Another way to look at it is that it is the depreciation of USD compared to other currencies that boosted (in USD) the profits of S&P500 companies (because they run their business internationally and in other currencies, too) compared to other indexes. So being worried about the depreciation of USD means being worried about what caused S&P500 to overperform in the first place ![]()

That is a good way of explaining it.

Continuing the same example. Suppose there are 2 identical companies with identical international revenues. One company is listed on the US stock exchange with headquarters in the US and the other is listed on the Swiss stock exchange with headquarters in Switzerland.

If USD depreciates the impact on revenues would be exactly the same for both companies whether both are measured in CHF or USD

The Swiss company has an additional headwind because it has more costs in Switzerland and in CHF. There would be a bigger negative impact from a declining USD on the profits and share price of the Swiss company

The example is too simplistic. In reality if USD is depreciating then inflation is likely to be higher in the US and prices denominated in USD can be increased. The operating costs of the US company will increase for the same reason

However the point is that owning Swiss indexes does not directly provide protection against depreciation of USD or other currencies. Most of the constituents of these indexes have most of their revenues coming from overseas

Exceptions are stocks with swiss based revenues as mentioned by @yetanothername. Whether it is a good idea to invest in those is another question.

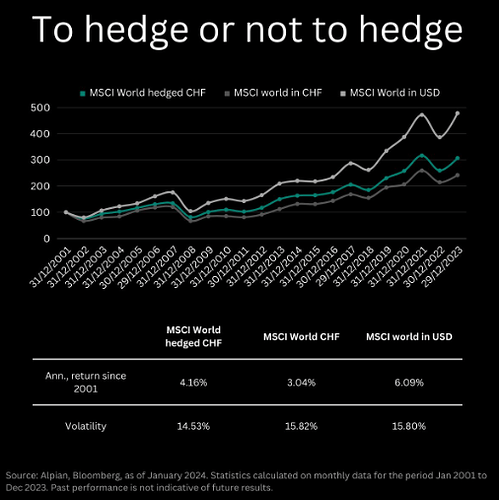

There’s this article by Alpian that argues for CHF hedging, as it apparently has outperformed non-hedging in the last 22 years when investing in MSCI world.

They include this extremely high resolution chart:

Thoughts?

What is the difference between the first 2?

“MSCI World hedged CHF” is hedged in CHF and “MSCI World CHF” is not hedged. It’s right in the name ![]()

Did they consider the cost of hedging in this graph?

Well, comparing the net result for CHF-based investors is the goal of this comparison, so the chart would be worthless if they hadn’t. Which obviously doesn’t necessarily mean they did ![]()

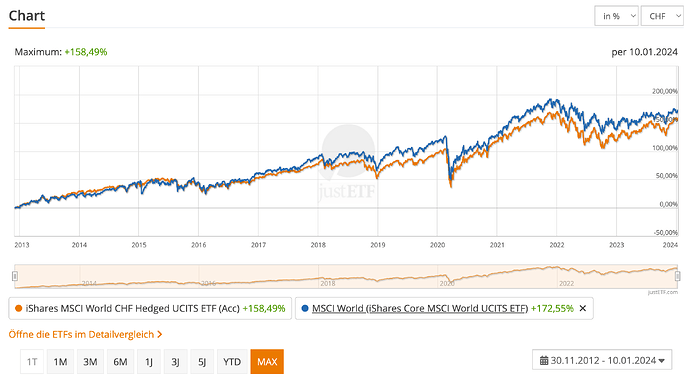

The large difference is surprising to me. On justETF, you can compare two actual ETFs with different results (but it only goes back to 2013):

Part of the difference is because of the TER difference (0.2% vs. 0.55%). I assume they did not consider this and just looked at the index differences. But the index differences do not really matter too much for the average investor, it is the return on the products that they can actually buy and hedged ETFs were historically much more expensive (although it looks like HSBC launched one with only 0.18% TER recently, but it is very small at the moment).

It doesn’t seem to me like there is such a big difference. The white line is MSCI World in USD, so irrelevant to this discussion. The green and grey lines are actually fairly close and look comparable to the justetf graph when taken from 2013 onward.

My thought is that the next 22 years of USD vs CHF behavior might not be a mirror of the last 22 ones.

In contrast to the long term trend, CHF depreciated against USD from 1995 (1.15) to Oct/Nov 2000 (1.8). If you want to advertise hedging, 2001 is a very convenient starting point for comparison.

Sorry guys but why the normal CHF is not the same as the USD? The fund should be in any case in USD

Sorry I mean the last 2 ![]()

@jay quite beat me to it. I actually hadn’t seen his post when writing this.

