Do you need hold the ETF at a Swiss broker for that, or does it work with IBKR as well?

Ibkr works for that.

Yes

But US investor would normally compare this with US stock market.

Same.

I recall the narrative (here and elsewhere) being that we have a big home bias anyway via our 2nd pillar, but the 2nd pillar is not geared for growth - for good reason. My own is about 30% in Swiss equity, 10% foreign, the rest is bonds, CDs, MMFs, and expected growth quoted is a mere 1.5% pa, that’s basically almost matching a standard savings account rate.

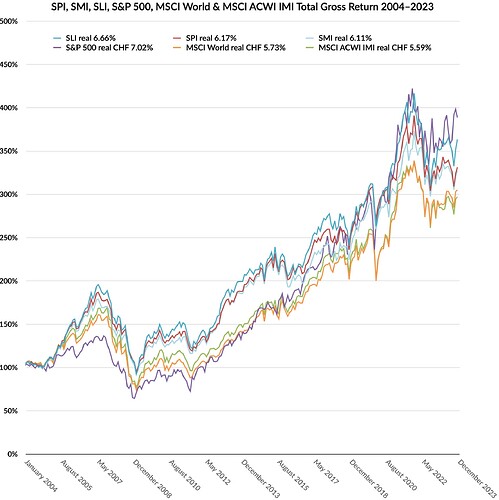

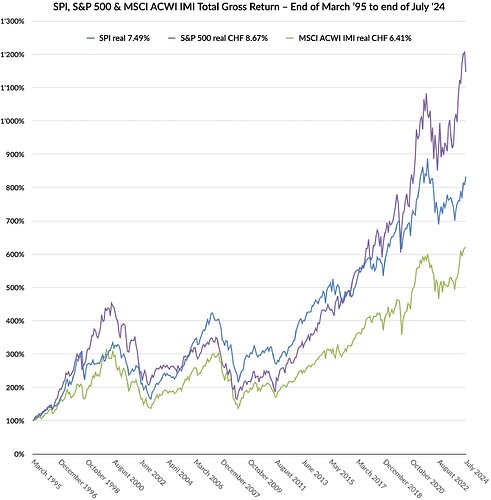

I feel like I should have used Gross and not Net for MSCI World/ACWI, because the Total Return indices for SMI, SLI and SPI (there are no separate Net and Gross indices, just one called Total Return) are most likely without withholding taxes as well.

I have now included the S&P 500 in above tables as well. As the data for it is before taxes (Total Gross Return), and from what I’ve gathered the data from SIX for the Swiss indices seems to be Gross as well, I changed the values of the MSCI indices to Gross.

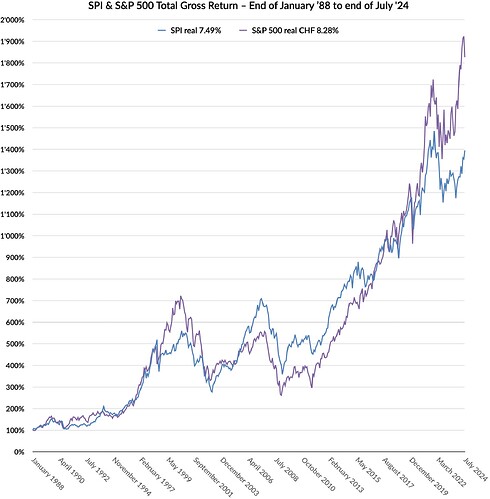

SPI and S&P 500 go back farther, so here’s the data for the last 36.5 years:

| Jan '88 – Jul '24 | Ø p.a. | Ø p.a. (CHF) | Ø p.a. (CHF, real) | total | total (CHF) | total (CHF, real) |

|---|---|---|---|---|---|---|

| SPI TR | +8.75% | +8.75% | +7.49% | +2’038% | +2’038% | +1’295% |

| S&P 500 TR Gross | +10.88% | +9.56% | +8.28% | +4’230% | +2’701% | +1’727% |

| USD/CHF | -1.19% | — | — | -35.3% | — | — |

| Inflation CH | +1.18% | — | — | +53.3% | — | — |

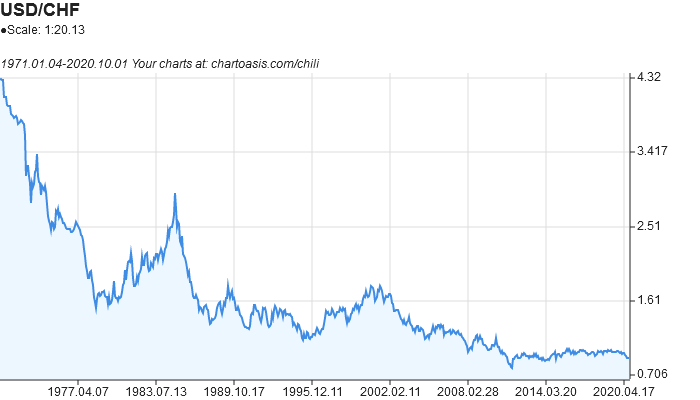

Thanks for this information. I always had in mind something closer to -2% to -3% p.a.

