I want to highlight this answer. After few years investing, the exchange rate is the most important thing about investment. I had some winnings picks on the last years, but they where in losses due to the exchange rate. Other picks I had at the end 0 or nearly 0 CHF gains, because the position was for example 5% and the exchange rate -5%. In the last few years, I don’t recall any single position which I made some gains due to the CHF rate.

So, don’t be fool by amazing returns, like 10% or 15% per year, if you are doing -10% or -15% on the rate. CAD and GBP were the worst on my experience. CAD right now has done -13% in 2 years for example.

People has to understand that every single website and information on internet is for US investors with USD base account. Why bother to look for 10%-15% return per year on a stock when you are doing -10% on the exchange rate? As a swiss investors, it’s better to invest on stocks or ETF in CHF, unless you are Michael Burry and can make 30% on a stock in 3 months.

The longer you hold a stock on another currency, the worst, and the buy and hold is the strategy that every single amateur investor should follow.

Some people may argue that the CHF will not go up forever against other currencies, and it’s true. But what we have seen till now, during the 2008 crisis, the CHF went up and then it was flat for a decade, but it didn’t go down to the pre 2008 crisis. That means, the chances tthat the CHF will go up or keep flat are higher than going down.

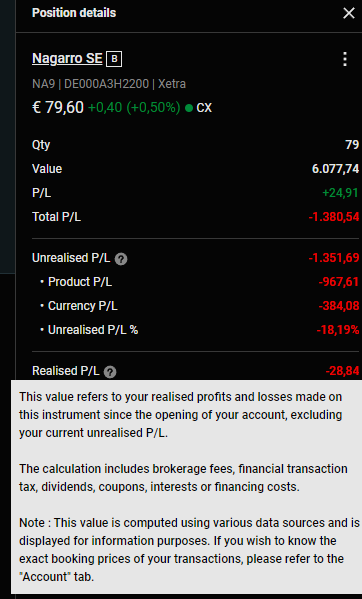

Degiro has the most straighforward UI to tell you that. When you use autoFX, you will see the PnL of the stock and the PnL of the exchange currency, they will also show you the realized PnL till now (even if you haven’t sold yet, there are already profits like dividends or losses like fees, taxes, etc)