But it shows how we noticed and had exactly the same thing in mind ![]()

Let’s say the timeframe of 22 years was chosen very “conveniently”, at least from an FX perspective:

- 2000 until early 2002 was a period in which the USD was particularly strong against the CHF. You’d - have to go back all the way to 1989 for a lower CHF/USD exchange rate than during this period.

- Also, the subsequent 10 years saw a historic rise of the CHF against the USD, with CHF/USD more than doubling (!) from 2001 through August 2011 - it has more or less stood flat since then.

I did some pixel interpolation on the Alpian chart, which is pretty inaccurate of course, and found:

- start of 2013: unhedged -8%, hedged +18%

- end of 2023: unhedged +144%, hedged +208%

If we correct for the differing starting point:

- unhedged had +165% ((100+144)/(100-8)-1)

- hedged +161% ((100+208)/(100+18)-1)

s/ It’s like a henge (like Stonehenge), it looks like a hedge but it’s older and made out of stones or earth.

From MorningStar: “Currency-hedged ETFs typically hold a basket of foreign stocks or bonds as their underlying investment along with currency-forward contracts that perform the hedging function. These contracts effectively lock in a predetermined future exchange rate.”

My poor understanding is, in a layman’s nutshell (not nut sack!), that the product (ETF) is in CHF but behaving like it was partly in USD, but not completely otherwise it’d be a USD printing machine (earning USD-level returns in CHF, converting the CHF into USD, ???, profit). Or it could be the other way around.

I don’t know, let alone understand how hedging works (either) so I avoid it. Don’t care too much to understand either, any sort of future predictive complexity is unpalatable to me, and I feel fine with that.

Demystification room: to hedge or not to hedge?

The Swiss Franc has always been both a curse and a blessing for the Swiss. It’s a blessing for holidays and imports, but a curse when investing abroad.

2023 illustrated this well. With the Swiss Franc appreciating by 9.0% against the US dollar and 6.1% against the euro, Swiss investors who invested outside Switzerland saw diminished gains due to currency fluctuations.

However, currency risk isn’t inevitable, as there are ways to hedge investments. For instance, if you’re investing through funds and ETFs, consider a hedged share class.

It’s important to note that hedging costs have risen recently. For example, hedging a basket of international stocks (MSCI World) costs between 2.5% to 3.5% per annum in recent years.

This presents a tricky choice for investors: Accept a sure cost, akin to an annual tax on investments, or face large fluctuations that can significantly impact returns.

Without a crystal ball, historical data offers valuable insights. Over the past 22 years, hedging against currency risks in a basket of international stocks would have been the better strategy, not just from a return perspective but also in reducing risk (as measured by volatility). While these findings aren’t absolute, for Swiss investors, considering hedging could be beneficial.

Here is the article: Market insights of January 2024 | Alpian | Swiss Banking Excellence

IF you find a hedged IndexFond/ETF with the same TER than a Non-Hedged one, we should go 50% Hedged. This is the case these days.

Reason beeing is that Interest Rate Parity applies and over the long run, Hedging is a Zero Benefit / Zero Cost exercise. So instead of puting 10k bets onnTed, we put 5k bets on red and black.

The beauty of 50/50 is as well that we get somewhat average results. No big regrets in either direction. There may be a small Volatility benefit but we can’t eat volatility - so that won‘t matter much.

The only thing to consider is that if there was a catastrophe in Switzerland and the CHF lost massive value, the Hedge would cost us deerely. In such scenario, it is as well unlikely that Interest Rate parity will protect us. Just imagine Fukushima in Aargau and the CHF loses 80% in a day. THEREFORE, I think tagt every Portfolio needs at least 30-50% non-hedged Assets as an Insurance. So if we have a large Foreign Shares quota, go to 50/50. if you only have a small Share Quota or a big Home Bias, keep more Jnhedged Shares.

If you want to play the FX game, do you need to mix it with your investment? Can’t you play the FX roulette separately (I think IB has bunch of product with high leverage for that¸right?)

Why are you on such a crusade against hedging?

It‘s not purely playing the fx game, that‘s very different. It‘s very disingenious of you to say this.

The same logic also applies to not hedging. It‘s also an fx game.

Having both a hedged and non-hedged portion in your portfolio is exactly a strategy to mitigate playing the fx game. As illustrated enough times, by enough articles and resources in this thread already.

There is a cheap synthetic acwi etf by UBS in ACWIS. It has a ter of 0.19% which is not super cheap, but also nit very expensive. Due it being synthtic it also gets around US withholding taxes, that normally are partly lost with Ireland etfs.

So compared to say an ishares ACWI etf it should be conparable.

A little more expensive than VT of course.