As you can see from the 2004-2023 table above, it has indeed been around -2% p.a. for the last 20 years.

Could you please add the calculus/chart for a savings account? Just kidding.

Big moves in my portfolio due to FX today and in fact over the last 2 months due to strong USD.

Converting CHF to T-Bills at the end of 2023 and holding wouldn’t have been so bad: you got around 5-6% interest and another 7% in FX gains for a total of 12%. Not to shabby for ‘cash’.

Hehe, fortunately nobody knows the future. Dollar <CHF 0.8 was the prediction in this thread. ![]()

My answer: it does not matter. Every stock is it’s own currency. Especially the big U.S. stocks that make their money all around the world are.

And guess what: a currency hedge is not a hedge but just another bet. It costs money and you can win or lose. Sometimes a stock goes up because the Dollar goes down, sometimes it goes up because the Dollar goes up… and vice versa.

I don’t bet on worthless things (cash is trash) so I don’t bet on currencies and y don’t hedge my stocks “currency risk”.

I also prefer not hedging stocks but this point is just weird. A hedge is basically an insurance: just because an insurance is a bet, does not mean that it is as good as any bet. From the perspective of the single bet, making an insurance on your home is the same as betting that your neighbour’s home will get burned down - but these are obviously very different thing for you as the home owner.

It is not like an insurance, more like gambling. If your house burns down you lose and the insurance pays the loss. If a currency goes down your stock may go up… or down. If a currency goes up your stock may go down… ur up.

Every stock is it’s own currency, that is my point. Even if the stock is traded in USD the company may make more money when the USD goes down then when it goes up. You never know.

There may be no correlation at all, there may be a positive or a negative correlation, you never know in advance. But with an insurance you always know. You won’t have more money because your house burns down (OK, actually I would, but that is another story, the land on which my house stands is worth more than the house…).

A broad US market fund is very much exposed to the USD. You almost see that 1:1 in your portfolio when the USD apreciates.

There is a nice chart (that I can’t find right now, but maybe will post later), which shows that a lot of the US’ overperformance over the last decade was due to apreciation of the USD.

The US is also a net importer country.

I think you find statistics for everything. Let’s compare the dollar index to the SP500 (with dividends, SPY ETF) in different timeframes:

Sometimes there is positive, sometimes negative correlation and sometimes there is no correlation at all. Of course you will find single time frames to support any theory of correlation, but I simply cannot see any. While the correlation of a burnt-down house and a house insurance is always there…

Long term the only thing I see is that stocks grow more than the dollar.

USD has been depreciating against CHF over the past 30 years. In this forum as well as in Reddit, everyone recommends VT which trades in USD.

When you purchase USD denominated ETFs using Swiss francs, you are taking on an extra layer of currency risk.

In other words, your return in CHF depends not only on how well the ETF itself performs, but also on how the USD/CHF exchange rate moves over time.

How can someone hedge against this? Is there any evidence that this does not matter in the long term?

Read this article and you will find the errors in your assumptions by yourself:

Slashing FX Costs! In Which Currency Should I Buy ETFs?

This is partly but not completely wrong. I think Makis is suggesting we need to split absolute performance of an ETF from real-world use of the money: If you buy VT you need to convert CHF to USD, then when you sell you get USD, which needs to be converted again if you’re not using USD in your life.

I recall there were many posts on reddit CH PersonalFinance in 2023 asking “where did muh gainz go?” as people would see eg 20% gain in VT on yahoo finance (in USD) but get 10% in their own accounts (in CHF) (don’t nitpick the numbers/dates, talking about the sentiment). It sounds simple but I don’t judge, this stuff is not taught at school (sadly).

What I understood after doing a monstrous amount of reading before starting any investment was that absolute performance is exactly the same across currencies when you take into account converting currencies, but what happens after that (ie spending the money) is more complicated and needs its own consideration.

Edit 1: I mean, growing NW is good and all but I don’t know of any supermarket or stripper accepting screenshots of VT charts as payment. Maybe NFTs will changeahahaha… (s/).

Edit 2: more seriously, I find that the entry into investing and protecting/managing/growing a portfolio is 1000 times more/better covered than the exit, which makes sense as having more money available solves many problems in life, but the [eventual/partial/total] exit is no less important.

Edit 3: you don’t need to go to reddit, I just scrolled up this thread and see posts from more knowledgeable and experienced members than myself (see posts 32, 34, 48) talking about “losses” and “misleading numbers” due to FX. The point is, they’re not wrong, people do care about the actual use of their portfolios, in which case FX matters. Even saw my own confused posts of the time!

The foreign currency risk is not because of ETF currency. It’s because of underlying ETF investments

For example SPY5 is sold in CHF on SIX

But this ETF invests in American companies who have a lot of exposure to USD. This exposure is exactly the same if you buy VOO.

Having said that, if you are looking for hedged currency ETFs which aim to protect against currency risk/benefit you need to do a bit more reading and make up your mind. Following Reddit thread might be interesting