Yes it is possible. Both stocks are quite volatile though, so you may want to make sure to have an adequate risk management and only a reasonable short exposure.

You cannot be serious! (Cit. John McEnroe)

This is the way!

Hello,

Could you please help me understand a small issue?

I’m wondering if it’s purely cosmetic, or if I should take action (to avoid paying interests).

I have a cash account and I use the web portal. The Swiss franc is my base currency.

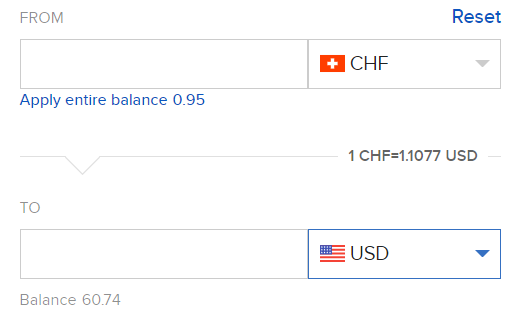

Each time I want to invest, I send my francs to IB, then I convert them to dollars using the “convert currency” one-step market order from the front page :

Then I buy one of the two dollar-denominated ETFs I have in my portfolio.

In recent times, that conversion did not work, meaning nothing would happen when I submit. It used to work smoothly before.

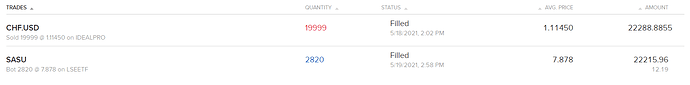

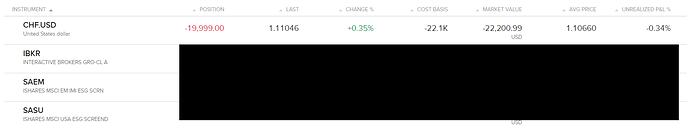

In the last two days, I wanted buy a tracker and needed dollars. I sold my Fr. 19’999 from the trading page of CHF.USD and bought the tracker:

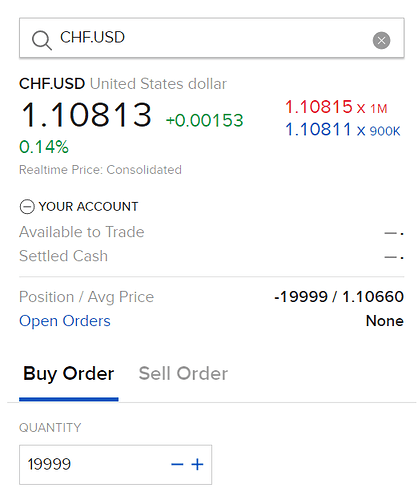

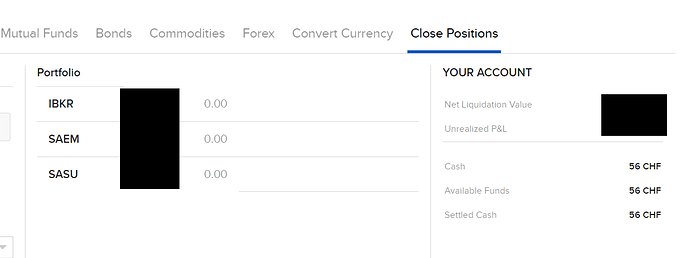

Now, I see that I have an open short position on the Fr.19’999 :

From CHF.USD trade page, I can’t close it – the system says I don’t have enough cash:

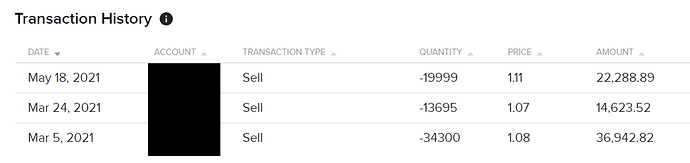

In the transaction history, it appears exactly as the previous currency conversions:

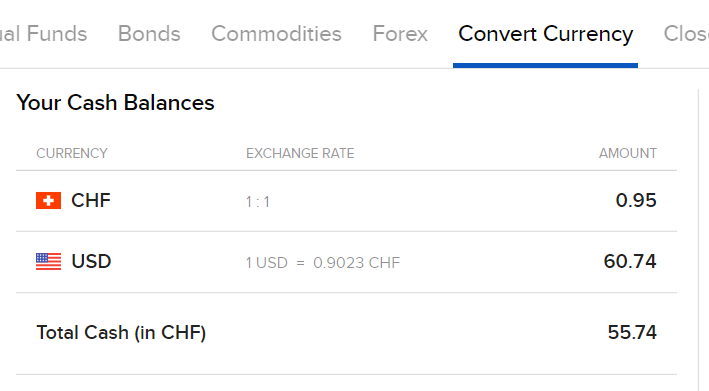

My cash balance seems normal :

And there is no forex position to close on the dedicated menu :

So now I have this open short position on top of my usual ETF positions. I’m wondering if it’s purely cosmetic, or if I should take action ?

