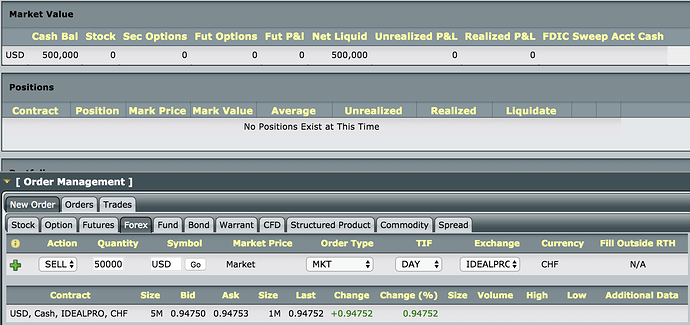

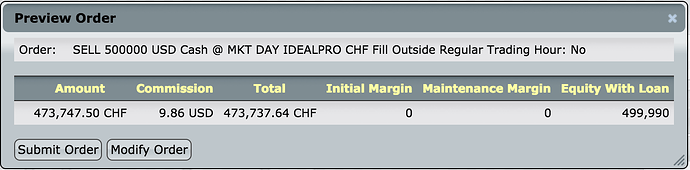

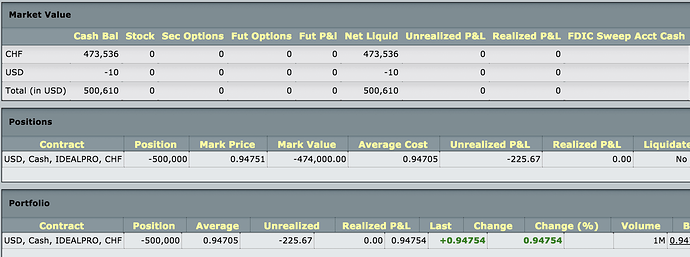

I tried to convert the currency using WebTrader Demo. There you start with 500’000 USD, so I sold 500’000 USD, getting back CHF (normally you do the opposite). However, this created a negative USD position. Does this position go away EOD or is it considered a loan? Why is my USD cash not visibile as a position at the beginning, only in market value? Is this why @_MP wrote we have to download the software?