buy $10’200 USD for $9’987 CHF

- now you know how much CHF you need to send

Because my main problem was that some days there was stupid TSLA FUD spread in the news, which was a great buying opportunity, but I couldn’t buy, because I had to wait until the money arrived. Or I wanted to buy a round number of shares, but I didn’t know how much money to send so that it’s enough, but not too much.

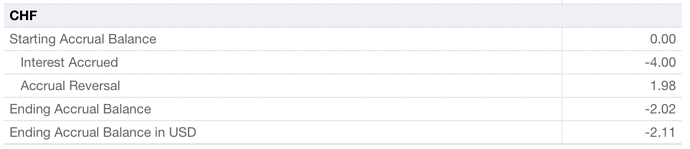

Regarding my interest charges, here’s an interesting piece of my activity statement from May:

As you can see, the accrued interest was 4 CHF, but only 1.98 was charged, and 2.02 was rolled over to the next month, for some reason. So hopefully there will be no extra charge in July.

Sure, margin account is perfect for that.

Although I am not sure how exactly can you buy the needed amount of USD. Nevertheless, if you have leftovers worth less than 5 USD in non-base currency, after some time it will be converted into the base currency for free.

I had a similar weird issue on Monday: I deposited some CHF to IB, immediately invested it, but still had to pay like CHF 7 negative interest for that one day (at incredible monthly interest rates for CHF!).

So I already had 6 CHF on IB and around USD 30. Still, IB charged me CHF 7, which left me with CHF -1. So IB auto-converted USD to CHF to cover my negative CHF account. I asked myself: Why not just charge me in USD?

Also, I find it kind of unfair that even ultra-short term CHF cash positions are charged with super-high negative interest, because how else are we supposed to deposit the money we earn in Switzerland?

You mean sell stocks? That’s not possible, I’m HODLing my VT ![]()

How much CHF did you transfer? Negative rates only apply above CHF 50’000 and negative interest of CHF 7 would be a huge amount at a rate of 1.06% p.a…

Yeah that’s definitely strange, it was less than 50k. The IB reporting is just too confusing, I’ll have another look at this.

UPDATE: So YTD I’ce been charged CHF 35 negative interest? How’s that even possible when I’ve invested all my deposits immediately? Is there any reasonable interest report available on IB? Like: What interest have I been charged at which rate fir which amount and duration? Aka transparent reporting…

Spoiler: I’m definitely not a billionnaire ![]()

Can you see the negative interest charged in your activity statement?

Yes, that’s where I got it from.

That sounds like something is wrong. I’d open a ticket.

Sounds like you have a negative position somewhere…

Thanks guys, it’s like losing blood from an internal wound you can’t find, I’ll make a ticket.

I’ve opened a second, margin account at IB a while ago. So my setup is:

- A cash account, which is my original account and which I use for all my activities.

- A margin account, which I don’t actively use, but which I have ready as a “giant credit card”, for the case I want to make use of an opportunity on very short notice. I have some non-dividend-paying stocks parked there to provide margin.

Yes, go to Transfer & Pay → Transfer Positions and then choose source and destination account, the share and the amount you want to transfer and that’s it.

Doesn’t splitting it up like that lead to diseconomies ? Meaning smaller borrowing potential and increased risk of margin call

In the Webportal on the top go to “Transfer & Pay” and choose “Transfer Positions”.

Now you should see three options “Incoming”, “Outgoing” and “Internal”, choose “Internal”. Afterwards it should be self-explanatory.

So, did you get an answer?

Those margin accounts are a bit frightening imho.

Yeah, apparently I missed the daily closing time for currency exchanges, so I lost one day. Then, apparently, IBKR takes one day to “validate” the currency exchange. And then, unfortunately, it was a Friday, so I got charged CHF interest for Saturday & Sunday on top of that. Equals 4 full days of interest for a large sum of CHF!

So be cautious with big foreign currency sums, even if you supposedly convert them immediately, as I did.

This still doesn’t make sense to me. You said it was below 50k and below CHF 50k IBKR doesn’t charge any negative interest.

For CHF 7 over 4 days, your CHF balance would have to be at least CHF 180k (50k no negative interest, 130k at -0.486% → CHF 631.80 per year → CHF 6.92 for 4 days)