Many thanks for your help

This is just a virtual position. You don’t have a negative CHF balance.

Thank you!

I’m happy that is not harmful, just ugly. Do you know how to get rid of it, by any chance?

The 3 dots on the right side → Show Virtual FX Positions

or try The 3 dots on the right side → Close non base currencies

Does anyone know if holding Ireland domiciled ETFs in a US broker make them liable for US estate tax? Or does the broker location does not matter at all (except for the cash portion).

Thanks!

Do your own research, but afaik it doesn’t matter what matters is the domicile of the investment.

Edit: that said it’s fairly rare to have an account at a US broker in any case, most brokers force you to close it once you move out. (for example IB or Schwab accounts for Swiss people are usually in UK)

Don’t think it is, to be honest. Many describe account opening on their website, some like Schwab are actively promoting account opening for non-residents. Others (Fidelity) at least mention limitation on your existing account upon leaving the U.S. I think it’s rather been U.K. brokers recently moving clients or forcing them out after Brexit, not so much U.S. brokers.

This is kind of anoying. below is the answer I got from IBKR.

Two questions:

- Does this mean they dont keep the shares in my name? isnt that kinda risky if IBKR goes bust?

- Is there really no way to register shares? I would say that is a huge disadvantage and I may switch to Swissquote…

Blockquote

As mentioned in our previous communication IBKR does not to offer to customer the registration of securities in their name with the exception if client wants to attend the AGM.

In respect to shares registration please refer to

LINK…/index.php

European Position Transfers:

Limitations:

IBKR will not provide individual registration of holdings. IBKR keeps all positions in the firm (“street name”)

As such, all client assets are hold in street name Interactive Brokers LLC.

In this regard we are unable to facilitate your request.

Regards,

Blockquote

Pretty much all big brokers and banks hold assests in street name. It’s just a technical thing anyway, you legally still have all the rights that come with the asset… even if the broker goes bust.

If the assets were really in your name, you pretty much couldn’t trade it anymore.

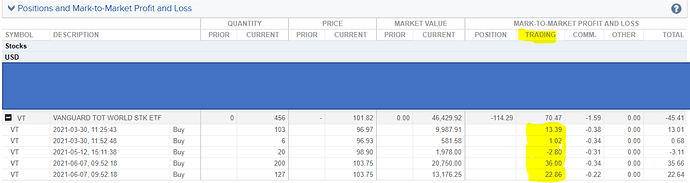

Could anyone explain me what does it mean this trading column in detail and with normal words?

Is it the value gained or lost since I invested in this asset my CHF?

I am a IBKR newbie trying to buy his first ETF.

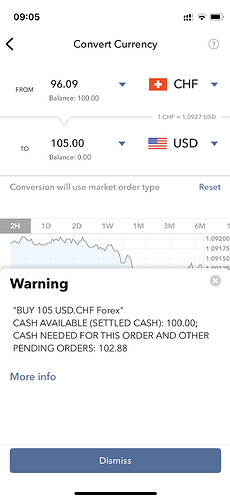

I transferred 100 CHF from my UBS account and I correctly got the full amount credited in IBKR.

Now I am trying to convert CHF to USD to buy a VT share but I get this warning.

Could someone please explain why I need 102.88 CHF to buy 105 USD?

Isn’t possible to trade my entire balance in CHF to USD?

Thanks.

You need to pay transaction fee in your base currency. In general best to keep some buffer for those fees.

I really do not get the urge of many forum members to have absolutely ZERO balance in their IB CHF account… I mean, we are talking about peanuts, what kind of opportunity cost can be in that ? I always keep 2-300 CHF (or other currency) in my accounts

I need help. I am trying to open an account and now it asks me for the number of Unterhaltsberechtigte? What ist that? My child? Or is it if you pay something if you are divorced? Or is it all people living here without me (husband and child?). Thank you.

Why not in english? I set everything in english to avoid bad translations and mix-up while I read advices on internet.

I have no idea. It just appeared in German and I haven’t seen a button to change.

Edit: I was able to change it to English. It is now number of dependents. So I assume it is the child as the husband earns his own money? But he is also responsible for the child. So she is only dependent on me for 50%? I think I still don’t understand the concept.