Just because assets are uncorrelated, doesn’t mean that something will go up if something is going down. In fact, that would be negative correlation.

True, negative correlation is the unicorn.

Bonds have typically been used, but we’ve seen this relationship break down so you can’t rely just on that. I guess if you diversify into many different asset classes, it can help, but then you probably also suffer from reduced returns and still don’t get a perfect hedge.

So I think we have to start with abandoning the idea of ever getting a perfect inversely correlated asset, but just have enough that we can benefit from re-balancing.

I remember seeing results that it doesn’t even need much allocation to benefit from re-balancing.

You wouldn‘t even want that. That would have negative expected return, as the stock market goes up way more on average, than it goes down.

An actually it does exist: you just short the market.

The ideal asset would be something that has negative correlation during bear markets, and positive/uncorrelated returns during other environments. While having good positive expected returns itself.

CAOS kind of does that, but the return expectation outside of fast crashes is not that great. And during slow moving bears it will not do well.

That‘s when trend following generally does well.

CH Domicile at a CH Broker has a better Chance of surviving a fatal atack on IE. Clearly, if IE goes down, chances are that e.g. UK Assets held in a CH fund are gone as well (as UK assets were likely kept in the UK); but at least the US Assets should survive (as the CH fund directly holds them in the US). So long story short, its one single point of failure less.

Eu Broker (for e.g. IE ETF) does the reverse. Meaning that it increases the likelyhood of keeping the assets in case of a fatal attack on CH.

I understand, but find the likelihood of that level of global breakdown (among nominal or real allies, at least not declared enemies) approaching “we have bigger problems than our investments” scale.

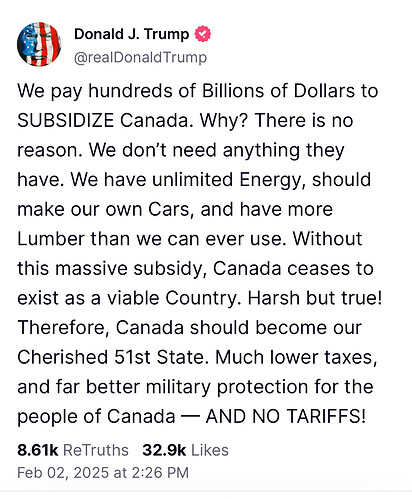

One would have thought we are already buying enough of their deficits (Treasuries). Tarriff hikes - wouldn’t it be primarily the US consumer funding those - of course saying foreigners pay them is decisively more popular.

Comments from US presidents are becoming very dangerous now . I think we are not in negotiations phase anymore. It seems like an war (just not a war involving military)… half of things said by US govt is not even factual but they are using it to justify their actions

For example -: buying more from a country than how much you sell is not subsidy. It depends on what the other countries produce and what we produce.

Are our investments in US safe or should we get worried?

We only have to survive 4 years ![]()

Ready to go shopping today? Edit: personally sticking to my plan of not getting out of bed for less than 15% drop and holding fast for 5-6 months. Edit 2: mini futures predict a 2% drop today. Boo effing hoo.

I saw a suicide note on r/options.

@Abs_max you may still be at the “denial” stage, (“he can’t possibly have said that”) I think it’s part of the “art of the bullshit deal”, there’s no policy, only short-term gain and pettiness. If he tanks the US’s 401k what does that do to a politician?

There’s still a lot of uncertainty, some think tariffs won’t go through/will be temporary.

(Either due to negotiations, tho unclear to me what there is to negotiate, or court actions)

I currently expects market to not have priced something more permanent/full blown trade war (maybe rightly so, hard to know in hindsight).

Edit: Self-styled ‘Tariff Man’ shocks Wall Street with tariffs

No idea

This seems to be pointless in my view

Now Trump says EU is way out of line. He continues to talk about trade deficit for goods and conveniently ignores trade surplus for services. US chose to become a service economy and move manufacturing outside. Now they blame other nations to supply them goods.

I don’t understand what to make of this. Hopefully western media will be as harsh as they are for china. However I doubt so.

Time for EU to become independent in Tech services or else it would be used as coercion in future.

What?

Which part? Western media are plenty harsh.

Me neither, but “analysts” are on meltdown mode since yesterday.

The random trade war

If you use such long time frame, any dip wouldn’t be noticeable.

But the markets are down today 1.5 - 2% at this moment. Let’s see what happens next

Soft landing is my hope.

I don’t like it. I didn’t like it before. Tariffs and VAT are poison for the economy. Things can no longer be fabricated where it makes sense, productivity falls and so on. Of course you can pass some costs to the consumers, raising inflation. But you cannot pass all costs to consumers; that is why the VAT is a very bad system for the economy. If a company makes less profit than the VAT it ceases to exist in one way or another.

Smaller countries went almost bankrupt because of tariffs they implemented. Now the spiraling has started (or continued, was started ages ago) and I see no way to stop it.

Europe has tariffs and VAT since a long time. It was just a question of time until other parts of the world start that bullshit too.

It was a nice time while it lasted, made a lot of money. I will continue my investing and probably the added volatility will make me some money too. But I think the fat years are gone, and maybe for a long long time, not only 4 years.

I stick to my prior view. Its time to prepare for a shooting war, either in Taiwan or Europe. Its further time to prepare for confiscation by dictators. Therefore, I will indeed:

- Reduce US Stock Exposure to 33% of my Non-CH Shares, initially 50% and then further flexing down

- Diversify Fund Locations, particularely exiting part of my IE based ETF in favor of CH based Index Funds (yes, they are less tax efficient but this is a mitigation for a 100% loss risk)

- Materially increase Gold exposure

With regard to geographic diversification of brokers, I will probably wait for a while, this only becomes relevant if Switzerland is beeing pulled into the conflict.